3M 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

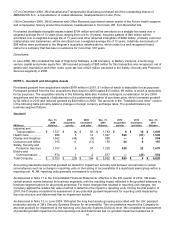

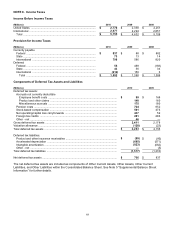

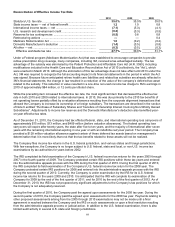

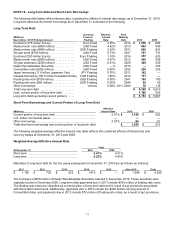

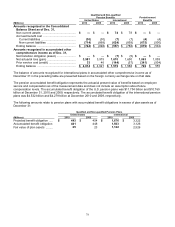

NOTE 8. Income Taxes

Income Before Income Taxes

(Millions)

2010

2009

2008

United States ......................................................................................

$

2,778

$

2,338

$

2,251

International ........................................................................................

2,977

2,294

2,857

Total ................................................................................................

$

5,755

$

4,632

$

5,108

Provision for Income Taxes

(Millions)

2010

2009

2008

Currently payable

Federal ............................................................................................

$

837

$

88

$

882

State ................................................................................................

73

13

14

International ....................................................................................

796

586

820

Deferred

Federal ............................................................................................

55

489

(168

)

State ................................................................................................

43

56

34

International ....................................................................................

(212

)

156

6

Total ............................................................................................

$

1,592

$

1,388

$

1,588

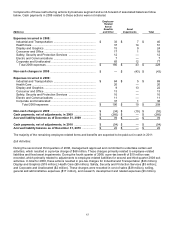

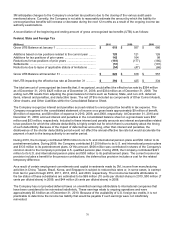

Components of Deferred Tax Assets and Liabilities

(Millions)

2010

2009

Deferred tax assets:

Accruals not currently deductible

Employee benefit costs ...........................................................................................

$

99

$

168

Product and other claims ........................................................................................

148

160

Miscellaneous accruals ...........................................................................................

175

180

Pension costs ..............................................................................................................

724

852

Stock-based compensation .........................................................................................

501

473

Net operating/capital loss carryforwards .....................................................................

437

59

Foreign tax credits ......................................................................................................

281

286

Other - net ...................................................................................................................

46

—

Gross deferred tax assets ...............................................................................................

2,411

2,178

Valuation allowance ........................................................................................................

(128

)

(23

)

Total deferred tax assets ................................................................................................

$

2,283

$

2,155

Deferred tax liabilities:

Product and other insurance receivables ....................................................................

$

(59

)

$

(80

)

Accelerated depreciation ............................................................................................

(695

)

(571

)

Intangible amortization ................................................................................................

(823

)

(662

)

Other - net ...................................................................................................................

—

(5

)

Total deferred tax liabilities .............................................................................................

(1,577

)

(1,318

)

Net deferred tax assets ...................................................................................................

$

706

$

837

The net deferred tax assets are included as components of Other Current Assets, Other Assets, Other Current

Liabilities, and Other Liabilities within the Consolidated Balance Sheet. See Note 5 “Supplemental Balance Sheet

Information” for further details.