3M 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

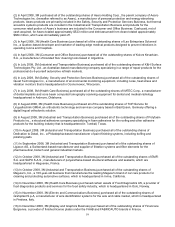

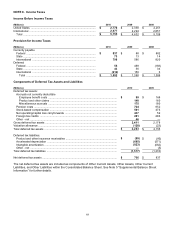

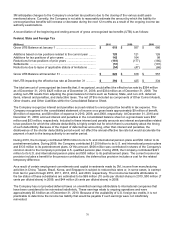

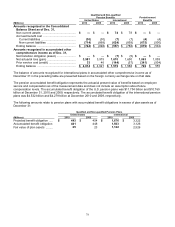

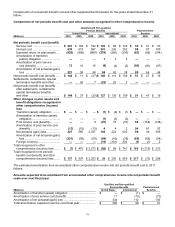

Reconciliation of Effective Income Tax Rate

2010

2009

2008

Statutory U.S. tax rate ...................................................................

35.0

%

35.0

%

35.0

%

State income taxes — net of federal benefit .................................

1.2

1.0

0.8

International income taxes — net ..................................................

(7.1

)

(5.3

)

(4.1

)

U.S. research and development credit ..........................................

(0.2

)

(0.3

)

(0.5

)

Reserves for tax contingencies .....................................................

(0.5

)

0.8

0.8

Restructuring actions .....................................................................

—

—

0.4

Medicare Modernization Act ..........................................................

1.0

(0.2

)

(0.2

)

Domestic Manufacturer’s deduction ..............................................

(1.4

)

(0.5

)

(0.8

)

All other — net ...............................................................................

(0.3

)

(0.5

)

(0.3

)

Effective worldwide tax rate .......................................................

27.7

%

30.0

%

31.1

%

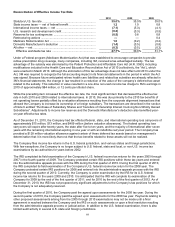

Under a Federal program (Medicare Modernization Act) that was established to encourage companies to provide

retiree prescription drug coverage, many companies, including 3M, received a tax-advantaged subsidy. The tax

advantage of the subsidy was eliminated by the Patient Protection and Affordable Care Act (H.R. 3590), including

modifications included in the Health Care and Education Reconciliation Act of 2010 (collectively, the “Act’), which

were enacted in March 2010. Although the elimination of this tax advantage does not take effect until 2013 under the

Act, 3M was required to recognize the full accounting impact in its financial statements in the period in which the Act

was signed. Because future anticipated retiree health care liabilities and related tax subsidies are already reflected in

3M’s financial statements, the change in law resulted in a reduction of the value of the company’s deferred tax asset

related to the subsidy. This reduction in value resulted in a one-time non-cash income tax charge to 3M’s earnings in

2010 of approximately $84 million, or 12 cents per diluted share.

While the preceding item increased the effective tax rate, the most significant item that decreased the effective tax

rate in both 2010 and 2009 related to international taxes. In 2010, this was due primarily to the 2010 tax benefits of

net operating losses partially offset by a valuation allowance resulting from the corporate alignment transactions that

allowed the Company to increase its ownership of a foreign subsidiary. The transactions are described in the section

of Note 6 entitled “Purchase of Subsidiary Shares and Transfers of Ownership Interest Involving Non-Wholly Owned

Subsidiaries”. Adjustments to income tax reserves and the Domestic Manufacturer’s deduction also benefited year-

on-year effective tax rates.

As of December 31, 2010, the Company had tax effected federal, state, and international operating loss carryovers of

approximately $15 million, $13 million, and $409 million (before valuation allowances). The federal operating loss

carryovers will expire after twenty years, the state after five to ten years, and the majority of international after seven

years with the remaining international expiring in one year or with an indefinite carryover period. The Company has

provided a $128 million valuation allowance against certain of these deferred tax assets based on management’s

determination that it is more-likely-than-not that the tax benefits related to these assets will not be realized.

The Company files income tax returns in the U.S. federal jurisdiction, and various states and foreign jurisdictions.

With few exceptions, the Company is no longer subject to U.S. federal, state and local, or non-U.S. income tax

examinations by tax authorities for years before 2002.

The IRS completed its field examination of the Company’s U.S. federal income tax returns for the years 2005 through

2007 in the fourth quarter of 2009. The Company protested certain IRS positions within these tax years and entered

into the administrative appeals process with the IRS during the first quarter of 2010. During the first quarter of 2010,

the IRS completed its field examination of the Company’s U.S. federal income tax return for the 2008 year. The

Company protested certain IRS positions for 2008 and entered into the administrative appeals process with the IRS

during the second quarter of 2010. Currently, the Company is under examination by the IRS for its U.S. federal

income tax returns for the years 2009 and 2010. It is anticipated that the IRS will complete its examination of the

Company for 2009 by the end of the first quarter of 2011, and for 2010 by the end of the first quarter of 2012. As of

December 31, 2010, the IRS has not proposed any significant adjustments to the Company’s tax positions for which

the Company is not adequately reserved.

During the first quarter of 2010, the Company paid the agreed upon assessments for the 2005 tax year. During the

second quarter of 2010, the Company paid the agreed upon assessments for the 2008 tax year. Payments relating to

other proposed assessments arising from the 2005 through 2010 examinations may not be made until a final

agreement is reached between the Company and the IRS on such assessments or upon a final resolution resulting

from the administrative appeals process or judicial action. In addition to the U.S. federal examination, there is also

limited audit activity in several U.S. state and foreign jurisdictions.