3M 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

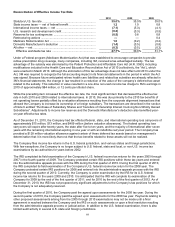

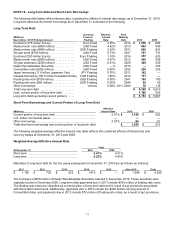

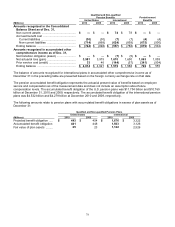

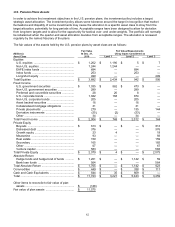

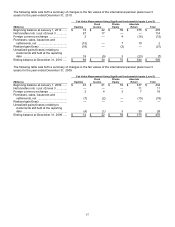

Components of net periodic benefit cost and other supplemental information for the years ended December 31

follow:

Components of net periodic benefit cost and other amounts recognized in other comprehensive income

Qualified and Non-qualified

Pension Benefits

Postretirement

United States

International

Benefits

(Millions)

2010

2009

2008

2010

2009

2008

2010

2009

2008

Net periodic benefit cost (benefit)

Service cost ..................................

$

201

$

183

$

192

$

105

$

98

$

120

$

55

$

51

$

53

Interest cost ..................................

638

619

597

241

235

252

88

97

100

Expected return on plan assets .....

(929

)

(906

)

(889

)

(278

)

(260

)

(305

)

(83

)

(86

)

(104

)

Amortization of transition

(asset) obligation .......................

—

—

—

1

3

3

—

—

—

Amortization of prior service

cost (benefit) .............................

13

16

15

(4

)

(4

)

(2

)

(94

)

(81

)

(97

)

Amortization of net actuarial (gain)

loss ............................................

221

99

58

84

42

38

85

66

64

Net periodic benefit cost (benefit) .....

$

144

$

11

$

(27

)

$

149

$

114

$

106

$

51

$

47

$

16

Settlements, curtailments, special

termination benefits and other ......

—

26

7

(22

)

25

3

—

—

—

Net periodic benefit cost (benefit)

after settlements, curtailments,

special termination benefits

and other .......................................

$

144

$

37

$

(20

)

$

127

$

139

$

109

$

51

$

47

$

16

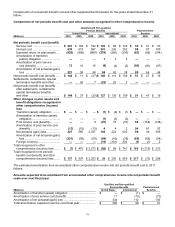

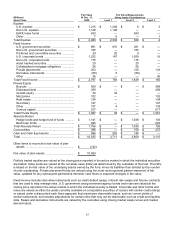

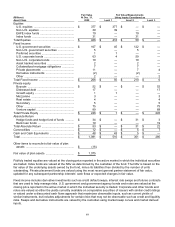

Other changes in plan assets and

benefit obligations recognized in

other comprehensive (income)

loss

Transition (asset) obligation ..........

$

—

$

—

$

—

$

(1

)

$

(2

)

$

(1

)

$

—

$

—

$

—

Amortization of transition (asset)

obligation ....................................

—

—

—

(1

)

(3

)

(3

)

—

—

—

Prior service cost (benefit) .............

—

—

9

(91

)

19

(37

)

69

(169

)

(148

)

Amortization of prior service cost

(benefit) ......................................

(13

)

(16

)

(15

)

4

4

2

94

81

97

Net actuarial (gain) loss .................

227

585

2,337

104

224

622

89

36

385

Amortization of net actuarial (gain)

loss .............................................

(221

)

(99

)

(58

)

(84

)

(42

)

(38

)

(85

)

(66

)

(64

)

Foreign currency ............................

—

—

—

(19

)

(101

)

202

(1

)

(1

)

2

Total recognized in other

comprehensive (income) loss ........

$

(7

)

$

470

$

2,273

$

(88

)

$

99

$

747

$

166

$

(119

)

$

272

Total recognized in net periodic

benefit cost (benefit) and other

comprehensive (income) loss ........

$

137

$

507

$

2,253

$

39

$

238

$

856

$

217

$

(72

)

$

288

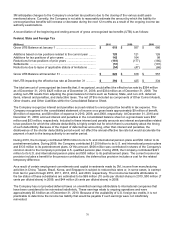

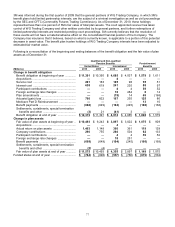

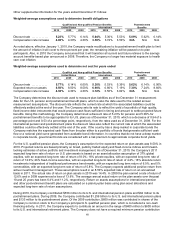

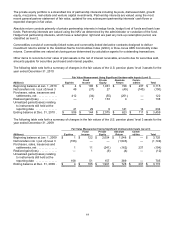

The estimated amortization from accumulated other comprehensive income into net periodic benefit cost in 2011

follows:

Amounts expected to be amortized from accumulated other comprehensive income into net periodic benefit

costs over next fiscal year

Qualified and Non-qualified

Pension Benefits

Postretirement

(Millions)

United States

International

Benefits

Amortization of transition (asset) obligation ..................................

$

—

$

(1

)

$

—

Amortization of prior service cost (benefit) ....................................

11

(13

)

(72

)

Amortization of net actuarial (gain) loss ........................................

334

112

103

Total amortization expected over the next fiscal year ...................

$

345

$

98

$

31