3M 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

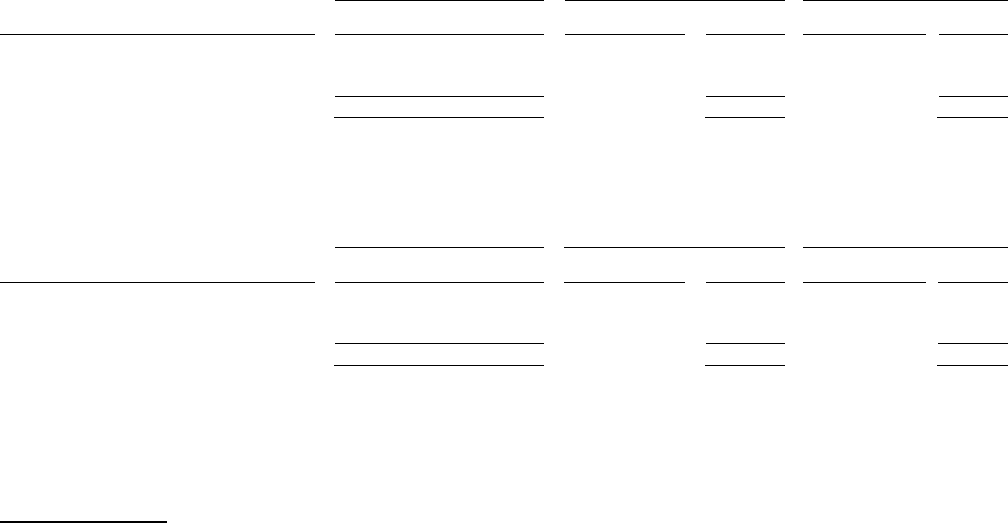

92

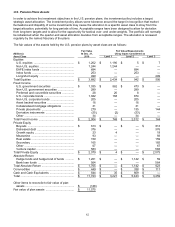

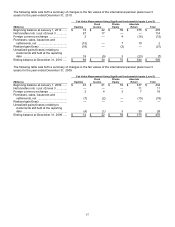

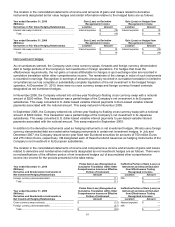

Year ended December 31, 2010

(Millions)

Pretax Gain (Loss)

Recognized in Other

Comprehensive Income

On Effective Portion of

Derivative

Pretax Gain (Loss) Recognized

in Income on Effective Portion

of Derivative as a Result of

Reclassification from

Accumulated Other

Comprehensive Income

Ineffective Portion of Gain

(Loss) on Derivative and

Amount Excluded from

Effectiveness Testing

Recognized in Income

Derivatives in Cash Flow Hedging

Relationships

Amount

Location

Amount

Location

Amount

Foreign currency forward/option contracts ....

$

(30

)

Cost of sales

$

(39

)

Cost of sales

$

—

Foreign currency forward contracts ...............

34

Interest expense

33

Interest expense

—

Commodity price swap contracts ..................

(13

)

Cost of sales

(9

)

Cost of sales

—

Total .........................................................

$

(9

)

$

(15

)

$

—

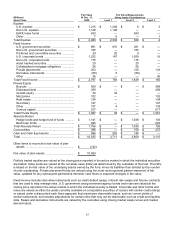

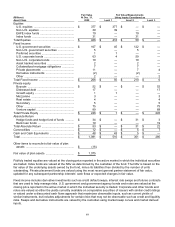

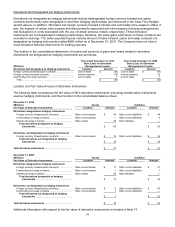

Year ended December 31, 2009

(Millions)

Pretax Gain (Loss)

Recognized in Other

Comprehensive Income

on Effective Portion of

Derivative

Pretax Gain (Loss) Recognized

in Income on Effective Portion

of Derivative as a Result of

Reclassification from

Accumulated Other

Comprehensive Income

Ineffective Portion of Gain

(Loss) on Derivative and

Amount Excluded from

Effectiveness Testing

Recognized in Income

Derivatives in Cash Flow Hedging

Relationships

Amount

Location

Amount

Location

Amount

Foreign currency forward/option contracts ....

