ADT 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

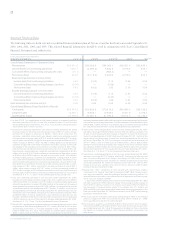

28

expense); (iii) charges for the impairment of goodwill of $278.4

million; (iv) other loss of $151.8 million related to the retire-

ment of debt; (v) other charges of $148.6 million, of which

$34.0 million is included in cost of sales related primarily to

product warranty accruals and the dismantlement of customers’

ADT security systems, and $114.6 million is included in selling,

general and administrative expenses related primarily to uncol-

lectible accounts receivable, internal investigation fees, as well

as severance and facility closures, slightly offset by a credit for

changes in estimates of charges recorded in prior periods; (vi)

a charge of $91.5 million for a retroactive, incremental premium

on prior period directors and officers insurance included in

selling, general and administrative expenses; (vii) a charge of

$11.5 million relating to the write down of investments; (viii)

other interest expense of $2.4 million; (ix) other expense of

$0.1 million; (x) income from the early retirement of debt of

$24.1 million; (xi) other interest income of $18.7 million; and

(xii) net restructuring credits of $12.3 million, of which charges

of $2.4 million are included in cost of sales.

Loss from continuing operations for fiscal 2002 included a

net charge totaling $6,762.3 million ($6,091.4 million after-tax),

consisting of the following: (i) goodwill impairment charge of

$1,343.7 million relating to continuing operations; (ii) charges

for the impairment of long-lived assets of $3,309.5 million

primarily related to the write down of the Tyco Global Network

(“TGN”); (iii) net restructuring and other charges of $1,874.7

million, of which $635.4 million is included in cost of sales and

$115.0 million related to a bad debt provision is included in

selling, general and administrative expenses; (iv) a write off of

purchased in-process research and development of $17.8 mil-

lion; (v) a loss on the write off of investments of $270.8 million;

(vi) a gain on the sale of businesses of $23.6 million; and (vii)

gain from the early extinguishment of debt of $30.6 million.

Income from continuing operations for fiscal 2001 included

a net charge of $614.9 million ($546.3 million after-tax) con-

sisting of the following: (i) net restructuring, impairment and

other charges totaling $705.4 million; (ii) a write off of pur-

chased in-process research and development of $184.3 million;

(iii) a net gain on sale of businesses of $410.4 million; (iv) a loss

of $133.8 million related to the write down of an investment;

(v) a $24.5 million net gain on the sale of common shares of a

subsidiary; and (vi) a loss from the early extinguishment of debt

of $26.3 million.

We are currently assessing the potential impact of various

legislative proposals that would deny U.S. federal government

contracts to U.S. companies that move their corporate location

abroad. The legislative proposals could cover the 1997 acquisi-

tion of Tyco International Ltd., a Massachusetts corporation, by

ADT Limited (a public company that had been located in

Bermuda since the 1980s with origins dating back to the United

Kingdom since the early 1900s), as a result of which ADT

changed its name to Tyco International Ltd. and became the

parent to the Tyco group. During the fourth quarter of fiscal

2003, the State of California adopted legislation that purports

to limit the eligibility of certain Bermuda and other foreign-

chartered companies to participate in certain state contracts.

Although the California law provides that waivers may be

issued permitting such companies to participate in state con-

tracts under certain circumstances, it is unclear how that waiver

authority will be exercised. In addition, various other states and

municipalities in the U.S. have proposed similar legislation.

There also is similarly proposed tax legislation, which could

substantially increase our corporate income taxes and, conse-

quently, decrease future net income and increase our future

cash outlay for taxes.

Tyco’s revenues related to U.S. federal government and

California state contracts account for less than 2% and 0.1%,

respectively, of total net revenues for the fiscal year ended

September 30, 2003. We are unable to predict, with any level of

certainty, the likelihood or final form in which any proposed

legislation might become law, or the nature of regulations that

may be promulgated under any such future legislative enact-

ments or the impact such enactments and increased regulatory

scrutiny may have on our governmental business or on non-

governmental customers’ willingness to do business with us. As

a result of these uncertainties, we are unable to assess the impact

on us of any proposed legislation in this area and can provide

no assurance that they will not be materially adverse.

TYCO INTERNATIONAL LTD.

Management’s Discussion and Analysis of Financial Condition and Results of Operations