3M 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

Purchase of Subsidiary Shares and Transfers of Ownership Interests Involving Non-Wholly Owned

Subsidiaries

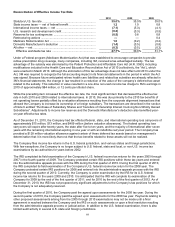

During the second half of 2009 and the first half of 2010, 3M effected a purchase of subsidiary shares and transfers

of ownership interests to align activities in Japan and to simplify the Company’s ownership structure. As a result of

these activities, beginning in June 2010 the Company has a wholly owned subsidiary in the region in addition to its

majority owned Sumitomo 3M Limited entity (Sumitomo 3M). Because the Company retained its controlling interest in

the subsidiaries involved, these activities resulted in changes to 3M Company shareholders’ equity and

noncontrolling interest. These activities included the following:

During the second half of 2009, a wholly owned subsidiary that, in turn, owned a portion of the Company’s

majority owned Sumitomo 3M, was transferred to another subsidiary (referred to herein as 3M HC) that was

majority, rather than wholly, owned. Sumitomo 3M also owned a portion of 3M HC. As a result of the

transaction, 3M’s effective ownership in Sumitomo 3M was reduced from 75 percent to 71.5 percent. The

transfer resulted in a decrease in 3M Company shareholders’ equity and an increase in noncontrolling

interest of $81 million in the second half of 2009.

During the first quarter of 2010, majority owned 3M HC which, as a result of the transfer above owned a

portion of the Company’s majority owned Sumitomo 3M, transferred this interest to Sumitomo 3M. In

addition, Sumitomo 3M purchased a portion of its shares held by its noncontrolling interest, Sumitomo

Electric Industries, Ltd. (SEI), by paying cash of 5.8 billion Japanese Yen and entering into a note payable to

SEI of 17.4 billion Japanese Yen (approximately $63 million and $188 million, respectively, based on

applicable exchange rates at that time). As a result of these transactions, 3M’s effective ownership in

Sumitomo 3M was increased from 71.5 percent to 75 percent. The cash paid as a result of the purchase of

Sumitomo 3M shares from SEI was classified as an investing activity in the consolidated statement of cash

flows. The remainder of the purchase financed by the note payable to SEI was considered non-cash

investing and financing activity in the first quarter of 2010. These transactions resulted in an increase in 3M

Company shareholders’ equity of $22 million and a decrease in noncontrolling interest of $278 million in the

first quarter of 2010.

During the second quarter of 2010, majority owned Sumitomo 3M transferred its interest in 3M HC to 3M HC.

As a result of this transaction, 3M HC became wholly owned by the Company. The transfer resulted in an

increase in 3M Company shareholders’ equity and a decrease in noncontrolling interest of $24 million in the

second quarter of 2010.

3M also acquired the remaining noncontrolling interest of a previously majority owned subsidiary for an immaterial

amount during the first half of 2010. In addition, as discussed in Note 2, in October 2010 3M acquired a controlling

interest in Cogent Inc. via a tender offer and in December 2010 completed a second-step merger for the same

amount per outstanding share as the tender offer, thereby acquiring the remaining noncontrolling interest in Cogent

Inc. The resulting October 2010 increase and December 2010 decrease in noncontrolling interest associated with the

Cogent Inc. transactions are presented netting to zero with respect to the amount impacting noncontrolling interest in

the consolidated statement of changes in equity. However, the December 2010 transaction resulted in an immaterial

transfer from noncontrolling interest to 3M Company shareholders’ equity.

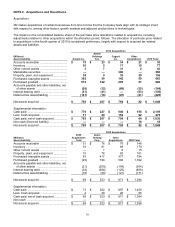

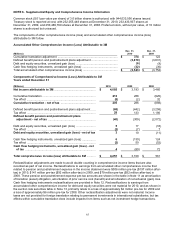

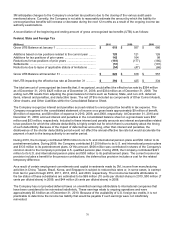

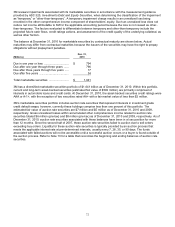

The following table summarizes the effects of these transactions on equity attributable to 3M Company shareholders

for the respective periods.

(Millions)

2010

2009

Net income attributable to 3M ........................................................

$

4,085

$

3,193

Transfer from (to) noncontrolling interest .......................................

43

(81

)

Change in 3M Company shareholders’ equity from net income

attributable to 3M and transfers from (to) noncontrolling interest

$

4,128

$

3,112