ADT 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Tyco is involved in various stages of investigation and cleanup

related to environmental remediation matters at a number of

sites. The ultimate cost of site cleanup is difficult to predict

given the uncertainties regarding the extent of the required

cleanup, the interpretation of applicable laws and regulations

and alternative cleanup methods. As of September 30, 2003,

Tyco concluded that it was probable that it would incur remedial

costs in the range of approximately $142 million to $451 mil-

lion. As of September 30, 2003, Tyco concluded that the best

probable estimate within this range is approximately $270 mil-

lion, of which $32 million is included in accrued expenses and

other current liabilities and $238 million is included in other

long-term liabilities on the Consolidated Balance Sheet. In view

of the Company’s financial position and reserves for environ-

mental matters of $270 million, the Company has concluded

that any potential payment of such estimated amounts will not

have a material adverse effect on its financial position, annual

results of operations or liquidity.

Like many other companies, Tyco and some of our sub-

sidiaries are named as defendants in personal injury lawsuits

based on alleged exposure to asbestos-containing materials.

Consistent with the national trend of increased asbestos-related

litigation, we have observed an increase in the number of these

lawsuits in the past several years. The majority of these cases

have been filed against subsidiaries in our Healthcare division

and our Engineered Products and Services division. A limited

number of the cases allege premises liability, based on claims

that individuals were exposed to asbestos while on a subsidiary’s

property. Some of the cases involve product liability claims,

based principally on allegations of past distribution of heat-

resistant industrial products incorporating asbestos or the past

distribution of industrial valves that incorporated asbestos-

containing gaskets or packing. Each case typically names

between dozens to hundreds of corporate defendants.

Tyco’s involvement in asbestos cases has been limited because

our subsidiaries did not mine or produce asbestos. Furthermore,

in our experience, a large percentage of these claims were never

substantiated and have been dismissed by the courts. Our vig-

orous defense of these lawsuits has resulted in judgments in our

favor in all cases tried to verdict. We have not suffered an adverse

verdict in a trial court proceeding related to asbestos claims.

When appropriate, we settle claims. However, the total

amount paid to date to settle and defend all asbestos claims has

been immaterial. As of September 30, 2003, there were approx-

imately 14,000 asbestos liability cases pending against us and

our subsidiaries.

We believe that we and our subsidiaries have substantial

indemnification protection and insurance coverage, subject to

applicable deductibles, with respect to asbestos claims. These

indemnitors and the relevant carriers typically have been hon-

oring their duty to defend and indemnify. We believe that we

have valid defenses to these claims and intend to continue to

defend them vigorously. Additionally, based on our historical

experience in asbestos litigation and an analysis of our current

cases, we believe that we have adequate amounts accrued for

potential settlements and adverse judgments in asbestos-related

litigation. While it is not possible at this time to determine

with certainty the ultimate outcome of these asbestos-related

proceedings, we believe that the final outcome of all known and

anticipated future claims, after taking into account our sub-

stantial indemnification rights and insurance coverage, will not

have a material adverse effect on our financial position, annual

results of operations or liquidity.

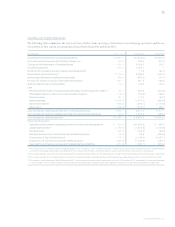

BACKLOG

At September 30, 2003, we had a backlog of unfilled orders of

$11,533.9 million, compared to a backlog of $11,015.5 million

at September 30, 2002. We expect that approximately 83% of

our backlog at September 30, 2003 will be filled during fiscal

2004. Backlog by reportable industry segment is as follows

($ in millions):

SEPTEMBER 30, 2003 2002

Fire and Security $««6,964.7 $««6,691.5

Electronics 2,071.0 2,076.5

Engineered Products and Services 2,061.4 1,873.4

Healthcare 327.4 239.7

Plastics and Adhesives 109.4 134.4

$11,533.9 $11,015.5

Backlog for Fire and Security includes recurring “revenue-in-

force,” which represents one year’s fees for security monitoring

and maintenance services under contract. The amount of

recurring revenue-in-force at September 30, 2003 and 2002 is

$3,606.7 million and $3,483.9 million, respectively. Within the

Fire and Security segment, backlog increased primarily due to

favorable foreign currency exchange rates.

Within the Electronics segment, backlog remained level.

Backlog for Engineered Products and Services increased prima-

rily due to several new contracts and, to a lesser extent, due to

favorable foreign currency exchange rates. Backlog in the Health-

care and Plastics and Adhesives segments represents unfilled

orders, which, in the nature of the businesses, are normally

shipped shortly after purchase orders are received.We do not view

backlog in the Healthcare and Plastics and Adhesives segments

to be a significant indicator of the level of future sales activity.

TYCO INTERNATIONAL LTD.