3M 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74

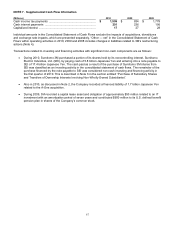

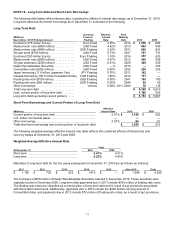

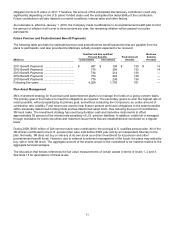

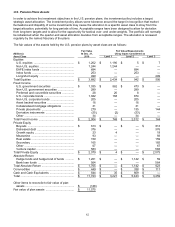

During the first quarter of 2010, the Company entered into a floating rate note payable of 17.4 billion Japanese Yen

(approximately $188 million based on applicable exchange rates at that time) in connection with the purchase of

additional interest in the Company’s Sumitomo 3M Limited subsidiary as discussed in Note 6. This note is due in

three equal installments of 5.8 billion Japanese Yen, with one installment paid on September 30, 2010, and the

remaining installments due March 30, 2011 and September 30, 2011. 11.6 billion Japanese Yen is outstanding on

this obligation at year-end 2010. Interest accrues on the note based on the three-month Tokyo Interbank Offered

Rate (TIBOR) plus 40 basis points.

In the fourth quarter of 2010, the Company entered into a 100.5 million Canadian Dollar loan, with four equal

installments due in April 2011, July 2011, October 2011 and January 2012. At December 31, 2010, the floating

interest rate on this loan was 1.8%.

Other borrowings included debt held by 3M’s international companies and floating rate notes in the United States,

with the long-term portion of this debt primarily composed of U.S. dollar floating rate debt.

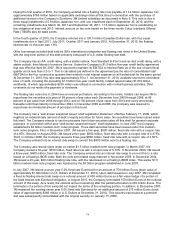

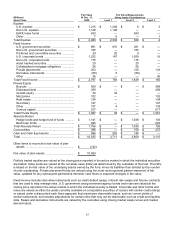

The Company has an AA- credit rating, with a stable outlook, from Standard & Poor’s and an Aa2 credit rating, with a

stable outlook, from Moody’s Investors Service. Under the Company’s $1.5-billion five-year credit facility agreement

that was effective April 30, 2007, 3M is required to maintain its EBITDA to Interest Ratio as of the end of each fiscal

quarter at not less than 3.0 to 1. This is calculated (as defined in the agreement) as the ratio of consolidated total

EBITDA for the four consecutive quarters then ended to total interest expense on all funded debt for the same period.

At December 31, 2010, this ratio was approximately 35 to 1. At December 31, 2010, available short-term committed

lines of credit, including the preceding $1.5 billion five-year credit facility, totaled approximately $1.674 billion

worldwide, of which approximately $255 million was utilized in connection with normal business activities. Debt

covenants do not restrict the payment of dividends.

The floating rate notes due in 2044 have an annual put feature. According to the terms, holders can require 3M to

repurchase the securities at a price of 98 percent of par value each December from 2005 through 2008, at 99

percent of par value from 2009 through 2013, and at 100 percent of par value from 2014 and every anniversary

thereafter until final maturity in December 2044. In December 2009 and 2008, the Company was required to

repurchase an immaterial amount of principal on this bond.

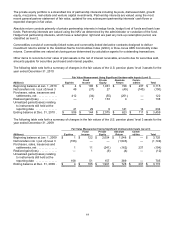

The Company has a “well-known seasoned issuer” shelf registration statement, effective February 17, 2009, which

registers an indeterminate amount of debt or equity securities for future sales. No securities have been issued under

this shelf. The Company intends to use the proceeds from future securities sales off this shelf for general corporate

purposes. In connection with a prior “well-known seasoned issuer” shelf registration, in June 2007 the Company

established a $3 billion medium-term notes program. Three debt securities have been issued under this medium-

term notes program. First, in December 2007, 3M issued a five-year, $500 million, fixed rate note with a coupon rate

of 4.65%. Second, in August 2008, 3M issued a five-year, $850 million, fixed rate note with a coupon rate of 4.375%.

Third, in October 2008, the Company issued a three-year $800 million, fixed rate note with a coupon rate of 4.50%.

The Company entered into an interest rate swap to convert this $800 million note to a floating rate.

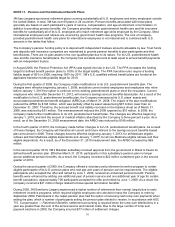

The Company also issued notes under an earlier $1.5 billion medium-term note program. In March 2007, the

Company issued a 30-year, $750 million, fixed rate note with a coupon rate of 5.70%. In November 2006, 3M issued

a three-year, $400 million, fixed rate note. The Company entered into an interest rate swap to convert this to a rate

based on a floating LIBOR index. Both the note and related swap matured in November 2009. In December 2004,

3M issued a 40-year, $60 million floating rate note, with the rate based on a floating LIBOR index. This earlier $1.5

billion medium term note program was replaced by the $3 billion program established in June 2007.

In July 2007, 3M issued a seven year 5.0% fixed rate Eurobond for an amount of 750 million Euros (book value of

approximately $1.044 billion in U.S. Dollars at December 31, 2010). Upon debt issuance in July 2007, 3M completed

a fixed-to-floating interest rate swap on a notional amount of 400 million Euros as a fair value hedge of a portion of

the fixed interest rate Eurobond obligation. In August 2010, the Company terminated 150 million Euros of the notional

amount of this swap. As a result, the notional amount remaining after the partial termination is 250 million Euros. The

termination of a portion of this swap did not impact the terms of the remaining portion. In addition, in December 2007,

3M reopened the existing seven year 5.0% fixed rate Eurobond for an additional amount of 275 million Euros (book

value of approximately $368 million in U.S. Dollars at December 31, 2010). This security was issued at a premium

and was subsequently consolidated with the original security on January 15, 2008.