3M 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

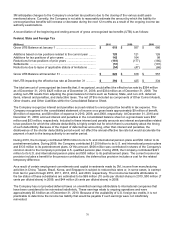

3M anticipates changes to the Company’s uncertain tax positions due to the closing of the various audit years

mentioned above. Currently, the Company is not able to reasonably estimate the amount by which the liability for

unrecognized tax benefits will increase or decrease during the next 12 months as a result of the ongoing income tax

authority examinations.

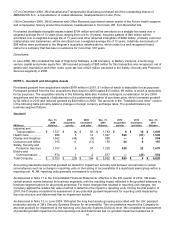

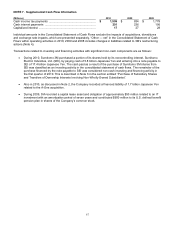

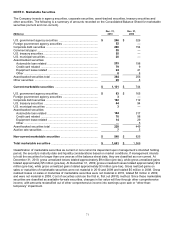

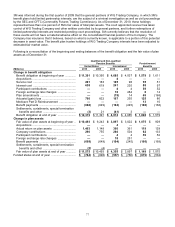

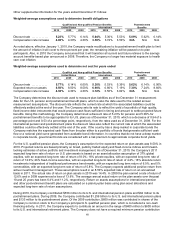

A reconciliation of the beginning and ending amount of gross unrecognized tax benefits (UTB) is as follows:

Federal, State and Foreign Tax

(Millions)

2010

2009

2008

Gross UTB Balance at January 1 ..................................................

$

618

$

557

$

680

Additions based on tax positions related to the current year ........

128

121

126

Additions for tax positions of prior years .......................................

142

164

98

Reductions for tax positions of prior years ....................................

(161

)

(177

)

(180

)

Settlements ...................................................................................

(51

)

—

(101

)

Reductions due to lapse of applicable statute of limitations .........

(54

)

(47

)

(66

)

Gross UTB Balance at December 31 ............................................

$

622

$

618

$

557

Net UTB impacting the effective tax rate at December 31 ............

$

394

$

425

$

334

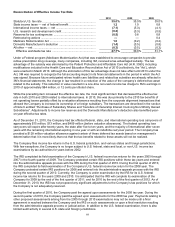

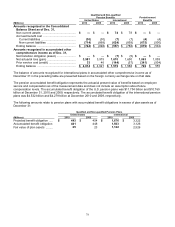

The total amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate by $394 million

as of December 31, 2010, $425 million as of December 31, 2009, and $334 million as of December 31, 2008. The

ending net UTB results from adjusting the gross balance for items such as Federal, State, and non-U.S. deferred

items, interest and penalties, and deductible taxes. The net UTB is included as components of Other Current Assets,

Other Assets, and Other Liabilities within the Consolidated Balance Sheet.

The Company recognizes interest and penalties accrued related to unrecognized tax benefits in tax expense. The

Company recognized in the consolidated statement of income on a gross basis approximately $9 million of benefit,

$6 million of expense, and $8 million of expense in 2010, 2009, and 2008, respectively. At December 31, 2010 and

December 31, 2009, accrued interest and penalties in the consolidated balance sheet on a gross basis were $52

million and $53 million, respectively. Included in these interest and penalty amounts are interest and penalties related

to tax positions for which the ultimate deductibility is highly certain but for which there is uncertainty about the timing

of such deductibility. Because of the impact of deferred tax accounting, other than interest and penalties, the

disallowance of the shorter deductibility period would not affect the annual effective tax rate but would accelerate the

payment of cash to the taxing authority to an earlier period.

During 2010, the Company contributed $556 million to its U.S. and international pension plans and $62 million to its

postretirement plans. During 2009, the Company contributed $1.259 billion to its U.S. and international pension plans

and $133 million to its postretirement plans. Of this amount, $600 million was contributed in shares of the Company’s

common stock to the Company’s principal U.S. qualified pension plan. During 2008, the Company contributed $421

million to its U.S. and international pension plans and $53 million to its postretirement plans. The current income tax

provision includes a benefit for the pension contributions; the deferred tax provision includes a cost for the related

temporary difference.

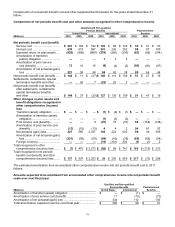

As a result of certain employment commitments and capital investments made by 3M, income from manufacturing

activities in China, Taiwan, Brazil, Korea, and Singapore is subject to reduced tax rates or, in some cases, is exempt

from tax for years through 2010, 2011, 2013, 2014, and 2023, respectively. The income tax benefits attributable to

the tax status of these subsidiaries are estimated to be $69 million (10 cents per diluted share) in 2010, $50 million (7

cents per diluted share) in 2009, and $44 million (6 cents per diluted share) in 2008.

The Company has not provided deferred taxes on unremitted earnings attributable to international companies that

have been considered to be reinvested indefinitely. These earnings relate to ongoing operations and were

approximately $5.6 billion as of December 31, 2010. Because of the availability of U.S. foreign tax credits, it is not

practicable to determine the income tax liability that would be payable if such earnings were not indefinitely

reinvested.