ADT 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

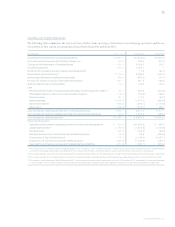

Consolidated Balance Sheet under the transitional accounting

prescribed by FIN 46 effective July 1, 2003 ($ in millions):

Restricted cash $««21.7

Accounts receivable 7.5

Property, plant and equipment 433.8

Other assets (1) 28.2

Total assets $491.2

Loans payable and current maturities of long-term debt $««10.6

Accounts payable 2.1

Accrued expenses and other current liabilities (2) (31.6)

Long-term debt 551.6

Other long-term liabilities (3) (12.8)

Minority interest 46.4

Total liabilities 566.3

Cumulative effect of accounting change, net of tax $«(75.1)

(1) Includes the elimination of $16.2 million of equity investments related to joint

ventures previously recorded under the equity method which are now consolidated

under FIN 46.

(2) Includes the elimination of $32.7 million of accrued expenses associated with syn-

thetic leases previously recorded as operating leases which are now recorded as

capital leases under FIN 46.

(3) Includes the elimination of $14.7 million of long-term liabilities associated with

synthetic leases previously recorded as operating leases which are now recorded as

capital leases under FIN 46.

GUARANTEES

The Company may, from time to time, enter into sales contracts

whereby it will buy back (at a discount) a transaction from a

customer’s third-party financier in the event of a customer’s

default. For such transactions that include “shared risk,” the

Company accrues a liability based on historical loss data. As of

September 30, 2003, $3.2 million was accrued related to these

contracts. In the event the Company must pay for this shared

risk, the Company’s recourse is as follows: place the lease with

a financially viable third-party financier; repossess the purchased

products or equipment; seek payment through a personal guar-

antee issued by the customer; or, alternatively, sue the customer.

The Company’s Fire and Security business has guaranteed

the performance of a third-party contractor. The perform-

ance guarantee arose from contract negotiations, because the

contractor could provide cost-effective service on a telecommu-

nications contract. In the event the contractor does not perform

its contractual obligations, Tyco Fire and Security would per-

form the service itself. Therefore, the Company’s exposure

would be the cost of any services performed, which would not

have a material effect to the Company’s financial position or

annual results of operations. Because it is not probable that the

Company will have to make any payments or perform any

services pursuant to the guarantee it has not recorded any

obligation related to the guarantee. The contract was entered

into in July 2002 and expires at the end of the warranty period,

July 2004. If the third-party subcontractor does not perform its

obligations, Tyco may consider withholding any future pay-

ment for work performed by the contractor.

The Company, in disposing of assets or businesses, often

provides representations, warranties and/or indemnities to

cover various risks including, for example, unknown damage to

the assets, environmental risks involved in the sale of real estate,

liability to investigate and remediate environmental contami-

nation at hazardous waste disposal sites and manufacturing

facilities, and unidentified tax liabilities and legal fees related to

periods prior to disposition. The Company does not have the

ability to estimate the potential liability from such indemnities

because they relate to unknown conditions. However, we have

no reason to believe that these uncertainties would have a mate-

rial adverse effect on the Company’s financial position, annual

results of operations or liquidity.

The Company has recorded liabilities for known indemni-

fications included as part of environmental liabilities. See

“Liquidity and Capital Resources

—

Commitments and Contin-

gencies” above for a discussion of these liabilities.

The Company has guaranteed the fair value of certain vessels

not to exceed $235 million and has accrued $10.4 million and

$4.4 million as of September 30, 2003 and 2002, respectively,

based on its estimate of fair value of the vessels (see “Liquidity and

Capital Resources

—

Commitments and Contingencies” above).

Due to the Company’s downsizing of certain operations as

part of restructuring plans, acquisitions, or otherwise, the Com-

pany has leased properties which it has vacated but has sublet

to third parties. In the event third parties vacate the premises,

the Company would be legally obligated under master lease

arrangements. The Company believes that the financial risk of

default by sublessors is individually and in the aggregate not

material to the Company’s financial position, annual results of

operations or liquidity.

In the normal course of business, the Company is liable for

contract completion and product performance. In the opinion

of management, such obligations will not significantly affect

the Company’s financial position, annual results of operations

or liquidity.

The Company generally accrues estimated product war-

ranty costs at the time of sale. In other instances, additional

amounts are recorded when such costs are probable and can be

reasonably estimated. For further information on estimated

product warranty, see Notes 1 and 20 to the Consolidated

Financial Statements.

TYCO INTERNATIONAL LTD.