3M 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

NEW ACCOUNTING PRONOUNCEMENTS

Information regarding new accounting pronouncements is included in Note 1 to the Consolidated Financial

Statements.

FINANCIAL CONDITION AND LIQUIDITY

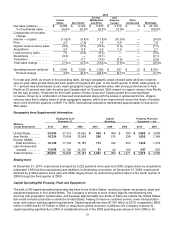

As indicated in the following table, at December 31, 2010, 3M had $5.018 billion of cash, cash equivalents, and

marketable securities and $5.452 billion of debt. Debt included $4.183 billion of long-term debt, $1.185 billion related

to the current portion of long-term debt and short-term borrowings of $84 million. The strength of 3M’s capital

structure and consistency of its cash flows provide 3M reliable access to capital markets. Additionally, the Company’s

maturity profile is staggered to ensure refinancing needs in any given year are reasonable in proportion to the total

portfolio.

The Company generates significant ongoing cash flow, which has been used, in part, to fund share repurchase

activities, pay dividends on 3M common stock, and for acquisitions. As discussed in Note 2, in the fourth quarter of

2010, the Company purchased Arizant Inc., Attenti Holdings S.A. and Cogent Inc. As a result, cash outflows

(including repayment of acquired debt, but net of cash and marketable securities acquired) for these three

acquisitions totaled approximately $1.4 billion. 3M was able to complete these acquisitions without incurring

additional debt, while maintaining a strong cash, cash equivalents and marketable securities position.

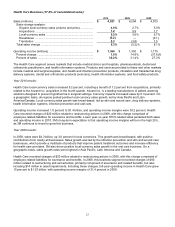

At December 31

(Millions)

2010

2009

2008

Total Debt ......................................................................................

$

5,452

$

5,710

$

6,718

Less: Cash, cash equivalents and marketable securities .............

5,018

4,609

2,574

Net Debt ........................................................................................

$

434

$

1,101

$

4,144

The Company defines net debt as total debt less cash, cash equivalents and marketable securities. 3M considers net

debt to be an important measure of liquidity and its ability to meet ongoing obligations. This measure is not defined

under U.S. generally accepted accounting principles and may not be computed the same as similarly titled measures

used by other companies.

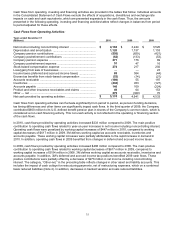

Cash, cash equivalents and marketable securities at December 31, 2010 totaled approximately $5.0 billion, helped

by cash flows from operating activities of $5.2 billion. The Company has sufficient liquidity to meet currently

anticipated growth plans, including capital expenditures, working capital investments and acquisitions. The Company

does not utilize derivative instruments linked to the Company’s stock. However, the Company does have contingently

convertible debt that, if conditions for conversion are met, is convertible into shares of 3M common stock (refer to

Note 10 in this document).

The Company’s financial condition and liquidity are strong. Various assets and liabilities, including cash and short-

term debt, can fluctuate significantly from month to month depending on short-term liquidity needs. Working capital

(defined as current assets minus current liabilities) totaled $6.126 billion at December 31, 2010, compared with

$5.898 billion at December 31, 2009. Working capital increases were primarily attributable to increases in cash and

cash equivalents, short-term marketable securities, accounts receivable and inventories, which were largely offset by

decreases in working capital driven by increases in current liabilities, primarily short-term debt and accounts payable.

Primary short-term liquidity needs are met through U.S. commercial paper and euro commercial paper issuances.

The Company maintains a commercial paper program that allows 3M to have a maximum of $3 billion outstanding

with a maximum maturity of 397 days from date of issuance. As of December 31, 2010 and 2009, 3M had no

outstanding commercial paper. The Company believes it is unlikely that its access to the commercial paper market

will be restricted. Effective April 30, 2007, the Company has a $1.5-billion five-year credit facility, which has

provisions for the Company to request an increase of the facility up to $2 billion (at the lenders’ discretion), and

providing for up to $150 million in letters of credit. At December 31, 2010, available short-term committed lines of

credit, including the preceding $1.5 billion five-year credit facility, totaled approximately $1.674 billion worldwide, of

which approximately $255 million was utilized in connection with normal business activities. Debt covenants do not

restrict the payment of dividends.

The Company has a “well-known seasoned issuer” shelf registration statement, effective February 17, 2009, which

registers an indeterminate amount of debt or equity securities for future sales. No securities have been issued under

this shelf. The Company intends to use the proceeds from future securities sales off this shelf for general corporate