3M 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.110

retroreflective sheeting, entered into illegal and anticompetitive contracts, and engaged in other anticompetitive acts

including false advertising and disparagement. Avery's antitrust lawsuit follows a lawsuit that 3M filed earlier in 2010

against Avery in the United States District Court for the District of Minnesota claiming that Avery's OmniCube product

infringes certain 3M patent rights. 3M’s motion to preliminarily enjoin the sales of Avery’s OmniCube retroreflective

sheeting was denied in December 2010. 3M also filed suit in 2010 seeking a declaratory judgment that 3M’s

Diamond Grade DG3 full cube retroreflective sheeting does not infringe two Avery patents. In February 2011, the

United States District Judge for the Central District of California granted the Company’s motion to transfer Avery’s

antitrust lawsuit to the District of Minnesota.

In December 2010, Meda AB filed a lawsuit in the Supreme Court of the State of New York, County of New York,

alleging breach certain representations and warranties contained in the October 2006 acquisition agreement

pursuant to which Meda AB acquired the Company’s European pharmaceutical business. The lawsuit seeks to

recover an amount to be determined at trial, but not less than $200 million, in compensatory damages alleging that

3M failed to disclose, during the due diligence period, certain pricing arrangements between 3M’s French subsidiary

and the French government agency that determines the eligible levels of reimbursement for prescription

pharmaceuticals. As previously stated, the damage amounts specified in complaints are not a meaningful factor in

any assessment of the Company’s potential liability. The Company believes it has a number of legal and factual

defenses to this claim and will vigorously defend it.

No liability has been recorded for the Company’s commercial litigation described in this section because the

Company believes that liability is not probable and estimable at this time and the Company is not able to estimate a

possible loss or range of loss given the limited activity in these cases.

French Competition Authority Investigation

On December 4, 2008, the Company’s subsidiary in France (“3M France”) received a Statement of Objections from

the French Competition Authority (“FCA”) alleging an abuse of a dominant position regarding the supply of retro-

reflective films for vertical signing applications in France and participation in a concerted practice with the major

French manufacturers of vertical signs. On December 22, 2010, the FCA issued a decision finding that there was

insufficient evidence that 3M France participated in any such concerted practice. The FCA also found that 3M France

from 2003 to 2005 abused a dominant position on the French market for retro-reflective films intended for the

manufacturing of vertical signs through discriminatory rebates and characteristics of its accreditation system and

fined 3M France 1.97 million Euros. While the Company disagrees with the FCA’s decision on abuse of a dominant

position, the Company does not plan to appeal. The Company does not expect any additional litigation to arise from

the FCA decision.

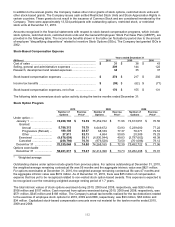

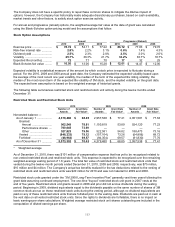

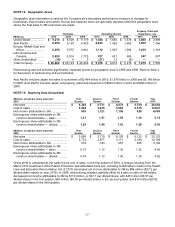

NOTE 15. Employee Savings and Stock Ownership Plans

The Company sponsors employee savings plans under Section 401(k) of the Internal Revenue Code. These plans

are offered to substantially all regular U.S. employees. Effective January 1, 2010, substantially all Company

contributions are made in cash. During 2008 the Board of Directors approved various changes to the employee

savings plans. For substantially all employees hired prior to January 1, 2009, employee 401(k) contributions of up to

6% of eligible compensation are matched at rates of 60% or 75%, depending on the plan the employee participated

in. Employees hired on or after January 1, 2009 receive a cash match of 100% for employee 401(k) contributions of

up to 6% of eligible compensation and also receive an employer retirement income account cash contribution of 3%

of the participant’s total eligible compensation. All contributions are invested in a number of investment funds

pursuant to their elections.

The Company maintained an Employee Stock Ownership Plan (ESOP) that was established in 1989 as a cost-

effective way of funding the majority of the Company’s contributions under 401(k) employee savings plans. Total

ESOP shares were considered to be shares outstanding for earnings per share calculations. The ESOP debt

matured in 2009.

Dividends on shares held by the ESOP were paid to the ESOP trust and, together with Company contributions, were

used by the ESOP to repay principal and interest on the outstanding ESOP debt. The tax benefit related to dividends

paid on unallocated shares was charged directly to equity and totaled approximately $1 million in 2009 and $2 million

in 2008. Over the life of the ESOP debt, shares were released for allocation to participants based on the ratio of the

current year’s debt service to the remaining debt service prior to the current payment.

Until 2009, the ESOP was the primary funding source for the Company’s employee savings plans. As permitted by

accounting standards relating to employers’ accounting for employee stock ownership plans, the debt of the ESOP