3M 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

In addition to the annual grants, the Company makes other minor grants of stock options, restricted stock units and

other stock-based grants. The Company issues cash settled Restricted Stock Units and Stock Appreciation Rights in

certain countries. These grants do not result in the issuance of Common Stock and are considered immaterial by the

Company. There were approximately 13,524 participants with outstanding options, restricted stock, or restricted

stock units at December 31, 2010.

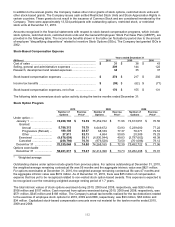

Amounts recognized in the financial statements with respect to stock-based compensation programs, which include

stock options, restricted stock, restricted stock units and the General Employees’ Stock Purchase Plan (GESPP), are

provided in the following table. The income tax benefits shown in the table can fluctuate by period due to the amount

of employee “disqualifying dispositions” related to Incentive Stock Options (ISOs). The Company last granted ISOs in

2002.

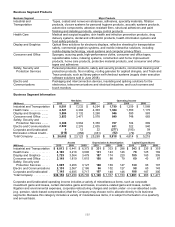

Stock-Based Compensation Expense

Years ended December 31

(Millions)

2010

2009

2008

Cost of sales ..................................................................................

$

31

$

38

$

43

Selling, general and administrative expenses ...............................

209

144

122

Research, development and related expenses .............................

34

35

37

Stock-based compensation expenses ..........................................

$

274

$

217

$

202

Income tax benefits .......................................................................

$

(98

)

$

(62

)

$

(71

)

Stock-based compensation expenses, net of tax .........................

$

176

$

155

$

131

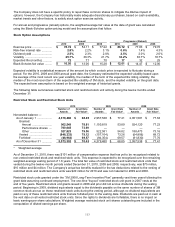

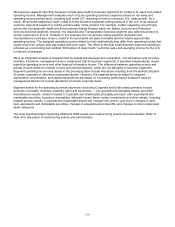

The following table summarizes stock option activity during the twelve months ended December 31:

Stock Option Program

2010

2009

2008

Number of

Exercise

Number of

Exercise

Number of

Exercise

Options

Price*

Options

Price*

Options

Price*

Under option —

January 1 ............................

74,268,165

$

72.39

75,452,722

$

71.96

74,613,051

$

70.50

Granted:

Annual .........................

5,788,313

78.79

6,649,672

53.93

5,239,660

77.22

Progressive (Reload) ...

188,105

88.67

68,189

77.37

78,371

79.53

Other ............................

27,911

82.13

4,654

50.85

20,389

79.25

Exercised ........................

(9,678,654

)

59.11

(6,930,544

)

49.83

(3,797,663

)

49.38

Canceled .........................

(258,796

)

70.76

(976,528

)

73.50

(701,086

)

79.12

December 31 ......................

70,335,044

$

74.80

74,268,165

$

72.39

75,452,722

$

71.96

Options exercisable

December 31 ......................

58,201,617

$

75.87

62,414,398

$

73.73

63,282,408

$

70.01

* Weighted average

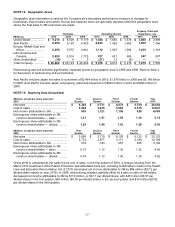

Outstanding shares under option include grants from previous plans. For options outstanding at December 31, 2010,

the weighted-average remaining contractual life was 56 months and the aggregate intrinsic value was $821 million.

For options exercisable at December 31, 2010, the weighted-average remaining contractual life was 47 months and

the aggregate intrinsic value was $619 million. As of December 31, 2010, there was $65 million of compensation

expense that has yet to be recognized related to non-vested stock option-based awards. This expense is expected to

be recognized over the remaining weighted-average vesting period of 1.7 years.

The total intrinsic values of stock options exercised during 2010, 2009 and 2008, respectively, was $263 million,

$108 million and $107 million. Cash received from options exercised during 2010, 2009 and 2008, respectively, was

$571 million, $345 million and $188 million. The Company’s actual tax benefits realized for the tax deductions related

to the exercise of employee stock options for 2010, 2009 and 2008, respectively, was $93 million, $38 million and

$34 million. Capitalized stock-based compensation amounts were not material for the twelve months ended 2010,

2009 and 2008.