3M 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

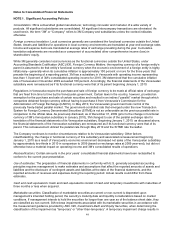

In October 2009, the FASB issued ASU No. 2009-13, Multiple-Deliverable Revenue Arrangements—a consensus of

the FASB Emerging Issues Task Force, that provides amendments to the criteria for separating consideration in

multiple-deliverable arrangements. As a result of these amendments, multiple-deliverable revenue arrangements will

be separated in more circumstances than under existing U.S. GAAP. The ASU does this by establishing a selling

price hierarchy for determining the selling price of a deliverable. The selling price used for each deliverable will be

based on vendor-specific objective evidence if available, third-party evidence if vendor-specific objective evidence is

not available, or estimated selling price if neither vendor-specific objective evidence nor third-party evidence is

available. A vendor will be required to determine its best estimate of selling price in a manner that is consistent with

that used to determine the price to sell the deliverable on a standalone basis. This ASU also eliminates the residual

method of allocation and will require that arrangement consideration be allocated at the inception of the arrangement

to all deliverables using the relative selling price method, which allocates any discount in the overall arrangement

proportionally to each deliverable based on its relative selling price. Expanded disclosures of qualitative and

quantitative information regarding application of the multiple-deliverable revenue arrangement guidance are also

required under the ASU. The ASU does not apply to arrangements for which industry specific allocation and

measurement guidance exists, such as long-term construction contracts and software transactions. For 3M, ASU

No. 2009-13 is effective beginning January 1, 2011. 3M will elect to adopt the provisions of this standard

prospectively to new or materially modified arrangements beginning on the effective date. The adoption of this

standard is not expected to have a material impact on 3M’s consolidated results of operations or financial condition.

In October 2009, the FASB issued ASU No. 2009-14, Certain Revenue Arrangements That Include Software

Elements—a consensus of the FASB Emerging Issues Task Force, that reduces the types of transactions that fall

within the current scope of software revenue recognition guidance. Existing software revenue recognition guidance

requires that its provisions be applied to an entire arrangement when the sale of any products or services containing

or utilizing software when the software is considered more than incidental to the product or service. As a result of the

amendments included in ASU No. 2009-14, many tangible products and services that rely on software will be

accounted for under the multiple-element arrangements revenue recognition guidance rather than under the software

revenue recognition guidance. Under the ASU, the following components would be excluded from the scope of

software revenue recognition guidance: the tangible element of the product, software products bundled with tangible

products where the software components and non-software components function together to deliver the product’s

essential functionality, and undelivered components that relate to software that is essential to the tangible product’s

functionality. The ASU also provides guidance on how to allocate transaction consideration when an arrangement

contains both deliverables within the scope of software revenue guidance (software deliverables) and deliverables

not within the scope of that guidance (non-software deliverables). For 3M, ASU No. 2009-14 is effective beginning

January 1, 2011. 3M will elect to adopt the provisions of this standard prospectively to new or materially modified

arrangements beginning on the effective date. The adoption of this standard is not expected to have a material

impact on 3M’s consolidated results of operations or financial condition.

In January 2010, the FASB issued ASU No. 2010-6, Improving Disclosures About Fair Value Measurements, that

amends existing disclosure requirements under ASC 820 by adding required disclosures about items transferring into

and out of levels 1 and 2 in the fair value hierarchy; adding separate disclosures about purchases, sales, issuances,

and settlements relative to level 3 measurements; and clarifying, among other things, the existing fair value

disclosures about the level of disaggregation. For 3M, this ASU was effective for the first quarter of 2010, except for

the requirement to provide level 3 activity of purchases, sales, issuances, and settlements on a gross basis, which is

effective beginning the first quarter of 2011. Additional disclosures required by this standard for 2010 are included in

Note 13. Since this standard impacts disclosure requirements only, its adoption did not have a material impact on

3M’s consolidated results of operations or financial condition.

In April 2010, the FASB issued ASU No. 2010-17, Milestone Method of Revenue Recognition—a consensus of the

FASB Emerging Issues Task Force that recognizes the milestone method as an acceptable revenue recognition

method for substantive milestones in research or development arrangements. This standard would require its

provisions be met in order for an entity to recognize consideration that is contingent upon achievement of a

substantive milestone as revenue in its entirety in the period in which the milestone is achieved. In addition, this ASU

would require disclosure of certain information with respect to arrangements that contain milestones. For 3M this

standard would be required prospectively beginning January 1, 2011. The adoption of this standard is not expected

to have a material impact on 3M’s consolidated results of operations or financial condition.