3M 2010 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

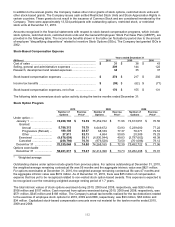

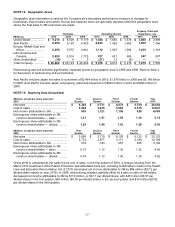

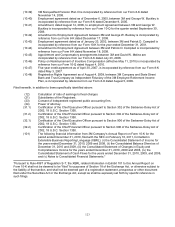

General Employees’ Stock Purchase Plan (GESPP):

In May 1997, shareholders approved 30 million shares for issuance under the Company’s GESPP. Substantially all

employees are eligible to participate in the plan. Participants are granted options at 85% of market value at the date

of grant. There are no GESPP shares under option at the beginning or end of each year because options are granted

on the first business day and exercised on the last business day of the same month.

General Employees’ Stock Purchase Plan

2010

2009

2008

Exercise

Exercise

Exercise

Shares

Price*

Shares

Price*

Shares

Price*

Options granted ......................

1,325,579

$

70.57

1,655,936

$

50.58

1,624,775

$

62.68

Options exercised ...................

(1,325,579

)

70.57

(1,655,936

)

50.58

(1,624,775

)

62.68

Shares available for grant —

December 31 ......................

4,334,360

5,659,939

7,315,875

* Weighted average

The weighted-average fair value per option granted during 2010, 2009 and 2008 was $12.45, $8.93 and $11.06,

respectively. The fair value of GESPP options was based on the 15% purchase price discount. The Company

recognized compensation expense for GESSP options of $17 million in 2010, $15 million in 2009 and $18 million in

2008.

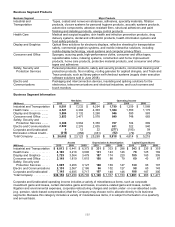

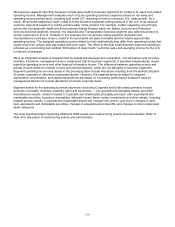

NOTE 17. Business Segments

Effective in the first quarter of 2010, 3M made certain product moves between its business segments in its continuing

effort to drive growth by aligning businesses around markets and customers. There were no changes impacting

business segments related to product moves for the Health Care segment, Consumer and Office segment, Display

and Graphics segment, or Electro and Communications segment. The product moves between business segments

are summarized as follows:

x Certain acoustic systems products in the Occupational Health and Environmental Safety Division (part of

the Safety, Security and Protection Services business segment) were transferred to the Automotive

Division within the Industrial and Transportation business segment. In addition, thermal acoustics

systems products which were included in the Occupational Health and Environmental Safety Division as

a result of 3M’s April 2008 acquisition of Aearo Holding Corp. were transferred to the Aerospace and

Aircraft Maintenance Department within the Industrial and Transportation business segment. These

product moves establish an acoustic center of excellence within the Industrial and Transportation

business segment. The preceding product moves resulted in an increase in net sales for total year 2009

of $116 million for Industrial and Transportation, which was offset by a corresponding decrease in net

sales for Safety, Security and Protection Services.

3M’s businesses are organized, managed and internally grouped into segments based on differences in products,

technologies and services. 3M continues to manage its operations in six operating business segments: Industrial and

Transportation; Health Care; Display and Graphics; Consumer and Office; Safety, Security and Protection Services;

and Electro and Communications. 3M’s six business segments bring together common or related 3M technologies,

enhancing the development of innovative products and services and providing for efficient sharing of business

resources. These segments have worldwide responsibility for virtually all 3M product lines. 3M is not dependent on

any single product/service or market. Certain small businesses and lab-sponsored products, as well as various

corporate assets and expenses, are not attributed to the business segments. Transactions among reportable

segments are recorded at cost.

The financial information presented herein reflects the impact of all of the preceding segment structure changes for

all periods presented.