3M 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

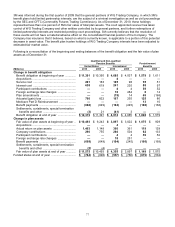

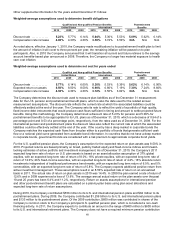

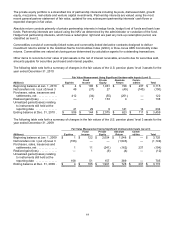

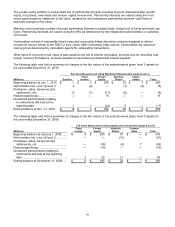

International Pension Plans Assets

Outside the U.S., pension plan assets are typically managed by decentralized fiduciary committees. The disclosure

below of asset categories is presented in aggregate for the 55 plans in 23 countries, however there is significant

variation in policy asset allocation from country to country. Local regulations, local funding rules, and local financial

and tax considerations are part of the funding and investment allocation process in each country. 3M’s Treasury

group provides standard funding and investment guidance to all international plans with more focused guidance to

the larger plans.

Each plan has its own strategic asset allocation. The asset allocations are reviewed periodically and rebalanced

when necessary.

The fair values of the assets held by the international pension plans by asset class are as follows:

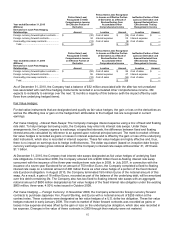

(Millions)

Fair Value

At Dec. 31,

Fair Value Measurements

Using Inputs Considered as

Asset Class

2010

Level 1

Level 2

Level 3

Equities

Growth equities ...............................................

$

371

$

300

$

70

$

1

Value equities .................................................

396

369

27

—

Core equities ...................................................

1,007

549

361

97

Total Equities ......................................................

$

1,774

$

1,218

$

458

$

98

Fixed Income

Domestic government debt .............................

$

656

$

194

$

455

$

7

Foreign government debt ...............................

398

51

345

2

Corporate debt securities ...............................

707

139

555

13

Mortgage backed debt ....................................

14

—

14

—

Other debt obligations ....................................

14

—

2

12

Total Fixed Income .............................................

$

1,789

$

384

$

1,371

$

34

Private Equity

Private equity funds ........................................

$

29

$

—

$

15

$

14

Real estate ......................................................

59

—

3

56

Total Private Equity ............................................

$

88

$

—

$

18

$

70

Absolute Return

Hedge funds ...................................................

$

130

$

—

$

130

$

—

Insurance ........................................................

344

—

—

344

Derivatives ......................................................

50

—

50

—

Other ...............................................................

3

—

3

—

Total Absolute Return .........................................

$

527

$

—

$

183

$

344

Cash and Cash Equivalents ...............................

$

242

$

233

$

9

$

—

Total ............................................................

$

4,420

$

1,835

$

2,039

$

546

Other items to reconcile to fair value of plan

assets .............................................................

$

(65

)

Fair value of plan assets ....................................

$

4,355