$

(58

)

Cost of sales

$

96

Cost of sales

$

—

Foreign currency forward contracts ...............

55

Interest expense

47

Interest expense

—

Commodity price swap contracts ..................

(18

)

Cost of sales

(34

)

Cost of sales

—

Total .........................................................

$

(21

)

$

109

$

—

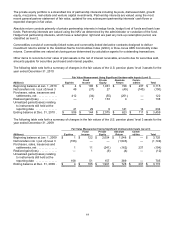

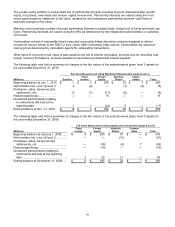

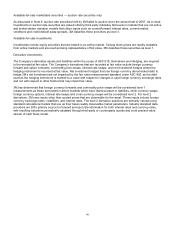

As of December 31, 2010, the Company had a balance of $32 million associated with the after tax net unrealized

loss associated with cash flow hedging instruments recorded in accumulated other comprehensive income. 3M

expects to reclassify to earnings over the next 12 months a majority of this balance (with the impact offset by cash

flows from underlying hedged items).

Fair Value Hedges:

For derivative instruments that are designated and qualify as fair value hedges, the gain or loss on the derivatives as

well as the offsetting loss or gain on the hedged item attributable to the hedged risk are recognized in current

earnings.

Fair Value Hedging - Interest Rate Swaps: The Company manages interest expense using a mix of fixed and floating

rate debt. To help manage borrowing costs, the Company may enter into interest rate swaps. Under these

arrangements, the Company agrees to exchange, at specified intervals, the difference between fixed and floating

interest amounts calculated by reference to an agreed-upon notional principal amount. The mark-to-market of these

fair value hedges is recorded as gains or losses in interest expense and is offset by the gain or loss of the underlying

debt instrument, which also is recorded in interest expense. These fair value hedges are highly effective and, thus,

there is no impact on earnings due to hedge ineffectiveness. The dollar equivalent (based on inception date foreign

currency exchange rates) gross notional amount of the Company’s interest rate swaps at December 31, 2010 was

$1.1 billion.

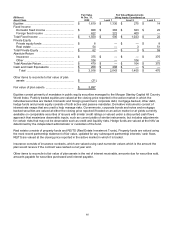

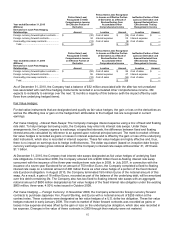

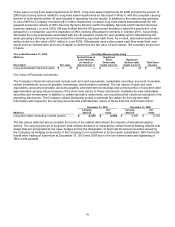

At December 31, 2010, the Company had interest rate swaps designated as fair value hedges of underlying fixed

rate obligations. In November 2006, the Company entered into a $400 million fixed-to-floating interest rate swap

concurrent with the issuance of the three-year medium-term note due in 2009. In July 2007, in connection with the

issuance of a seven-year Eurobond for an amount of 750 million Euros, the Company completed a fixed-to-floating

interest rate swap on a notional amount of 400 million Euros as a fair value hedge of a portion of the fixed interest

rate Eurobond obligation. In August 2010, the Company terminated 150 million Euros of the notional amount of this

swap. As a result, a gain of 18 million Euros, recorded as part of the balance of the underlying debt, will be amortized

over this debt’s remaining life. The Company also has two fixed-to-floating interest rate swaps with an aggregate

notional amount of $800 million designated as fair value hedges of the fixed interest rate obligation under the existing

$800 million, three-year, 4.50% notes issued in October 2008.

Fair Value Hedging — Foreign Currency: In November 2008, the Company entered into foreign currency forward

contracts to purchase Japanese Yen, Pound Sterling, and Euros with a notional amount of $255 million at the

contract rates. These contracts were designated as fair value hedges of a U.S. dollar tax obligation. These fair value

hedges matured in early January 2009. The mark-to-market of these forward contracts was recorded as gains or

losses in tax expense and was offset by the gain or loss on the underlying tax obligation, which also was recorded in

tax expense. Changes in the value of these contracts in 2009 through their maturity were not material.