3M 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.15

avoided disruption to its manufacturing operations through careful management of existing raw material inventories

and development and qualification of additional supply sources. 3M manages commodity price risks through

negotiated supply contracts, price protection agreements and forward physical contracts.

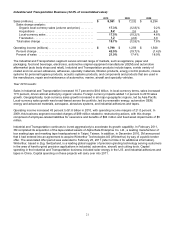

In 2011, 3M expects sales growth of 10 percent or more, with organic sales volume growing 5.5 to 7.5 percent,

currency effects adding 1 to 2 percent (assuming December 31, 2010 exchange rates), and acquisitions adding 4 to

6 percent for the year. This expected sales growth and related incremental operating income, including a benefit from

currency effects (assuming December 31, 2010 exchange rates), should more than offset the items that will

negatively impact earnings, as summarized below.

There are a few major items that will negatively impact earnings in 2011. First, as discussed further below, 3M

expects that pension and postretirement expense will decrease 2011 earnings, when compared to 2010, by

approximately 22 cents per diluted share. A banked vacation policy change made in 2009 will also negatively impact

earnings in 2011. Prior to 2009, 3M allowed employees to bank a certain amount of unused vacation. Effective

January 1, 2009, 3M employees were given two years to use their previously banked vacation, with the resulting

reduction in 3M’s liability benefiting both 2009 and 2010 operating results. This change resulted in an estimated 8

cent per diluted share benefit in 2010 results, which will not carry-over into 2011, and thus, will negatively impact

2011 versus 2010 comparisons. Finally, 3M’s early assessment of the income tax rate indicates an expected 2011

effective tax rate of approximately 29.5 percent compared to 27.7 percent for 2010.

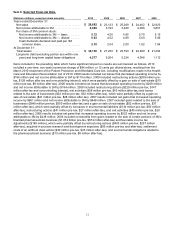

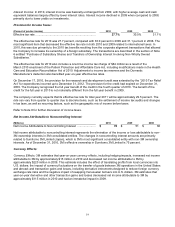

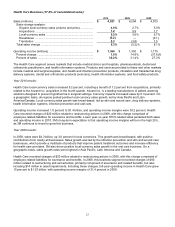

On a worldwide basis, 3M’s pension and postretirement plans were 90 percent funded at year-end 2010. The U.S.

qualified plan, which is approximately 71 percent of the worldwide pension obligation, was 97 percent funded, the

non-qualified pension plan was not funded, and the international pension plans were 89 percent funded. Asset

returns in 2010 for the U.S. qualified plan were 14.4% while the year-end 2010 discount rate was 5.23%, down 0.54

percentage points from the 2009 discount rate of 5.77%. 3M expects to contribute $400 million to $600 million of

cash to its global pension and postretirement plans in 2011. The Company does not have a required minimum

pension contribution obligation for its U.S. plans in 2011. 3M expects pension and postretirement benefit expense in

2011 to increase by approximately $213 million pre-tax, or 22 cents per diluted share, when compared to 2010. Refer

to critical accounting estimates within MD&A and Note 11 (Pension and Postretirement Benefit Plans) for additional

information concerning 3M’s pension and post-retirement plans.

Forward-looking statements in Item 7 may involve risks and uncertainties that could cause results to differ materially

from those projected (refer to the section entitled “Cautionary Note Concerning Factors That May Affect Future

Results” in Item 1 and the risk factors provided in Item 1A for discussion of these risks and uncertainties).

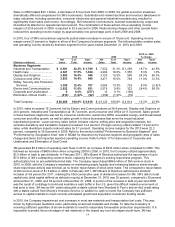

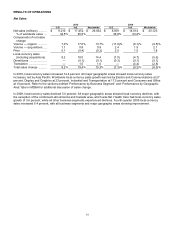

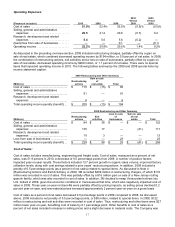

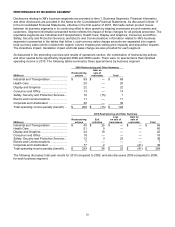

Special Items:

Special items represent significant charges or credits that are important to understanding changes in the Company’s

underlying operations.

In 2010, 3M recorded a one-time, non-cash income tax charge of $84 million, or 12 cents per diluted share, resulting

from the March 2010 enactment of the Patient Protection and Affordable Care Act, including modifications made in

the Health Care and Education Reconciliation Act of 2010 (collectively, the “Act”). The charge is due to a reduction in

the value of the company’s deferred tax asset as a result of the Act’s change to the tax treatment of Medicare Part D

reimbursements. This item is discussed in more detail in Note 8 (Income Taxes).

In 2009, net losses for restructuring and other actions decreased operating income by $194 million and net income

attributable to 3M by $119 million, or $0.17 per diluted share. 2009 included restructuring actions ($209 million pre-

tax, $128 million after tax and noncontrolling interest), which were partially offset by a gain on sale of real estate ($15

million pre-tax, $9 million after tax). The gain on sale of real estate relates to the June 2009 sale of a New Jersey

roofing granule facility, which is recorded in cost of sales within the Safety, Security and Protection Services business

segment. Restructuring is discussed in more detail in Note 4 (Restructuring Actions and Exit Activities).

In 2008, net losses for restructuring and other actions decreased operating income by $269 million and net income

attributable to 3M by $194 million, or $0.28 per diluted share. 2008 included restructuring actions ($229 million pre-

tax, $147 million after-tax and noncontrolling interest), exit activities ($58 million pre-tax, $43 million after-tax) and

losses related to the sale of businesses ($23 million pre-tax, $32 million after-tax), which were partially offset by a

gain on sale of real estate ($41 million pre-tax, $28 million after-tax). Divestiture impacts, restructuring actions and

exit activities are discussed in more detail in Note 2 (Acquisitions and Divestitures) and Note 4 (Restructuring Actions

and Exit Activities). Concerning the real estate gain, 3M received proceeds and recorded a gain in 2008 for a sale-

leaseback transaction relative to an administrative location in Italy.