3M 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

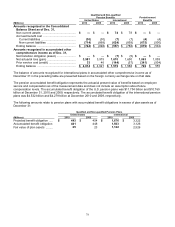

88

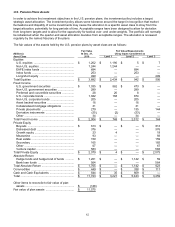

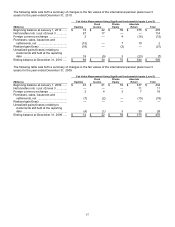

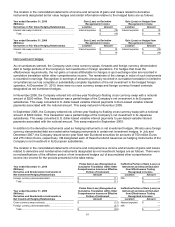

Postretirement Benefit Plans Assets

In order to achieve the investment objectives in the U.S. postretirement plan, the investment policy includes a target

strategic asset allocation. The investment policy allows some tolerance around the target in recognition that market

fluctuations and illiquidity of some investments may cause the allocation to a specific asset class to stray from the

target allocation, potentially for long periods of time. Acceptable ranges have been designed to allow for deviation

from long-term targets and to allow for the opportunity for tactical over- and under-weights. The portfolio will normally

be rebalanced when the quarter-end asset allocation deviates from acceptable ranges. The allocation is reviewed

regularly by the named fiduciary of the plan.

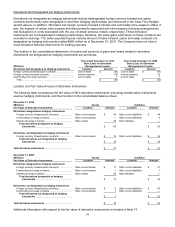

The fair values of the assets held by the postretirement benefits plans by asset class are as follows:

(Millions)

Fair Value

At Dec. 31,

Fair Value Measurements

Using Inputs Considered as

Asset Class

2010

Level 1

Level 2

Level 3

Equities

U.S. equities ...................................................

$

392

$

392

$

—

$

—

Non-U.S. equities ............................................

48

48

—

—

EAFE index funds ...........................................

21

—

21

—

Index funds .....................................................

45

—

45

—

Long/short equity ............................................

16

—

—

16

Total Equities ......................................................

$

522

$

440

$

66

$

16

Fixed Income

U.S. government securities ............................

$

210

$

50

$

160

$

—

Non-U.S. government securities .....................

10

—

10

—

Preferred securities .........................................

1

1

—

—

U.S. corporate bonds ......................................

54

5

49

—

Non-U.S. corporate bonds ..............................

11

—

11

—

Asset backed securities ..................................

3

—

3

—

Collateralized mortgage obligations ...............

7

—

7

—

Private placements .........................................

12

—

8

4

Derivative instruments ....................................

(2

)

—

(2

)

—

Other ...............................................................

2

—

2

—

Total Fixed Income .............................................

$

308

$

56

$

248

$

4

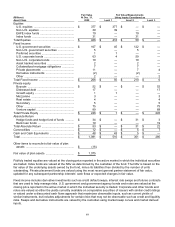

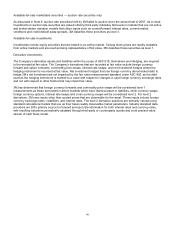

Private Equity

Buyouts ...........................................................

$

57

$

—

$

—

$

57

Distressed debt ...............................................

18

—

—

18

Growth equity ..................................................

1

—

—

1

Mezzanine ......................................................

3

—

—

3

Real estate ......................................................

5

—

—

5

Secondary .......................................................

5

—

—

5

Other ...............................................................

43

—

—

43

Venture capital ................................................

94

—

—

94

Total Private Equity ............................................

$

226

$

—

$

—

$

226

Absolute Return

Hedge funds and hedge fund of funds ...........

$

38

$

—

$

36

$

2

Bank loan funds ..............................................

18

—

—

18

Total Absolute Return .........................................

$

56

$

—

$

36

$

20

Commodities ......................................................

$

14

$

—

$

11

$

3

Cash and Cash Equivalents ...............................

$

43

$

1

$

42

$

—

Total ....................................................................

$

1,169

$

497

$

403

$

269

Other items to reconcile to fair value of plan

assets .............................................................

$

(20

)

Fair value of plan assets ....................................

$

1,149