3M 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

NOTE 4. Restructuring Actions and Exit Activities

Restructuring actions and exit activities generally include significant actions involving employee-related severance

charges, contract termination costs, and impairment of assets associated with such actions. Accounting policies

related to these activities are discussed in Note 1.

The following provides information, respectively, concerning the Company’s 2009/2008 restructuring actions and its

exit activities during 2008.

2009 and 2008 Restructuring Actions:

During the fourth quarter of 2008 and the first nine months of 2009, management approved and committed to

undertake certain restructuring actions. Due to the rapid decline in global business activity in the fourth quarter of

2008 and into the first three quarters of 2009, 3M aggressively reduced its cost structure and rationalized several

facilities, including manufacturing, technical and office facilities. These actions included all geographies, with

particular attention in the developed areas of the world that have and are experiencing large declines in business

activity, and included the following:

x During the fourth quarter of 2008, 3M announced the elimination of more than 2,400 positions. Of these

employment reductions, about 31 percent were in the United States, 29 percent in Europe, 24 percent in

Latin America and Canada, and 16 percent in the Asia Pacific area. These restructuring actions resulted in a

fourth-quarter 2008 pre-tax charge of $229 million, with $186 million for employee-related items/benefits and

other, and $43 million related to fixed asset impairments. The preceding charges were recorded in cost of

sales ($84 million), selling, general and administrative expenses ($135 million), and research, development

and related expenses ($10 million). Cash payments in 2008 related to this restructuring were not material.

x During the first quarter of 2009, 3M announced the elimination of approximately 1,200 positions. Of these

employment reductions, about 43 percent were in the United States, 36 percent in Latin America, 16 percent

in Europe and 5 percent in the Asia Pacific area. These restructuring actions resulted in a first-quarter 2009

pre-tax charge of $67 million, with $61 million for employee-related items/benefits and $6 million related to

fixed asset impairments. The preceding charges were recorded in cost of sales ($17 million), selling, general

and administrative expenses ($47 million), and research, development and related expenses ($3 million).

x During the second quarter of 2009, 3M announced the permanent reduction of approximately 900 positions,

the majority of which were concentrated in the United States, Western Europe and Japan. In the United

States, another 700 people accepted a voluntary early retirement incentive program offer, which resulted in a

$21 million non-cash charge. Of these aggregate employment reductions, about 66 percent were in the

United States, 17 percent in the Asia Pacific area, 14 percent in Europe and 3 percent in Latin America and

Canada. These restructuring actions in total resulted in a second-quarter 2009 pre-tax charge of $116

million, with $103 million for employee-related items/benefits and $13 million related to fixed asset

impairments. The preceding charges were recorded in cost of sales ($68 million), selling, general and

administrative expenses ($44 million), and research, development and related expenses ($4 million).

x During the third quarter of 2009, 3M announced the elimination of approximately 200 positions, with the

majority of those occurring in Western Europe and, to a lesser extent, the United States. These restructuring

actions, including a non-cash charge related to a pension settlement in Japan, resulted in a third-quarter

2009 net pre-tax charge of $26 million for employee-related items/benefits and other, which is net of $7

million of adjustments to prior 2008 and 2009 restructuring actions. The preceding charges were recorded in

cost of sales ($25 million) and research, development and related expenses ($1 million).

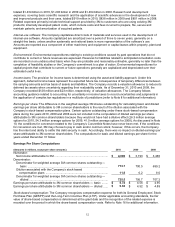

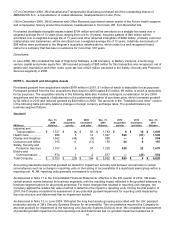

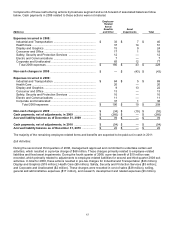

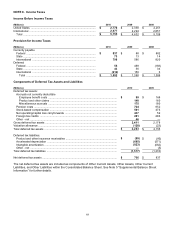

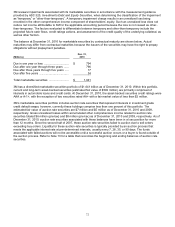

The restructuring expenses related to these actions are summarized by income statement line as follows:

(Millions)

2009

2008

Cost of sales ..............................................................................................................

$

110

$

84

Selling, general and administrative expenses ...........................................................

91

135

Research, development and related expenses .........................................................

8

10

Total restructuring expense ...................................................................................

$

209

$

229