3M 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

obligation for its U.S. plans in 2011. Therefore, the amount of the anticipated discretionary contribution could vary

significantly depending on the U.S. plans’ funded status and the anticipated tax deductibility of the contribution.

Future contributions will also depend on market conditions, interest rates and other factors.

As noted above, effective January 1, 2010, the Company made modifications to its postretirement health plan to limit

the amount of inflation it will cover to three percent per year; the remaining inflation will be passed on to plan

participants.

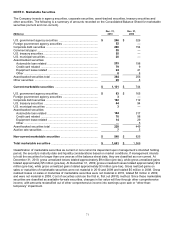

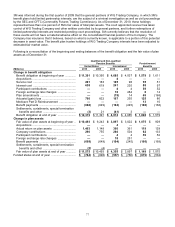

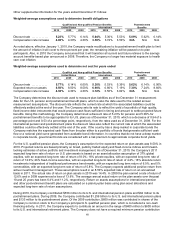

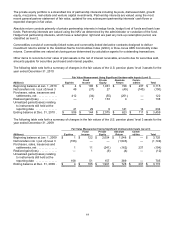

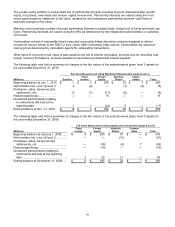

Future Pension and Postretirement Benefit Payments

The following table provides the estimated pension and postretirement benefit payments that are payable from the

plans to participants, and also provides the Medicare subsidy receipts expected to be received.

Qualified and Non-qualified

Pension Benefits

Postretirement

Medicare

Subsidy

(Millions)

United States

International

Benefits

Receipts

2011 Benefit Payments ......................................

$

697

$

194

$

130

$

13

2012 Benefit Payments ......................................

716

204

133

14

2013 Benefit Payments ......................................

734

214

130

—

2014 Benefit Payments ......................................

754

224

139

—

2015 Benefit Payments ......................................

776

238

136

—

Following five years ............................................

4,208

1,378

751

—

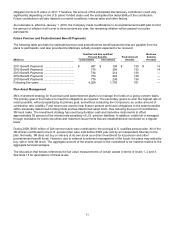

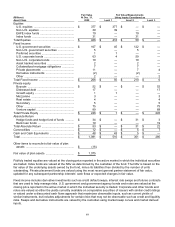

Plan Asset Management

3M’s investment strategy for its pension and postretirement plans is to manage the funds on a going-concern basis.

The primary goal of the funds is to meet the obligations as required. The secondary goal is to earn the highest rate of

return possible, without jeopardizing its primary goal, and without subjecting the Company to an undue amount of

contribution rate volatility. Fund returns are used to help finance present and future obligations to the extent possible

within actuarially determined funding limits and tax-determined asset limits, thus reducing the level of contributions

3M must make. The investment strategy has used long duration cash and derivative instruments to offset

approximately 50 percent of the interest rate sensitivity of U.S. pension liabilities. In addition, credit risk is managed

through mandates for public securities and maximum issuer limits that are established and monitored on a regular

basis.

During 2009, $600 million of 3M common stock was contributed to the principal U.S. qualified pension plan. All of the

3M shares contributed to the U.S. pension plan were sold before 2009 year end by an independent fiduciary to the

plan. Normally, 3M does not buy or sell any of its own stock as a direct investment for its pension and other

postretirement benefit funds. However, due to external investment management of the funds, the plans may indirectly

buy, sell or hold 3M stock. The aggregate amount of the shares would not be considered to be material relative to the

aggregate fund percentages.

The discussion that follows references the fair value measurements of certain assets in terms of levels 1, 2 and 3.

See Note 13 for descriptions of these levels.