ADT 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

inventory and a credit of $0.2 million related to reconciliation

items). Also included within the total credits of $1.4 million are

restructuring credits of $1.0 million due to costs being less than

anticipated and a credit of $6.0 million, which is included in

selling, general and administrative expenses, related to the settle-

ment of a lawsuit. The restructuring credits of $1.0 million

include a credit of $0.4 million also recorded in connection

with the Company’s intensified internal audits. The Plastics

and Adhesives segment expects to incur additional restructur-

ing charges in future periods related to the comprehensive cost

reduction program announced on November 4, 2003.

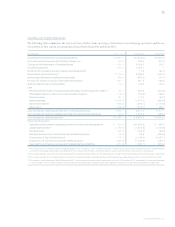

Net revenues for the Plastics and Adhesives segment

increased 7.5%, or $130.9 million, in fiscal 2002 over fiscal

2001. The increase was solely due to the effect of acquisitions.

In addition, net revenues for fiscal 2001 included $9.9 million

related to our ADT Automotive business, which was sold in

October 2000. Excluding the $4.5 million increase from foreign

currency exchange fluctuations and the acquisition of LINQ

Industrial Fabrics, Inc. in December 2001, and all other acqui-

sitions with a purchase price of $10 million or more, pro forma

revenues (calculated in the manner described above in

“Overview”) for the Plastics and Adhesives segment decreased

an estimated 13.0%.

Operating income decreased 30.5% in fiscal 2002 compared

to fiscal 2001 primarily due to decreased margins as a result of

volume shortfalls, a shift in the product mix, lower selling

prices in certain areas and unfavorable manufacturing vari-

ances. In addition, the segment incurred increased expenses

mostly relating to inventory write downs and uncollectible

accounts receivable.

Operating income and margins for fiscal 2002 reflect net

restructuring and other charges of $10.1 million, of which

inventory write downs of $1.1 million are included in cost of

sales. These charges primarily relate to severance associated

with the consolidation of operations and facility-related costs

due to exiting certain business lines. Operating income and

margins for fiscal 2002 also include a charge for the write off of

long-lived assets of $2.6 million primarily related to the impair-

ment of long-lived assets.

Operating income and margins for fiscal 2001 include net

restructuring and other charges of $8.3 million primarily

related to the closure of several manufacturing plants. Included

within the $8.3 million are charges of $4.0 million related to

inventory write downs, which has been included in cost of

sales. Operating income and margins also include a charge of

$1.2 million for the impairment of long-lived assets related to

the closure of the manufacturing plants.

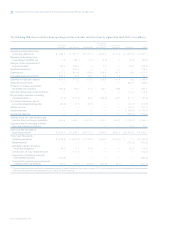

CORPORATE ITEMS

Foreign Currency The effect of changes in foreign exchange

rates for fiscal 2003 compared to fiscal 2002 was an increase in

net revenues and operating income of $1,574.2 million and

$192.1 million, respectively. The effect of changes in foreign

exchange rates for fiscal 2002 compared to fiscal 2001 was an

increase in net revenues of approximately $0.9 million and a

decrease in operating income of approximately $48.2 million.

Corporate Expenses Corporate expenses were $400.6 million in

fiscal 2003. Corporate expenses for fiscal 2003 include charges

totaling $178.9 million. Included within the $178.9 million is a

charge of $91.5 million for an incremental increase in directors

and officers insurance and charges of $38.5 million related to

internal investigation fees. Also included is a charge of $19.9

million primarily related to a severance accrual for corporate

employees and a restructuring credit of $10.6 million due to

costs being less than anticipated, both of which were changes

in estimates recorded in connection with the Company’s

intensified internal audits, detailed controls and operating

reviews and as a result of applying management’s judgments

and estimates. Also included within the $178.9 million are net

restructuring charges of $9.0 million, other net charges of

$16.0 million included in selling, general and administrative

expenses, and charges for the impairment of long-lived assets

of $14.6 million primarily related to the closure and relocation

of corporate offices and severance. Corporate expenses were

$419.7 million in fiscal 2002. This amount includes net restruc-

turing, impairment and other charges of $199.1 million primarily

related to the write off of investment banking fees and other

deal costs associated with the terminated breakup plan and

certain acquisitions that were not completed, costs incurred for

the internal investigation, and severance. Corporate expenses

were level in fiscal 2003 as compared to fiscal 2002, excluding

all of the items noted above. Corporate expenses were $243.9

million in fiscal 2001, and included a charge of $3.4 million

related to severance. Corporate expenses were down slightly in

fiscal 2002 as compared to fiscal 2001 due to an overall decrease

in compensation expense and lower than expected advertising

costs and expenses for charitable giving. However, these

decreases were partially offset by increased insurance costs,

legal and accounting fees, and other costs associated with the

business disruptions that began during the second quarter of

fiscal 2002.

TYCO INTERNATIONAL LTD.

Management’s Discussion and Analysis of Financial Condition and Results of Operations