3M 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

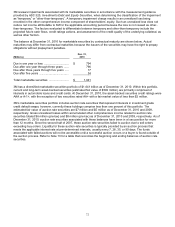

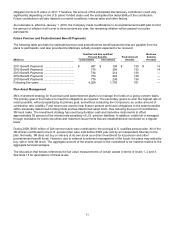

78

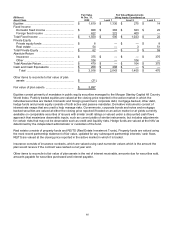

Qualified

and Non-qualified

Pension Benefits

Postretirement

United States

International

Benefits

(Millions)

2010

2009

2010

2009

2010

2009

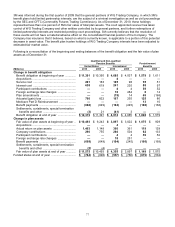

Amounts recognized in the Consolidated

Balance Sheet as of Dec. 31,

Non-current assets ...........................................

$

—

$

—

$

74

$

78

$

—

$

—

Accrued benefit cost .........................................

Current liabilities ............................................

(30

)

(30

)

(7

)

(7

)

(4

)

(4

)

Non-current liabilities ....................................

(714

)

(868

)

(624

)

(859

)

(675

)

(500

)

Ending balance .................................................

$

(744

)

$

(898

)

$

(557

)

$

(788

)

$

(679

)

$

(504

)

Amounts recognized in accumulated other

comprehensive income as of Dec. 31,

Net transition obligation (asset) ........................

$

—

$

—

$

(7

)

$

(5

)

$

—

$

—

Net actuarial loss (gain) ....................................

3,981

3,975

1,670

1,650

1,063

1,059

Prior service cost (credit) ..................................

33

46

(144

)

(57

)

(341

)

(504

)

Ending balance .................................................

$

4,014

$

4,021

$

1,519

$

1,588

$

722

$

555

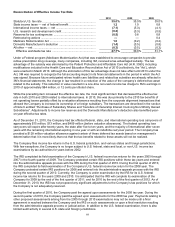

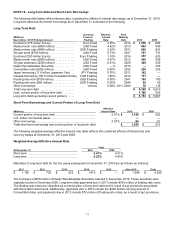

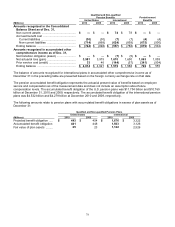

The balance of amounts recognized for international plans in accumulated other comprehensive income as of

December 31 in the preceding table are presented based on the foreign currency exchange rate on that date.

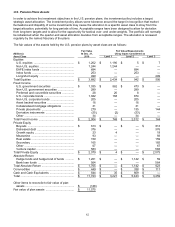

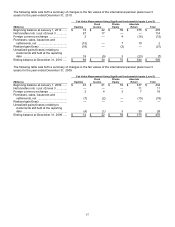

The pension accumulated benefit obligation represents the actuarial present value of benefits based on employee

service and compensation as of the measurement date and does not include an assumption about future

compensation levels. The accumulated benefit obligation of the U.S. pension plans was $11.754 billion and $10.769

billion at December 31, 2010 and 2009, respectively. The accumulated benefit obligation of the international pension

plans was $4.532 billion and $4.279 billion at December 2010 and 2009, respectively.

The following amounts relate to pension plans with accumulated benefit obligations in excess of plan assets as of

December 31:

Qualified and Non-qualified Pension

Plans

United States

International

(Millions)

2010

2009

2010

2009

Projected benefit obligation .....

$

443

$

454

$

1,676

$

3,322

Accumulated benefit obligation

441

448

1,563

3,126

Fair value of plan assets .........

25

23

1,122

2,526