3M 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

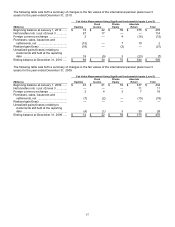

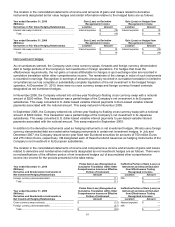

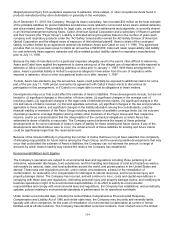

The following tables provide information by level for assets and liabilities that are measured at fair value on a

recurring basis.

Fair Value

(Millions)

at

Dec. 31,

Fair

Value Measurements

Using Inputs Considered as

Description

2010

Level 1

Level 2

Level 3

Assets:

Available-for-sale:

Marketable securities:

U.S. government agency securities ............

$

309

$

—

$

309

$

—

Foreign government agency securities .......

55

—

55

—

Corporate debt securities ............................

472

—

472

—

Commercial paper ........................................

55

—

55

—

Asset-backed securities:

Automobile loan related ...........................

397

—

397

—

Credit card related ...................................

149

—

149

—

Equipment lease related ..........................

38

—

38

—

Other ........................................................

8

—

8

—

U.S. treasury securities ...............................

99

99

—

U.S. municipal securities .............................

23

—

23

—

Auction rate securities .................................

7

—

—

7

Other securities ...........................................

29

—

29

—

Investments ....................................................

21

21

—

—

Derivative instruments — assets:

Foreign currency forward/option contracts .....

38

36

2

—

Interest rate swap contracts ...........................

39

—

39

—

Liabilities:

Derivative instruments — liabilities:

Foreign currency forward/option contracts .....

82

82

—

—

Commodity price swap contracts ....................

5

5

—

—