3M 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

(17) In December 2008, 3M (Industrial and Transportation Business) purchased all of the outstanding shares of

ABRASIVOS S.A., a manufacturer of coated abrasives, headquartered in Lima, Peru.

(18) In December 2008, 3M (Consumer and Office Business) purchased certain assets of the Futuro health supports

and compression hosiery product line business, headquartered in Cincinnati, OH, from Beiersdorf AG.

Purchased identifiable intangible assets totaled $794 million and will be amortized on a straight-line basis over a

weighted-average life of 13 years (lives ranging from one to 19 years). Acquired patents of $40 million will be

amortized over a weighted-average life of 11 years and other acquired intangibles of $696 million, primarily customer

relationships and tradenames, will be amortized over a weighted-average life of 13 years. Indefinite-lived assets of

$58 million were purchased in the Meguiar’s acquisition detailed above, which relate to a well recognized brand

name for a company that has been in existence for more than 100 years.

Divestitures:

In June 2008, 3M completed the sale of HighJump Software, a 3M Company, to Battery Ventures, a technology

venture capital and private equity firm. 3M received proceeds of $85 million for this transaction and recognized, net of

assets sold, transaction and other costs, a pre-tax loss of $23 million (recorded in the Safety, Security and Protection

Services segment) in 2008.

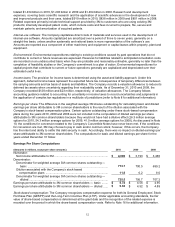

NOTE 3. Goodwill and Intangible Assets

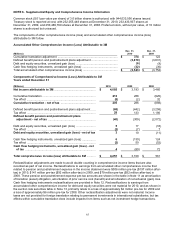

Purchased goodwill from acquisitions totaled $978 million in 2010, $1 million of which is deductible for tax purposes.

Purchased goodwill from the four acquisitions that closed in 2009 totaled $15 million, $9 million of which is deductible

for tax purposes. The acquisition activity in the following table also includes contingent consideration for pre-2009

acquisitions and the impacts of adjustments to the preliminary allocation of purchase price, which increased goodwill

by $2 million in 2010 and reduced goodwill by $40 million in 2009. The amounts in the “Translation and other” column

in the following table primarily relate to changes in foreign currency exchange rates. The goodwill balance by

business segment follows:

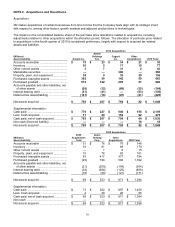

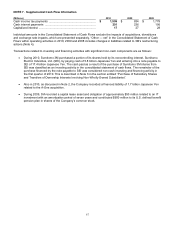

Goodwill

(Millions)

Dec. 31,

2008

Balance

2009

acquisition

activity

2009

translation

and other

Dec. 31,

2009

Balance

2010

acquisition

activity

2010

translation

and other

Dec. 31,

2010

Balance

Industrial and

Transportation .......

$

1,737

$

(4

)

$

50

$

1,783

$

8

$

18

$

1,809

Health Care ..............

988

5

14

1,007

520

(21

)

1,506

Display and Graphics

1,042

(44

)

(8

)

990

—

4

994

Consumer and Office

155

11

(11

)

155

24

8

187

Safety, Security and

Protection Services

1,157

6

57

1,220

428

22

1,670

Electro and

Communications ...

674

1

2

677

—

(23

)

654

Total Company .........

$

5,753

$

(25

)

$

104

$

5,832

$

980

$

8

$

6,820

Accounting standards require that goodwill be tested for impairment annually and between annual tests in certain

circumstances such as a change in reporting units or the testing of recoverability of a significant asset group within a

reporting unit. At 3M, reporting units generally correspond to a division.

As discussed in Note 17 to the Consolidated Financial Statements, effective in the first quarter of 2010, 3M made

certain product moves between its business segments, with the resulting impact reflected in the goodwill balances by

business segment above for all periods presented. For those changes that resulted in reporting unit changes, the

Company applied the relative fair value method to determine the impact to reporting units. During the first quarter of

2010, the Company completed its assessment of any potential goodwill impairment for reporting units impacted by

this new structure and determined that no impairment existed.

As discussed in Note 13, in June 2009, 3M tested the long lived assets grouping associated with the U.K. passport

production activity of 3M’s Security Systems Division for recoverability. This circumstance required the Company to

also test goodwill for impairment at the reporting unit (Security Systems Division) level. 3M completed its assessment

of potential goodwill impairment for this reporting unit and determined that no goodwill impairment existed as of