3M 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

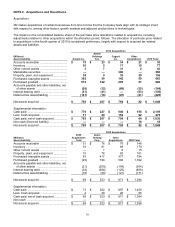

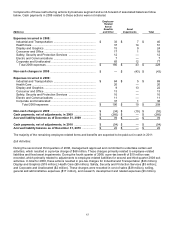

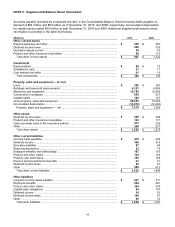

NOTE 2. Acquisitions and Divestitures

Acquisitions:

3M makes acquisitions of certain businesses from time to time that the Company feels align with its strategic intent

with respect to, among other factors, growth markets and adjacent product lines or technologies.

The impact on the consolidated balance sheet of the purchase price allocations related to acquisitions, including

adjustments relative to other acquisitions within the allocation period, follows. The allocation of purchase price related

to acquisitions in the fourth quarter of 2010 is considered preliminary, largely with respect to acquired tax-related

assets and liabilities.

2010 Acquisitions

(Millions)

Asset (Liability)

Arizant Inc.

Attenti

Holdings

S.A.

Cogent

Inc.

Other

Acquisitions

2010 Total

Accounts receivable ..................................

$

15

$

23

$

34

$

21

$

93

Inventory ....................................................

36

5

17

19

77

Other current assets ..................................

3

7

31

2

43

Marketable securities ................................

—

—

380

—

380

Property, plant, and equipment .................

38

9

30

29

106

Purchased intangible assets .....................

362

90

142

69

663

Purchased goodwill ...................................

512

122

295

51

980

Accounts payable and other liabilities, net

of other assets .......................................

(29

)

(12

)

(88

)

(35

)

(164

)

Interest bearing debt .................................

(31

)

(21

)

—

(53

)

(105

)

Deferred tax asset/(liability) .......................

(141

)

(16

)

(47

)

(21

)

(225

)

Net assets acquired ...................................

$

765

$

207

$

794

$

82

$

1,848

Supplemental information:

Cash paid ..................................................

$

776

$

227

$

946

$

156

$

2,105

Less: Cash acquired ..................................

11

20

152

92

275

Cash paid, net of cash acquired ................

$

765

$

207

$

794

$

64

$

1,830

Non-cash (financed liability) ......................

—

—

—

18

18

Net assets acquired ...................................

$

765

$

207

$

794

$

82

$

1,848

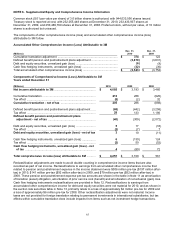

2008 Acquisitions

(Millions)

Asset (Liability)

2009

Acquisitions

Total

Aearo

Holding

Corp.

Other

Acquisitions

2008 Total

Accounts receivable ..................................

$

31

$

76

$

70

$

146

Inventory ....................................................

10

81

89

170

Other current assets ..................................

—

7

8

15

Property, plant, and equipment .................

15

78

83

161

Purchased intangible assets .....................

93

417

377

794

Purchased goodwill ...................................

(25

)

798

594

1,392

Accounts payable and other liabilities, net

of other assets .......................................

(21

)

(200

)

(104

)

(304

)

Interest bearing debt .................................

(18

)

(684

)

(125

)

(809

)

Deferred tax asset/(liability) .......................

(16

)

(50

)

(121

)

(171

)

Net assets acquired ...................................

$

69

$

523

$

871

$

1,394

Supplemental information:

Cash paid ..................................................

$

73

$

562

$

897

$

1,459

Less: Cash acquired ..................................

4

39

26

65

Cash paid, net of cash acquired ................

$

69

$

523

$

871

$

1,394

Non-cash ...................................................

—

—

—

—

Net assets acquired ...................................

$

69

$

523

$

871

$

1,394