3M 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

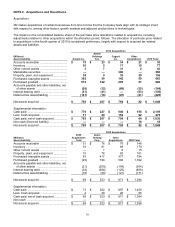

Goodwill resulting from business combinations is largely attributable to the existing workforce of the acquired

businesses and synergies expected to arise after 3M’s acquisition of these businesses. In-process research and

development associated with these business combinations were not material. Pro forma information related to

acquisitions was not included because the impact on the Company’s consolidated results of operations was not

considered to be material.

In addition to business combinations, 3M periodically acquires certain tangible and/or intangible assets and

purchases interests in certain enterprises that do not otherwise qualify for accounting as business combinations.

These transactions are largely reflected as additional asset purchase and investment activity.

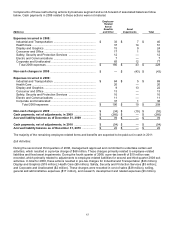

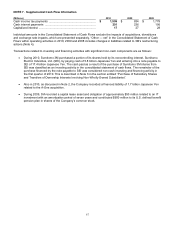

2010 acquisitions:

During 2010, 3M completed ten business combinations. The purchase price paid for these business combinations

(net of cash acquired), contingent consideration paid for pre-2009 business combinations, and the impact of other

matters (net) during 2010 aggregated to $1.830 billion. In addition, the Company recorded a financed liability of 1.7

billion Japanese Yen (approximately $18 million based on acquisition date exchange rates) as non-cash investing

and financing activity, which related to April 2010 acquisition of the A-One branded label business and related

operations (discussed further below).

(1) In January 2010, 3M (Consumer and Office Business) purchased all of the outstanding shares of Incavas

Industria de Cabos e Vassouras Ltda., a manufacturer of floor care products based in Rio Grande do Sul, Brazil.

(2) In April 2010, 3M (Consumer and Office Business) purchased a majority stake in the A-One branded label

business and related operations, which is headquartered in Tokyo, Japan and has manufacturing, distribution and

sales locations around Japan. The terms of this acquisition included embedded mirroring put and call options for a

fixed price and five-year term with respect to the remaining minority shares. Accordingly, 3M recorded this business

combination as an acquisition of all outstanding interests with a corresponding five-year financed liability of 1.7 billion

Japanese Yen relative to the embedded put/call option as of the acquisition date. The Company records interest on

this liability, which is recorded in other liabilities, at an annual rate of 1%.

(3) In May 2010, 3M (Health Care Business) purchased certain assets of J.R. Phoenix Ltd., a manufacturer of hand

hygiene and skin care products for health care and professional use based in Kitchener, Ontario, Canada.

(4) In June 2010, 3M (Industrial and Transportation Business) purchased all of the outstanding shares of MTI

PolyFab Inc., a manufacturer of thermal and acoustic insulation for the aerospace industry. MTI PolyFab Inc. is

based in Mississauga, Ontario, Canada.

(5) In July 2010, 3M (Safety, Security and Protection Services Business) purchased all of the outstanding shares of

Dailys Limited, a supplier of non-woven disposable protective clothing, primarily chemical protective coveralls for

industrial use. Dailys Limited is based in Ellesmere Port, United Kingdom.

(6) In October 2010, 3M (Consumer and Office Business) purchased certain assets of Ross Outdoor Sports

Specialties, LLC, a Colorado-based manufacturer of fly fishing equipment and accessories.

(7) In October 2010, 3M (Health Care Business) purchased all of the outstanding shares of Hangzhou ORJ Medical

Instrument and Material Co., Ltd., a manufacturer of orthodontic supplies based in Hangzhou, China.

(8) In October 2010, 3M (Health Care Business) purchased all of the outstanding shares of Arizant Inc., a

manufacturer of patient warming solutions designed to prevent hypothermia in surgical settings based in Eden

Prairie, Minnesota.

(9) In October 2010, 3M (Safety, Security and Protection Services Business) purchased all of the outstanding shares

of Attenti Holdings S.A., a Tel Aviv, Israel-based supplier of remote people-monitoring technologies used for

offender-monitoring applications and to assist eldercare facilities in monitoring and enhancing the safety of patients.

(10) In October 2010, 3M (Safety, Security and Protection Services Business) acquired a controlling interest in

Cogent Inc. via a tender offer, and in December 2010 completed a second-step merger for the same amount per

outstanding share as the tender offer, thereby acquiring the remaining noncontrolling interest in the company. Cogent

Inc., based in Pasadena, California, is a provider of finger, palm, face and iris biometric systems for governments,

law enforcement agencies, and commercial enterprises. The consideration paid in the preceding table includes $248

million related to the December 2010 acquisition of the remaining noncontrolling interest in Cogent, Inc. Net assets