3M 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

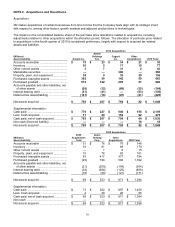

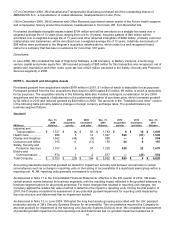

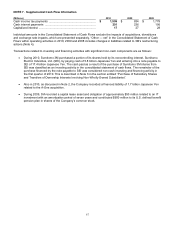

acquired in the Cogent Inc. transaction included $532 million of cash and marketable securities, as displayed in the

preceding table.

Purchased identifiable intangible assets related to the acquisitions that closed in 2010 totaled $663 million and will be

amortized on a straight-line basis over a weighted-average life of 11 years (lives ranging from 2 to 17 years).

Acquired identifiable intangible assets for which significant assumed renewals or extensions of underlying

arrangements impacted the determination of their useful lives were not material.

In February 2011, 3M (Industrial and Transportation Business) announced that it completed its acquisition of the

tape-related assets of Alpha Beta Enterprise Co. Ltd., a leading manufacturer of box sealing tape and masking tape

headquartered in Taipei, Taiwan.

In December 2010, 3M (Industrial and Transportation Business) announced that it entered into an agreement to

acquire Winterthur Technologies AG (Winterthur) by way of a public tender offer. Winterthur, based in Zug,

Switzerland, is a leading global supplier of precision grinding technology serving customers in the area of hard-to-

grind precision applications in industrial, automotive, aircraft, and cutting tools. The proposed transaction has an

aggregate value of approximately $450 million relative to all of the outstanding shares of Winterthur on a fully diluted

basis. On February 11, 2011, 3M published the Definitive Interim Result of the public tender offer and waived the

condition of the tendering of 67 percent of Winterthur’s shares. By that date, 3M acquired through open market

purchases approximately 15% of Winterthur’s shares. An additional approximately 23% of Winterthur’s shares have

been tendered under the public tender offer. The public tender offer was extended for a period of 10 trading days

from February 14, 2011 to February 25, 2011 in accordance with applicable tender offer rules. Settlement for all

tendered shares will occur on March 7, 2011.

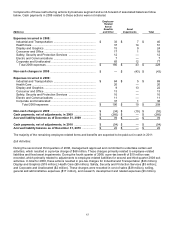

2009 acquisitions:

During 2009, 3M completed four business combinations. The purchase price paid for these business combinations

(net of cash acquired) and certain acquisition costs and contingent consideration paid for pre-2009 business

combinations during 2009 aggregated to $69 million.

(1) In January 2009, 3M (Safety, Security and Protection Services Business) purchased all of the outstanding shares

of Alltech Solutions, a provider of water pipe rehabilitation services based in Moncton, New Brunswick, Canada.

(2) In February 2009, 3M (Industrial and Transportation Business) purchased the assets of Compac Corp.’s pressure

sensitive adhesive tape business, a global leader in providing custom solutions in coating, laminating and converting

flexible substrates headquartered in Hackettstown, N.J.

(3) In April 2009, 3M (Industrial and Transportation Business) purchased all of the outstanding shares of Meguiar’s

International, UK, a distributor of Meguiar’s, Inc. products based in Daventry, United Kingdom.

(4) In July 2009, 3M (Consumer and Office Business) purchased the ACE® branded (and related brands) elastic

bandage, supports and thermometer product lines, which are sold broadly through consumer channels in North

America.

Purchased identifiable intangible assets related to the four acquisitions that closed in 2009 totaled $28 million. This

included $20 million of identifiable intangible assets that will be amortized on a straight-line basis over a weighted-

average life of eight years (lives ranging from three to 12 years) and $8 million of indefinite-lived intangible assets

related to the well-recognized ACE® brand. Acquired identifiable intangible assets for which significant assumed

renewals or extensions of underlying arrangements impacted the determination of their useful lives were not material.

2008 acquisitions:

During 2008, 3M completed 18 business combinations. The purchase price paid for business combinations (net of

cash acquired) and certain contingent consideration paid during the twelve months ended December 31, 2008 for

previous acquisitions aggregated to $1.394 billion.

The 18 business combinations are summarized as follows:

(1) In March 2008, 3M (Industrial and Transportation Business) purchased certain assets of Hitech Polymers Inc., a

manufacturer of specialty thermoplastic polymers and provider of toll thermoplastic compounding services based in

Hebron, Kentucky.