ADT 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

system batteries.) The amount of the accrued warranty liability

is determined based on historical information such as past

experience, product failure rates or number of units repaired,

estimated cost of material and labor, and in certain instances

estimated property damage.

Use of Estimates The preparation of consolidated financial

statements in conformity with GAAP requires management to

make extensive use of estimates and assumptions that affect the

reported amount of assets and liabilities and disclosure of contin-

gent assets and liabilities and the reported amounts of revenues

and expenses. Significant estimates in these Consolidated

Financial Statements include restructuring and other charges

and credits, purchase accounting liabilities, allowances for doubt-

ful accounts receivable, estimates of future cash flows associated

with asset impairments, useful lives for depreciation and amor-

tization, loss contingencies, net realizable value of inventories,

fair values of financial instruments, estimated contract revenues

and related costs, environmental and legal liabilities, income taxes

and tax valuation reserves, and the determination of discount

and other rate assumptions for pension and post-retirement

employee benefit expenses. Actual results could differ from

these estimates. Changes in estimates are recorded in results of

operations in the period that the event or circumstances giving

rise to such changes occur.

Accounting Pronouncements Effective October 1, 2002, the

Company adopted SFAS No. 143, “Accounting for Asset Retire-

ment Obligations.” SFAS No. 143 addresses accounting and

reporting for obligations associated with the retirement of

tangible long-lived assets and the associated asset retirement

costs. The adoption of this new standard did not have a material

impact on our results of operations or financial position.

Effective October 1, 2002, the Company adopted SFAS

No. 144, “Accounting for the Impairment or Disposal of Long-

Lived Assets.” The provisions of this statement provide a single

accounting model for impairment of long-lived assets. The

initial adoption of this new standard did not have a material

impact on our results of operations or financial position.

Effective January 1, 2003, the Company adopted SFAS No.

146, “Accounting for Costs Associated with Exit or Disposal

Activities,” which is effective for exit or disposal activities that

are initiated after December 31, 2002. This statement nullifies

the FASB’s Emerging Issues Task Force (“EITF”) Issue No. 94-3,

“Liability Recognition for Certain Employee Termination

Benefits and Other Costs to Exit an Activity (including Certain

Costs Incurred in a Restructuring).” This statement requires

that liabilities associated with exit or disposal activities be rec-

ognized and measured at fair value when incurred as opposed

to at the date an entity commits to the exit or disposal plans.

The initial adoption of this new standard did not have a material

impact on our results of operations or financial position.

Effective January 1, 2003, the Company adopted SFAS No.

148, “Accounting for Stock-Based Compensation

—

Transition

and Disclosure,” which amends SFAS No. 123, “Accounting for

Stock-Based Compensation” to provide transition methods for

a voluntary change to measuring compensation cost in connec-

tion with employee share option plans using a fair value based

method. The statement also amends the disclosure require-

ments of SFAS No. 123 to require prominent disclosures about

the method of accounting for compensation cost associated with

employee share option plans, as well as the effect of the method

used on reported results. The Company adopted the disclosure

requirements of SFAS No. 148 and has not changed its method

for measuring the compensation cost of share options.

Tyco continues to use the intrinsic value based method and

does not recognize compensation expense for the issuance of

options with an exercise price equal to or greater than the

market price at the time of grant. As a result, the adoption of

SFAS No. 148 had no impact on our results of operations or

financial position. Had the fair value based provisions of SFAS

No. 123 been adopted by Tyco, the effect on net income and

earnings per common share for fiscal 2003, fiscal 2002 and fiscal

2001 would have been as follows ($ in millions):

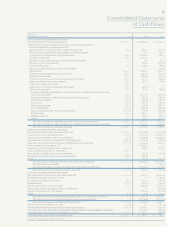

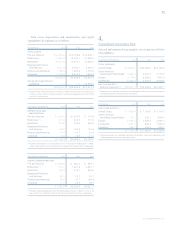

2003 2002 2001

Net income (loss) — as reported $«979.6 $(9,179.5) $3,464.0

Add: Share-based employee

compensation expense

included in reported net

income, net of tax 8.1 ——

Less: Total share-based

employee compensation

expense determined under

fair value based method for

all awards, net of tax (320.8) (415.4) (387.1)

Net income (loss) — pro forma $«666.9 $(9,594.9) $3,076.9

Income (loss) per share:

Basic — as reported $«««0.49 $«««««(4.62) $«««««1.92

Basic — pro forma 0.33 (4.83) 1.70

Diluted — as reported 0.49 (4.62) 1.89

Diluted — pro forma 0.33 (4.83) 1.68

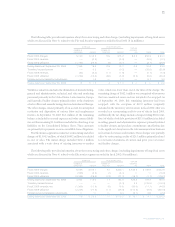

On the dates of grant using the Black-Scholes option-pricing

model and assumptions set forth below, the estimated weighted-

average fair value of Tyco options granted during fiscal 2003

and 2002 was $6.34 and $14.31, respectively, and the estimated

weighted-average fair value of Tyco and TyCom options

granted during fiscal 2001 was $19.72 and $9.11, respectively.

TYCO INTERNATIONAL LTD.