3M 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

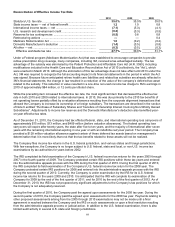

3M was informed during the first quarter of 2009 that the general partners of WG Trading Company, in which 3M’s

benefit plans hold limited partnership interests, are the subject of a criminal investigation as well as civil proceedings

by the SEC and CFTC (Commodity Futures Trading Commission). As of December 31, 2010, these holdings

represented less than one percent of 3M’s fair value of total plan assets. The court appointed receiver has taken

control of WG Trading Company and other entities controlled by its general partners, and further redemptions of

limited partnership interests are restricted pending court proceedings. 3M currently believes that the resolution of

these events will not have a material adverse effect on the consolidated financial position of the Company. The

Company has insurance that it believes, based on what is currently known, is applicable to a portion of this potential

decrease in asset value. The benefit plan trustee holdings of WG Trading Company interests have been adjusted to

estimated fair market value.

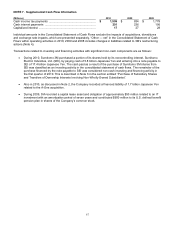

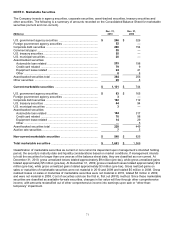

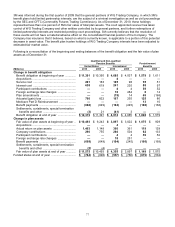

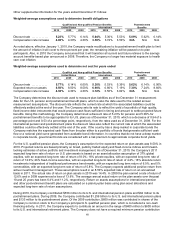

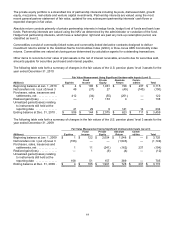

Following is a reconciliation of the beginning and ending balances of the benefit obligation and the fair value of plan

assets as of December 31:

Qualified

and Non-qualified

Pension Benefits

Postretirement

United States

International

Benefits

(Millions)

2010

2009

2010

2009

2010

2009

Change in benefit obligation

Benefit obligation at beginning of year .............

$

11,391

$

10,395

$

4,685

$

4,037

$

1,579

$

1,611

Acquisitions .......................................................

—

—

4

—

—

—

Service cost ......................................................

201

183

105

98

55

51

Interest cost ......................................................

638

619

241

235

88

97

Participant contributions ...................................

—

—

4

4

59

52

Foreign exchange rate changes .......................

—

—

16

284

6

14

Plan amendments .............................................

—

—

(75

)

14

69

(168

)

Actuarial (gain) loss ..........................................

760

822

167

255

125

80

Medicare Part D Reimbursement .....................

—

—

—

—

13

10

Benefit payments ..............................................

(668

)

(649

)

(194

)

(245

)

(166

)

(168

)

Settlements, curtailments, special termination

benefits and other .........................................

(3

)

21

(41

)

3

—

—

Benefit obligation at end of year .......................

$

12,319

$

11,391

$

4,912

$

4,685

$

1,828

$

1,579

Change in plan assets

Fair value of plan assets at beginning of year ..

$

10,493

$

9,243

$

3,897

$

3,022

$

1,075

$

929

Acquisitions .......................................................

—

—

4

—

—

—

Actual return on plan assets .............................

1,463

1,148

360

361

119

129

Company contributions .....................................

290

755

266

504

62

133

Participant contributions ...................................

—

—

4

4

59

52

Foreign exchange rate changes .......................

—

—

18

251

—

—

Benefit payments ..............................................

(668

)

(649

)

(194

)

(245

)

(166

)

(168

)

Settlements, curtailments, special termination

benefits and other .........................................

(3

)

(4

)

—

—

—

—

Fair value of plan assets at end of year ............

$

11,575

$

10,493

$

4,355

$

3,897

$

1,149

$

1,075

Funded status at end of year ...............................

$

(744

)

$

(898

)

$

(557

)

$

(788

)

$

(679

)

$

(504

)