3M 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

a. The Company carried out an evaluation, under the supervision and with the participation of its management,

including the Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of

the Company’s “disclosure controls and procedures” (as defined in the Exchange Act Rule 13a-15(e)) as of the end

of the period covered by this report. Based upon that evaluation, the Chief Executive Officer and Chief Financial

Officer concluded that the Company’s disclosure controls and procedures are effective.

b. The Company’s management is responsible for establishing and maintaining an adequate system of internal

control over financial reporting, as defined in the Exchange Act Rule 13a-15(f). Management conducted an

assessment of the Company’s internal control over financial reporting based on the framework established by the

Committee of Sponsoring Organizations of the Treadway Commission in Internal Control — Integrated Framework.

Based on the assessment, management concluded that, as of December 31, 2010, the Company’s internal control

over financial reporting is effective. Management’s assessment of the effectiveness of the Company’s internal control

over financial reporting as of December 31, 2010 excluded Cogent Inc., Arizant Inc. and Attenti Holdings S.A., which

were all acquired by the Company in the fourth quarter of 2010 in purchase business combinations. Total assets and

total net sales recorded by the Company related to these acquisitions, in the aggregate, represented less than 10

percent of consolidated total assets and less than 1 percent of consolidated net sales of the Company, respectively,

as of and for the year ended December 31, 2010. Companies are allowed to exclude acquisitions from their

assessment of internal control over financial reporting during the first year of an acquisition while integrating the

acquired company under guidelines established by the Securities and Exchange Commission. The Company’s

internal control over financial reporting as of December 31, 2010 has been audited by PricewaterhouseCoopers LLP,

an independent registered public accounting firm, as stated in their report which is included herein, which expresses

an unqualified opinion on the effectiveness of the Company’s internal control over financial reporting as of

December 31, 2010.

c. There was no change in the Company’s internal control over financial reporting that occurred during the

Company’s most recently completed fiscal quarter that has materially affected, or is reasonably likely to materially

affect, the Company’s internal control over financial reporting.

Item 9B. Other Information.

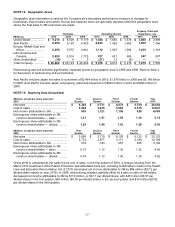

Pursuant to Section 1503 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Act”) which

became effective August 20, 2010, the Company is required to disclose, in connection with the four mines it

operates, certain safety information in its periodic reports filed with the SEC. During the year 2010, the Little Rock,

Arkansas, mine received citations for three violations as defined under Section 1503 (a)(1)(A) of the Act, from the

Mine Safety and Health Administration (the "Violations"). The Little Rock facility received proposed assessments of

$4,224 which are reportable under Section 1503 (a)(1)(F) of the Act. The Corona, California mine received citations

for seven Violations as defined, and had proposed assessments in the total amount of $38,789. The Wausau,

Wisconsin mine received citations for eighteen Violations. The Wausau facility received proposed assessments in the

total amount of $17,419 which are reportable under Section 1503 (a)(1)(F) of the Act. The Pittsboro, North Carolina,

mine received no citation for any Violations as defined, but received a proposed assessment for other violations in

the total amount of $400. During the year 2010, the Company did not receive any other citations or orders reportable

under Section 1503(a)(1) or have other violations reportable thereunder, had no mining-related fatalities, received no

written notices from the Mine Safety and Health Administration reportable under Section 1503(a)(2), and had no

pending legal action before the Federal Mine Safety and Health Review Commission.