Xcel Energy 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

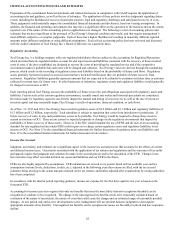

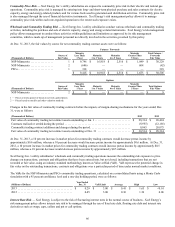

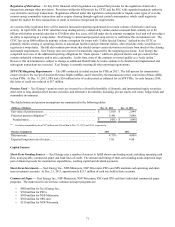

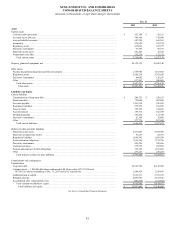

Commercial paper outstanding for Xcel Energy was as follows:

(Amounts in Millions, Except Interest Rates) Three Months Ended

Dec. 31, 2013

Borrowing limit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,450

Amount outstanding at period end . . . . . . . . . . . . . . . . . . . . . . . . . . 759

Average amount outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 515

Maximum amount outstanding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 759

Weighted average interest rate, computed on a daily basis . . . . . . . 0.29%

Weighted average interest rate at end of period . . . . . . . . . . . . . . . . 0.25

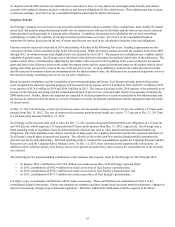

(Amounts in Millions, Except Interest Rates) Twelve Months Ended

Dec. 31, 2013 Twelve Months Ended

Dec. 31, 2012 Twelve Months Ended

Dec. 31, 2011

Borrowing limit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,450 $ 2,450 $ 2,450

Amount outstanding at period end . . . . . . . . . . . . . . . . . . . . . . . . . . 759 602 219

Average amount outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 481 403 430

Maximum amount outstanding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,160 634 824

Weighted average interest rate, computed on a daily basis . . . . . . . 0.31% 0.35% 0.36%

Weighted average interest rate at end of period . . . . . . . . . . . . . . . . 0.25 0.36 0.40

Credit Facilities — NSP-Minnesota, NSP-Wisconsin, PSCo, SPS and Xcel Energy Inc. each have five-year credit agreements with a

syndicate of banks. The total size of the credit facilities is $2.45 billion and each credit facility terminates in July 2017.

NSP-Minnesota, PSCo, SPS and Xcel Energy Inc. each have the right to request an extension of the revolving termination date for two

additional one-year periods. NSP-Wisconsin has the right to request an extension of the revolving termination date for an additional

one-year period. All extension requests are subject to majority bank group approval.

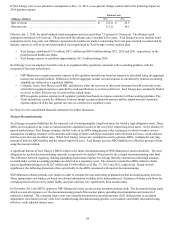

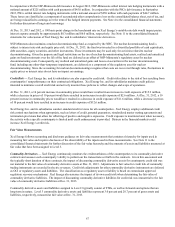

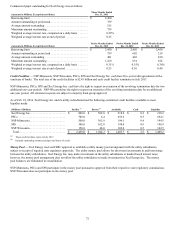

As of Feb. 18, 2014, Xcel Energy Inc. and its utility subsidiaries had the following committed credit facilities available to meet

liquidity needs:

(Millions of Dollars) Facility (a) Drawn (b) Available Cash Liquidity

Xcel Energy Inc. . . . . . . . . . . . . . . . . . . . . . . . . $ 800.0 $ 582.0 $ 218.0 $ 0.2 $ 218.2

PSCo . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 700.0 6.4 693.6 0.5 694.1

NSP-Minnesota . . . . . . . . . . . . . . . . . . . . . . . . . 500.0 305.9 194.1 0.4 194.5

SPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 300.0 102.0 198.0 0.9 198.9

NSP-Wisconsin . . . . . . . . . . . . . . . . . . . . . . . . . 150.0 48.0 102.0 0.5 102.5

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,450.0 $ 1,044.3 $ 1,405.7 $ 2.5 $ 1,408.2

(a) These credit facilities expire in July 2017.

(b) Includes outstanding commercial paper and letters of credit.

Money Pool — Xcel Energy received FERC approval to establish a utility money pool arrangement with the utility subsidiaries,

subject to receipt of required state regulatory approvals. The utility money pool allows for short-term investments in and borrowings

between the utility subsidiaries. Xcel Energy Inc. may make investments in the utility subsidiaries at market-based interest rates;

however, the money pool arrangement does not allow the utility subsidiaries to make investments in Xcel Energy Inc. The money

pool balances are eliminated in consolidation.

NSP-Minnesota, PSCo and SPS participate in the money pool pursuant to approval from their respective state regulatory commissions.

NSP-Wisconsin does not participate in the money pool.