3M 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 Driven to Innovate

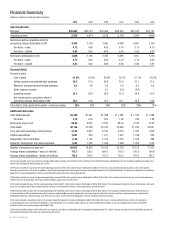

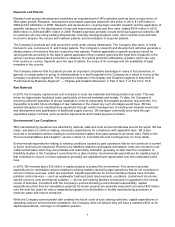

Financial Summary

(Dollars in millions, except per share amounts)

2010 2009 2008 2007 2006 2005

Operating Results

Net sales $26,662 $23,123 $25,269 $24,462 $22,923 $21,167

Operating income 5,918 4,814 5,218 6,193 5,696 4,854

Net income before cumulative effect of

accounting change attributable to 3M 4,085 3,193 3,460 4,096 3,851 3,139

Per share – basic 5.72 4.56 4.95 5.70 5.15 4.10

Per share – diluted 5.63 4.52 4.89 5.60 5.06 4.02

Net income attributable to 3M 4,085 3,193 3,460 4,096 3,851 3,104

Per share – basic 5.72 4.56 4.95 5.70 5.15 4.06

Per share – diluted 5.63 4.52 4.89 5.60 5.06 3.97

Financial Ratios

Percent of sales

Cost of sales 51.9% 52.4% 52.9% 52.1% 51.1% 49.2%

Selling, general and administrative expenses 20.5 21.2 20.8 20.5 22.1 21.9

Research, development and related expenses 5.4 5.6 5.6 5.6 6.6 6.0

Other expense (income) – – 0.1 (3.5) (4.6) –

Operating income 22.2 20.8 20.6 25.3 24.8 22.9

Net income before cumulative effect of

accounting change attributable to 3M 15.3 13.8 13.7 16.7 16.8 14.8

Total debt to total capital (total capital = debt plus equity) 25% 30% 39% 29% 26% 18%

Additional Information

Cash dividends paid $1,500 $1,431 $1,398 $ 1,380 $ 1,376 $ 1,286

Per share 2.10 2.04 2.00 1.92 1.84 1.68

Stock price at year-end 86.30 82.67 57.54 84.32 77.93 77.50

Total assets 30,156 27,250 25,793 24,699 21,294 20,541

Long-term debt (excluding current portion) 4,183 5,097 5,166 4,019 1,047 1,309

Capital expenditures 1,091 903 1,471 1,422 1,168 943

Depreciation and amortization 1,120 1,157 1,153 1,072 1,079 986

Research, development and related expenses 1,434 1,293 1,404 1,368 1,522 1,274

Number of employees at year-end 80,057 74,835 79,183 76,239 75,333 71,227

Average shares outstanding – basic (in millions) 713.7 700.5 699.2 718.3 747.5 764.9

Average shares outstanding – diluted (in millions) 725.5 706.7 707.2 732.0 761.0 781.3

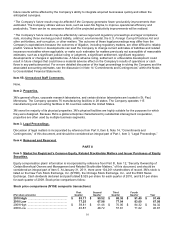

2010 results included a one-time income tax charge of $84 million resulting from the March 2010 enactment of the Patient Protection and Affordable Care Act, including modifications made in the

Health Care and Education Reconciliation Act of 2010.

2009 results included net losses that decreased operating income by $194 million and net income attributable to 3M by $119 million. This included restructuring actions, which were partially

offset by a gain on sale of real estate. In addition, certain amounts presented for prior periods have been reclassified to conform to the 2009 presentation. This primarily related to the retrospective

application of accounting guidance related to convertible debt instruments and noncontrolling interest.

2008 results included net losses that decreased operating income by $269 million and net income attributable to 3M by $194 million. This included restructuring actions, exit activities and losses

related to the sale of businesses, which were partially offset by a gain on sale of real estate.

2007 results included net gains that increased operating income by $681 million and net income attributable to 3M by $448 million. This included gains related to the sale of businesses and a gain

on sale of real estate, which were partially offset by increases in environmental liabilities, restructuring actions and exit activities.

2006 results included net gains that increased operating income by $523 million and net income attributable to 3M by $438 million. This included net benefits from gains related to the sale

of certain portions of 3M’s branded pharmaceuticals business and favorable income tax adjustments, which were partially offset by restructuring actions, acquired in-process research and

development expenses, settlement costs of an antitrust class action, and environmental obligations related to the pharmaceuticals business.

2005 results included a cumulative effect of accounting change that reduced net income attributable to 3M by $35 million after tax, or 5 cents per diluted share, related to the adoption of

accounting guidance for asset retirement obligations. Cumulative effect of accounting change impacts net income attributable to 3M only, and is not included as part of net income before

cumulative effect of accounting change attributable to 3M.

2005 results included charges of $75 million after tax related to a tax liability resulting from 3M’s reinvestment of approximately $1.7 billion of foreign earnings into the United States pursuant to

the repatriation provision of the American Jobs Creation Act of 2004.