3M 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.116

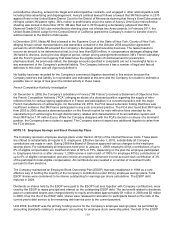

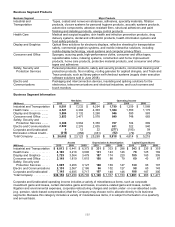

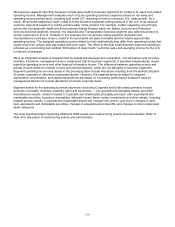

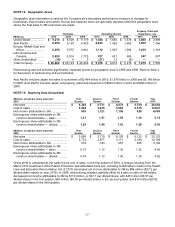

3M business segment reporting measures include dual credit to business segments for certain U.S. sales and related

operating income. Management evaluates each of its six operating business segments based on net sales and

operating income performance, including dual credit U.S. reporting to further incentivize U.S. sales growth. As a

result, 3M provides additional (“dual”) credit to those business segments selling products in the U.S. to an external

customer when that segment is not the primary seller of the product. For example, certain respirators are primarily

sold by the Occupational Health and Environmental Safety Division within the Safety, Security and Protection

Services business segment; however, the Industrial and Transportation business segment also sells this product to

certain customers in its U.S. markets. In this example, the non-primary selling segment (Industrial and

Transportation) would also receive credit for the associated net sales it initiated and the related approximate

operating income. The assigned operating income related to dual credit activity may differ from operating income that

would result from actual costs associated with such sales. The offset to the dual credit business segment reporting is

reflected as a reconciling item entitled “Elimination of Dual Credit,” such that sales and operating income for the U.S.

in total are unchanged.

3M is an integrated enterprise characterized by substantial intersegment cooperation, cost allocations and inventory

transfers. Therefore, management does not represent that its business segments, if operated independently, would

report the operating income and other financial information shown. The difference between operating income and

pre-tax income relates to interest income and interest expense, which are not allocated to business segments.

Segment operating income and assets in the preceding table include allocations resulting from the shared utilization

of certain corporate or otherwise unallocated assets. However, the separate amounts stated for segment

depreciation, amortization, and capital expenditures are based on secondary performance measures used by

management that do not include allocations of certain corporate items.

Segment assets for the operating business segments (excluding Corporate and Unallocated) primarily include

accounts receivable; inventory; property, plant and equipment — net; goodwill and intangible assets; and other

miscellaneous assets. Assets included in Corporate and Unallocated principally are cash, cash equivalents and

marketable securities; insurance receivables; deferred income taxes; certain investments and other assets, including

prepaid pension assets. Corporate and unallocated assets can change from year to year due to changes in cash,

cash equivalents and marketable securities, changes in prepaid pension benefits, and changes in other unallocated

asset categories.

The most significant items impacting 2009 and 2008 results were restructuring actions and exit activities. Refer to

Note 4 for discussion of restructuring actions and exit activities.