3M 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

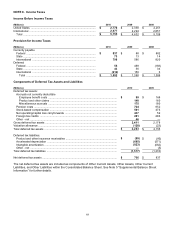

73

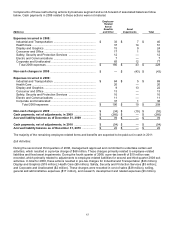

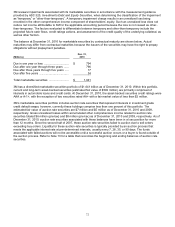

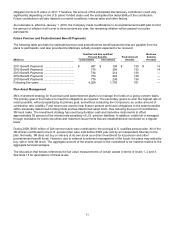

NOTE 10. Long-Term Debt and Short-Term Borrowings

The following debt tables reflect interest rates, including the effects of interest rate swaps, as of December 31, 2010.

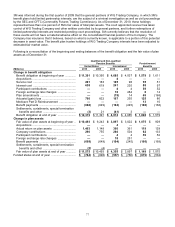

Long-term debt and short-term borrowings as of December 31 consisted of the following:

Long-Term Debt

(Millions)

Description / 2010 Principal Amount

Currency/

Fixed vs.

Floating

Effective

Interest

Rate

Final

Maturity

Date

2010

2009

Eurobond (775 million Euros) ................

Euro Fixed

4.30

%

2014

$

1,055

$

898

Medium-term note ($850 million) .............

USD Fixed

4.42

%

2013

849

849

Medium-term note ($800 million) .............

USD Floating

3.24

%

2011

806

801

30-year bond ($750 million) ..................

USD Fixed

5.73

%

2037

747

747

Eurobond (250 million Euros) ................

Euro Floating

1.18

%

2014

357

623

Medium-term note ($500 million) .............

USD Fixed

4.67

%

2012

500

500

30-year debenture ($330 million) .............

USD Fixed

6.01

%

2028

349

350

Dealer Remarketable Securities ..............

USD Fixed

—

%

2010

—

350

Convertible notes ($252 million) ..............

USD Fixed

0.50

%

2032

226

225

Japan borrowing (11.6 billion Japanese Yen) . .

JPY Floating

0.76

%

2011

142

—

Canada borrowing (100.5 million Canadian Dollar)

CAD Floating

1.80

%

2012

101

—

Floating rate note ($100 million) ..............

USD Floating

0.00

%

2041

100

100

Floating rate note ($60 million) ...............

USD Floating

0.00

%

2044

60

60

Other borrowings ..........................

Various

0.08

%

2011-2040

76

116

Total long-term debt ........................

$

5,368

$

5,619

Less: current portion of long-term debt ........

1,185

522

Long-term debt (excluding current portion) .....

$

4,183

$

5,097

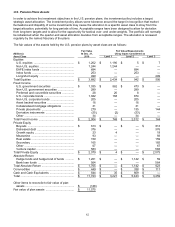

Short-Term Borrowings and Current Portion of Long-Term Debt

(Millions)

Effective

Interest Rate

2010

2009

Current portion of long-term debt ..................................................

2.41

%

$

1,185

$

522

U.S. dollar commercial paper ........................................................

—

—

—

Other borrowings ...........................................................................

2.47

%

84

91

Total short-term borrowings and current portion of long-term debt

$

1,269

$

613

The following weighted-average effective interest rate table reflects the combined effects of interest rate and

currency swaps at December 31, 2010 and 2009.

Weighted-Average Effective Interest Rate

Total

At December 31

2010

2009

Short-term ..............................................................

2.41

%

4.51

%

Long-term ...............................................................

4.22

%

4.04

%

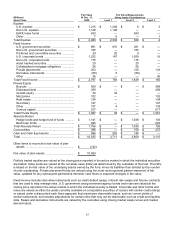

Maturities of long-term debt for the five years subsequent to December 31, 2010 are as follows (in millions):

2011

2012

2013

2014

2015

After 2015

Total

$

1,185

$

752

$

922

$

1,413

$

—

$

1,096

$

5,368

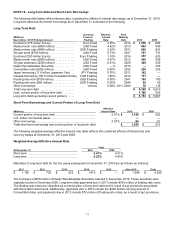

The Company’s $350 million of Dealer Remarketable Securities matured in December 2010. These securities were

originally issued in December 2000. Long-term debt payments due in 2011 include $160 million of floating rate notes.

The floating rate notes are classified as current portion of long-term debt as the result of put provisions associated

with these debt instruments. Additionally, payments due in 2012 include the $226 million carrying amount of

Convertible Notes, and payments due in 2013 include $73 million of floating rate notes, as a result of put provisions.