3M 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

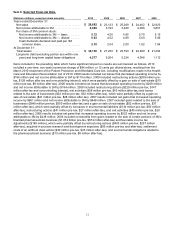

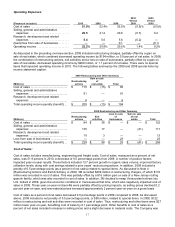

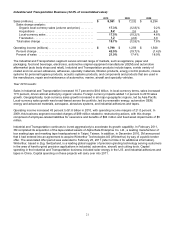

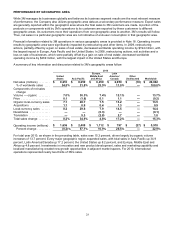

Year 2009 results:

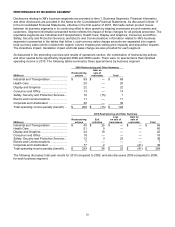

Industrial and Transportation is a large and highly diversified set of businesses that, when taken together, correlate

well with the overall economy. Early in 2009, the business saw significant sales declines that required swift and

aggressive restructuring and cost reduction plans to offset the impact of lower volumes, including the impact of large

inventory declines in the wholesale distribution channel. Inventories began to stabilize around mid-year 2009.

In 2009, sales were $7.2 billion, down 12.8 percent in dollars and down 10.2 percent in local currency. Foreign

currency impacts penalized sales for the year by 2.6 percent. Sales increased in the renewable energy and

automotive aftermarket businesses, but sales decreased in the other businesses, impacted by end-market declines.

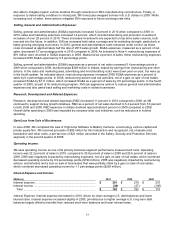

This segment announced restructuring actions in 2009, along with plant shut-downs, furloughs and mandatory

vacation across the operation. In 2009, this business segment recorded charges of $89 million related to

restructuring actions, with this charge comprised of employee-related liabilities for severance and benefits of $84

million and fixed asset impairments of $5 million. Including these special items, 2009 operating income was $1.3

billion and operating income margins were 17.4 percent. This segment recorded $66 million related to restructuring

and exit activities in 2008.

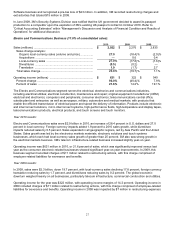

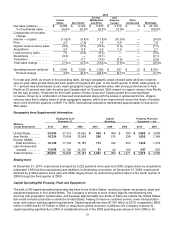

Investment:

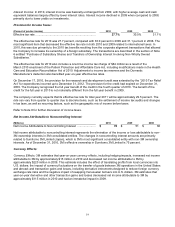

In March 2005, 3M’s automotive business completed the purchase of 19 percent of TI&M Beteiligungsgesellschaft

mbH (TI&M) for approximately $55 million. TI&M is the parent company of I&T Innovation Technology

Entwicklungsund Holding Aktiengesellschaft (I&T), an Austrian maker of flat flexible cable and circuitry. Pursuant to a

Shareholders Agreement, 3M marketed the firm’s flat flexible wiring systems for automotive interior applications to

the global automotive market. I&T filed a petition for bankruptcy protection in August 2006. As part of its agreement

to purchase the shares of TI&M, the Company was granted a put option, which gave the Company the right to sell

back its entire ownership interest in TI&M to the other investors from whom 3M acquired its 19 percent interest. The

put option became exercisable January 1, 2007. The Company exercised the put option and recovered

approximately $25 million of its investment from one of the investors based in Belgium in February 2007. The other

two TI&M investors from whom 3M purchased its shares have filed a bankruptcy petition in Austria. The Company

expects to recover approximately $8.7 million through the bankruptcy process and is pursuing recovery of the

balance of its investment, first, from the sellers’ bank and, to extent not made whole, pursuant to the terms of the

Share Purchase Agreement. The Company believes collection of its remaining investment is probable and, as a

result, no impairment reserve has been recorded.