Xcel Energy 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

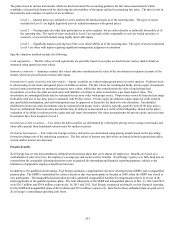

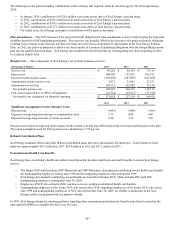

Xcel Energy bases the investment-return assumption on expected long-term performance for each of the investment types included in

its pension asset portfolio. Xcel Energy considers the historical returns achieved by its asset portfolio over the past 20-year or longer

period, as well as the long-term return levels projected and recommended by investment experts. The pension cost determination

assumes a forecasted mix of investment types over the long-term. Investment returns were below the assumed level of 6.88 percent in

2013 and above the assumed levels of 7.10 and 7.50 percent in 2012 and 2011, respectively. Xcel Energy continually reviews its

pension assumptions. In 2014, Xcel Energy’s expected investment return assumption is 7.05 percent.

The assets are invested in a portfolio according to Xcel Energy’s return, liquidity and diversification objectives to provide a source of

funding for plan obligations and minimize the necessity of contributions to the plan, within appropriate levels of risk. The principal

mechanism for achieving these objectives is the projected allocation of assets to selected asset classes, given the long-term risk, return,

and liquidity characteristics of each particular asset class. There were no significant concentrations of risk in any particular industry,

index, or entity. Market volatility can impact even well-diversified portfolios and significantly affect the return levels achieved by

pension assets in any year.

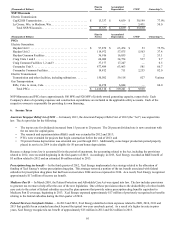

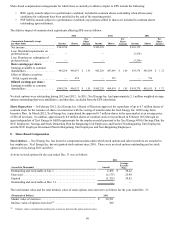

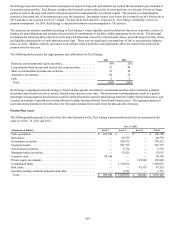

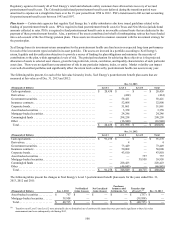

The following table presents the target pension asset allocations for Xcel Energy:

2013 2012

Domestic and international equity securities. . . . . . . . . . . . . . . . . . . . . . . . 30% 25%

Long-duration fixed income and interest rate swap securities . . . . . . . . . . 33 40

Short-to-intermediate fixed income securities. . . . . . . . . . . . . . . . . . . . . . . 15 10

Alternative investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 23

Cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 2

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100% 100%

Xcel Energy’s ongoing investment strategy is based on plan-specific investment recommendations that seek to minimize potential

investment and interest rate risk as a plan’s funded status increases over time. The investment recommendations result in a greater

percentage of long-duration fixed income securities being allocated to specific plans having relatively higher funded status ratios, and

a greater percentage of growth assets being allocated to plans having relatively lower funded status ratios. The aggregate projected

asset allocation presented in the table above for the master pension trust results from the plan-specific strategies.

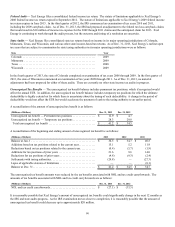

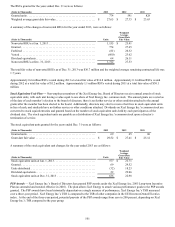

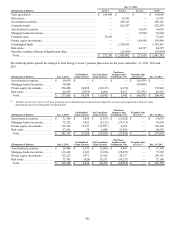

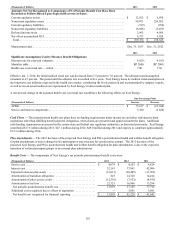

Pension Plan Assets

The following tables present, for each of the fair value hierarchy levels, Xcel Energy’s pension plan assets that are measured at fair

value as of Dec. 31, 2013 and 2012:

Dec. 31, 2013

(Thousands of Dollars) Level 1 Level 2 Level 3 Total

Cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 109,700 $ — $ — $ 109,700

Derivatives. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 29,759 — 29,759

Government securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 230,212 — 230,212

Corporate bonds. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 547,715 — 547,715

Asset-backed securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 6,754 — 6,754

Mortgage-backed securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 15,025 — 15,025

Common stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99,346 — — 99,346

Private equity investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 152,849 152,849

Commingled funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 1,769,076 — 1,769,076

Real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 47,553 47,553

Securities lending collateral obligation and other . . . . . . . . . . . . . . . . . . . . — 2,151 — 2,151

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 209,046 $ 2,600,692 $ 200,402 $ 3,010,140