ADT 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

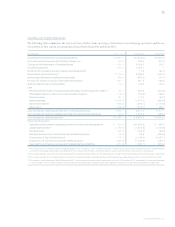

Operating results from the discontinued operations of Tyco

Capital through July 8, 2002 were as follows ($ in millions):

FOR THE PERIOD

FOR THE PERIOD JUNE 2 (DATE OF

OCTOBER 1, 2001 ACQUISITION)

THROUGH THROUGH

JULY 8, 2002 SEPTEMBER 30, 2001

Finance income $««3,327.6 $««1,676.5

Interest expense 1,091.5 597.1

Net finance income 2,236.1 1,079.4

Depreciation on operating

lease equipment 944.4 448.6

Net finance margin 1,291.7 630.8

Provision for credit losses 665.6 116.1

Net finance margin, after provision

for credit losses 626.1 514.7

Other income 741.1 335.1

Operating margin 1,367.2 849.8

Selling, general, administrative and

other costs and expenses 687.8 398.7

Goodwill impairment 6,638.1 —

Operating expenses 7,325.9 398.7

(Loss) income before income taxes

and minority interest (5,958.7) 451.1

Income taxes (316.1) (195.0)

Minority interest (7.7) (3.6)

(Loss) income from discontinued

operations $«(6,282.5) $÷÷«252.5

Average earning assets (“AEA”) (1) $36,269.0 $39,159.2

Net finance margin as a percent

of AEA (annualized) 4.75% 4.83%

(1) Average earning assets is the average of finance receivables, operating lease equip-

ment, finance receivables held for sale and certain investments, less credit balances

of factoring clients.

During fiscal 2003, Tyco recorded income from discontinued

operations of $20.0 million. The $20.0 million represented a

restitution payment made by Frank E. Walsh Jr. (see Note 18 to

the Consolidated Financial Statements). Tyco Capital’s revenues

were $4,068.7 million for the period October 1, 2001 through

July 8, 2002, consisting of finance income of $3,327.6 million

and other income of $741.1 million. Tyco Capital’s revenues for

the period June 2 through September 30, 2001 were $2,011.6

million, consisting of finance income of $1,676.5 million and

other income of $335.1 million. As a percentage of AEA, finance

income was 11.9% and 12.8% for the period October 1, 2001

through July 8, 2002 and for the period June 2 through

September 30, 2001, respectively. For the period October 1,

2001 through July 8, 2002, Tyco Capital’s loss before income

taxes and minority interest was $5,958.7 million. For the period

June 2 through September 30, 2001, Tyco Capital’s income

before income taxes and minority interest was $451.1 million.

Interest expense totaled $1,091.5 million and $597.1 million

for the period October 1, 2001 through July 8, 2002 and for the

period June 2 through September 30, 2001, respectively. As a

percentage of AEA, interest expense was 3.9% and 4.6% for the

period October 1, 2001 through July 8, 2002 and for the period

June 2 through September 30, 2001, respectively.

Other income for Tyco Capital was $741.1 million and

$335.1 million for the period October 1, 2001 through July 8,

2002 and for the period June 2 through September 30, 2001

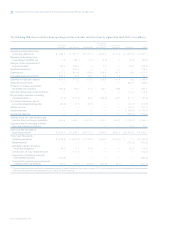

respectively, as set forth in the following table ($ in millions):

FOR THE PERIOD

FOR THE PERIOD JUNE 2 (DATE OF

OCTOBER 1, 2001 ACQUISITION)

THROUGH THROUGH

JULY 8, 2002 SEPTEMBER 30, 2001

Fees and other income $496.6 $212.3

Factoring commissions 117.8 50.7

Gains on securitizations 119.8 59.0

Gains on sales of leasing equipment 11.0 14.2

Losses on venture capital investments (4.1) (1.1)

Total $741.1 $335.1

Included in fees and other income are miscellaneous fees, syndi-

cation fees and gains from receivable sales.

During the period October 1, 2001 through July 8, 2002,

Tyco Capital recorded charges of $355.0 million relating prima-

rily to a weakness in the competitive local exchange carrier

industry included within its telecommunications portfolio and

the economic reforms instituted by the Argentine government

that converted Tyco Capital’s dollar-denominated receivables

into peso-denominated receivables. These charges have been

included in the provision for credit losses. The provision for

credit losses was $665.6 million, or 2.4% of AEA, and $116.1 mil-

lion, or 0.9% of AEA, for the period October 1, 2001 through

TYCO INTERNATIONAL LTD.