3M 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

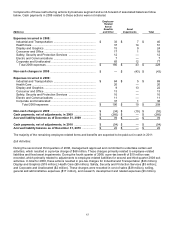

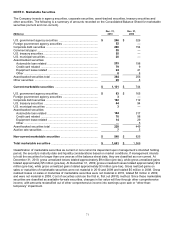

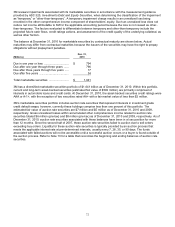

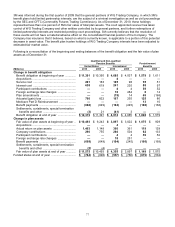

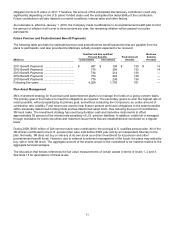

NOTE 9. Marketable Securities

The Company invests in agency securities, corporate securities, asset-backed securities, treasury securities and

other securities. The following is a summary of amounts recorded on the Consolidated Balance Sheet for marketable

securities (current and non-current).

Dec. 31,

Dec. 31,

(Millions)

2010

2009

U.S. government agency securities .................................................

$

246

$

326

Foreign government agency securities ............................................

52

—

Corporate debt securities .................................................................

280

154

Commercial paper .............................................................................

55

—

U.S. treasury securities .....................................................................

55

—

U.S. municipal securities ...................................................................

20

—

Asset-backed securities:

Automobile loan related ................................................................

253

198

Credit card related ........................................................................

79

9

Equipment lease related ...............................................................

24

41

Other .............................................................................................

8

8

Asset-backed securities total ...........................................................

364

256

Other securities ................................................................................

29

8

Current marketable securities ......................................................

$

1,101

$

744

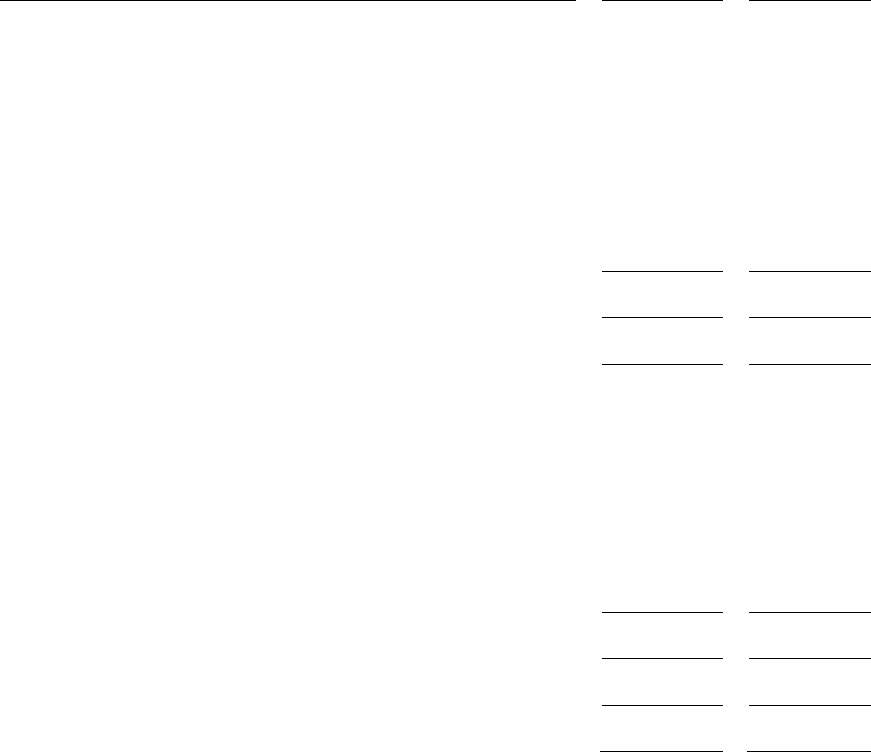

U.S. government agency securities .................................................

$

63

$

165

Foreign government agency securities ............................................

3

—

Corporate debt securities .................................................................

192

112

U.S. treasury securities ....................................................................

44

94

U.S. municipal securities ..................................................................

3

—

Asset-backed securities:

Automobile loan related ................................................................

144

317

Credit card related ........................................................................

70

98

Equipment lease related ...............................................................

14

29

Other .............................................................................................

—

5

Asset-backed securities total ...........................................................

228

449

Auction rate securities ......................................................................

7

5

Non-current marketable securities ...............................................

$

540

$

825

Total marketable securities ...........................................................

$

1,641

$

1,569

Classification of marketable securities as current or non-current is dependent upon management’s intended holding

period, the security’s maturity date and liquidity considerations based on market conditions. If management intends

to hold the securities for longer than one year as of the balance sheet date, they are classified as non-current. At

December 31, 2010, gross unrealized losses totaled approximately $9 million (pre-tax), while gross unrealized gains

totaled approximately $5 million (pre-tax). At December 31, 2009, gross unrealized losses totaled approximately $12

million (pre-tax), while gross unrealized gains totaled approximately $3 million (pre-tax). Gross realized gains on

sales or maturities of marketable securities were not material in 2010 and 2009 and totaled $5 million in 2008. Gross

realized losses on sales or maturities of marketable securities were not material in 2010, totaled $3 million in 2009,

and were not material in 2008. Cost of securities sold use the first in, first out (FIFO) method. Since these marketable

securities are classified as available-for-sale securities, changes in fair value will flow through other comprehensive

income, with amounts reclassified out of other comprehensive income into earnings upon sale or “other-than-

temporary” impairment.