3M 2010 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

Research and Patents

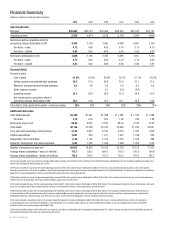

Research and product development constitutes an important part of 3M’s activities and has been a major driver of

3M’s sales growth. Research, development and related expenses totaled $1.434 billion in 2010, $1.293 billion in

2009 and $1.404 billion in 2008. Research and development, covering basic scientific research and the application of

scientific advances in the development of new and improved products and their uses, totaled $919 million in 2010,

$838 million in 2009 and $851 million in 2008. Related expenses primarily include technical support provided by 3M

to customers who are using existing 3M products; internally developed patent costs, which include costs and fees

incurred to prepare, file, secure and maintain patents; and amortization of acquired patents.

The Company’s products are sold around the world under various trademarks. The Company also owns, or holds

licenses to use, numerous U.S. and foreign patents. The Company’s research and development activities generate a

steady stream of inventions that are covered by new patents. Patents applicable to specific products extend for

varying periods according to the date of patent application filing or patent grant and the legal term of patents in the

various countries where patent protection is obtained. The actual protection afforded by a patent, which can vary

from country to country, depends upon the type of patent, the scope of its coverage and the availability of legal

remedies in the country.

The Company believes that its patents provide an important competitive advantage in many of its businesses. In

general, no single patent or group of related patents is in itself essential to the Company as a whole or to any of the

Company’s business segments. The importance of patents in the Display and Graphics segment is described in

“Performance by Business Segment” — “Display and Graphics Business” in Part II, Item 7, of this Form 10-K.

Raw Materials

In 2010, the Company experienced cost increases in most raw materials and transportation fuel costs. This was

driven by higher basic feedstock costs, particularly oil-derived materials and metals. To date, the Company is

receiving sufficient quantities of all raw materials to meet its reasonably foreseeable production requirements. It is

impossible to predict future shortages of raw materials or the impact any such shortages would have. 3M has

avoided disruption to its manufacturing operations through careful management of existing raw material inventories

and development and qualification of additional supply sources. 3M manages commodity price risks through

negotiated supply contracts, price protection agreements and forward physical contracts.

Environmental Law Compliance

3M’s manufacturing operations are affected by national, state and local environmental laws around the world. 3M has

made, and plans to continue making, necessary expenditures for compliance with applicable laws. 3M is also

involved in remediation actions relating to environmental matters from past operations at certain sites. Refer to the

“Environmental Matters and Litigation” section in Note 14, Commitments and Contingencies, for more detail.

Environmental expenditures relating to existing conditions caused by past operations that do not contribute to current

or future revenues are expensed. Reserves for liabilities related to anticipated remediation costs are recorded on an

undiscounted basis when they are probable and reasonably estimable, generally no later than the completion of

feasibility studies or the Company’s commitment to a plan of action. Environmental expenditures for capital projects

that contribute to current or future operations generally are capitalized and depreciated over their estimated useful

lives.

In 2010, 3M invested about $12 million in capital projects to protect the environment. This amount excludes

expenditures for remediation actions relating to existing matters caused by past operations that do not contribute to

current or future revenues, which are expensed. Capital expenditures for environmental purposes have included

pollution control devices — such as wastewater treatment plant improvements, scrubbers, containment structures,

solvent recovery units and thermal oxidizers — at new and existing facilities constructed or upgraded in the normal

course of business. Consistent with the Company’s policies stressing environmental responsibility, capital

expenditures (other than for remediation projects) for known projects are presently expected to be about $30 million

over the next two years for new or expanded programs to build facilities or modify manufacturing processes to

minimize waste and reduce emissions.

While the Company cannot predict with certainty the future costs of such cleanup activities, capital expenditures or

operating costs for environmental compliance, the Company does not believe they will have a material effect on its

capital expenditures, earnings or competitive position.