ADT 2003 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

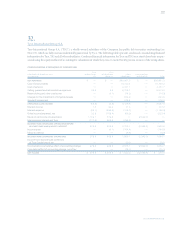

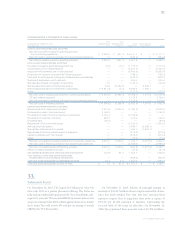

CONSOLIDATING STATEMENT OF CASH FLOWS

TYCO TYCO

YEAR ENDED SEPTEMBER 30, 2001 INTERNATIONAL INTERNATIONAL OTHER CONSOLIDATING

($ IN MILLIONS) LTD. GROUP S.A. SUBSIDIARIES ADJUSTMENTS TOTAL

CASH FLOWS FROM OPERATING ACTIVITIES:

Net cash provided by (used in) operating activities

from continuing operations $«««2,090.5 $«««(291.1) $«4,911.7 $÷÷÷÷«— $÷«6,711.1

Net cash used in operating activities from discontinued operations — — (260.2) — (260.2)

Net cash provided by (used in) operating activities 2,090.5 (291.1) 4,651.5 — 6,450.9

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchase of property, plant and equipment, net (0.2) (0.1) (1,773.1) — (1,773.4)

Construction of Tyco Global Network — — (2,247.7) — (2,247.7)

Acquisition of businesses, net of cash acquired — — (9,962.0) — (9,962.0)

Acquisition of customer accounts (ADT dealer program) — — (798.1) — (798.1)

Cash paid for purchase accounting and holdback/earn-out liabilities — — (878.7) — (878.7)

Disposal of businesses, net of cash sold — — 904.4 — 904.4

Net sales (purchases) of long-term investments 5.9 — (148.7) — (142.8)

Net decrease (increase) in intercompany loans 54.8 (5,993.5) — 5,938.7 —

Net (increase) decrease in investment in subsidiaries (10,621.3) (2.8) 8,985.0 1,639.1 —

Other — — (177.2) — (177.2)

Net cash used in investing activities from continuing operations (10,560.8) (5,996.4) (6,096.1) 7,577.8 (15,075.5)

CIT cash balance acquired — — 2,156.4 — 2,156.4

Net cash provided by investing activities from discontinued operations — — 1,516.8 — 1,516.8

Net cash used in investing activities (10,560.8) (5,996.4) (2,422.9) 7,577.8 (11,402.3)

CASH FLOWS FROM FINANCING ACTIVITIES:

Net proceeds from (repayments of) debt 3,374.9 6,320.9 (1,160.2) — 8,535.6

Proceeds from sale of common shares 2,196.6 — — — 2,196.6

Proceeds from sale of common shares for acquisitions 2,729.4 — (2,729.4) — —

Proceeds from exercise of options 226.6 — 318.4 — 545.0

Dividends paid (90.0) — — — (90.0)

Repurchase of Tyco common shares — — (1,326.1) — (1,326.1)

Net financing from parent — — 5,938.7 (5,938.7) —

Net capital contributions from parent — — 1,639.1 (1,639.1) —

Repurchase of minority interest shares of subsidiary — — (270.0) — (270.0)

Capital contributions to Tyco Capital — — (675.0) — (675.0)

Other — — (15.4) — (15.4)

Net cash provided by financing activities from continuing operations 8,437.5 6,320.9 1,720.1 (7,577.8) 8,900.7

Net cash used in financing activities from discontinued operations — — (2,605.0) — (2,605.0)

Net cash provided by (used in) financing activities 8,437.5 6,320.9 (884.9) (7,577.8) 6,295.7

Effect of currency translation on cash — — (21.0) — (21.0)

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS (32.8) 33.4 1,322.7 — 1,323.3

TYCO CAPITAL’S CASH AND CASH EQUIVALENTS

TRANSFERRED TO DISCONTINUED OPERATIONS — — (808.0) — (808.0)

CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR 34.2 3.6 1,227.0 — 1,264.8

CASH AND CASH EQUIVALENTS AT END OF YEAR $««««««««««1.4 $÷÷÷37.0 $«1,741.7 $÷÷÷÷«— $÷«1,780.1

TYCO INTERNATIONAL LTD.

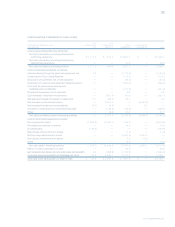

33.

Subsequent Events

On November 12, 2003, TIG issued $1.0 billion par value 6%

Notes due 2013 in a private placement offering. The Notes are

fully and unconditionally guaranteed by Tyco. In addition, sub-

sequent to year end, TIG executed LIBOR-in-arrears interest rate

swaps on notional value $875 million against these notes. Under

these swaps Tyco will receive 6% and pay on average 6-month

LIBOR plus 90.3 basis points.

On November 17, 2003, holders of principal amount at

maturity of $3,196.7 million of zero coupon convertible deben-

tures due 2020 notified Tyco that they had exercised their

option to require Tyco to repurchase their notes at a price of

$775.66 per $1,000 principal at maturity representing the

accreted value of the notes on that date. On November 18,

2003, Tyco purchased these notes for cash of $2,479.6 million.