Xcel Energy 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

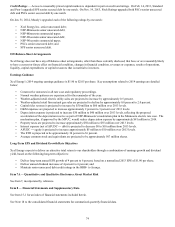

Regulation of Derivatives — In July 2010, financial reform legislation was passed that provides for the regulation of derivative

transactions amongst other provisions. Provisions within the bill provide the CFTC and the SEC with expanded regulatory authority

over derivative and swap transactions. Regulations effected under this legislation could preclude or impede some types of over-the-

counter energy commodity transactions and/or require clearing through regulated central counterparties, which could negatively

impact the market for these transactions or result in extensive margin and fee requirements.

As a result of this legislation there will be material increased reporting requirements for certain volumes of derivative and swap

activity. In April 2012, the CFTC ruled that swap dealing activity conducted by entities under a notional limit, initially set at $8

billion with further potential reduction to $3 billion after five years, will fall under the de minimis exemption level and will not subject

an entity to registering as a swap dealer. Xcel Energy’s current and projected swap activity is well below this de minimis level. The

CFTC has set an $800 million de minimis volume exemption for swaps with “Utility Special Entities,” defined by the CFTC as

primarily entities owning or operating electric or natural gas facilities and government entities, after which the entity would have to

register as a swap dealer. The bill also contains provisions that should exempt certain derivatives end users from much of the clearing

and margin requirements. Xcel Energy does not expect to be materially impacted by the margining provisions. Xcel Energy has

completed its review of the additional reporting obligations for “trade options,” which are physical electric and gas contracts that

contain embedded volumetric and/or price optionality. At this time, none of the contracts reviewed qualify as a “trade option.”

However, this determination is subject to change as additional Dodd-Frank Act rules continue to be finalized and implemented and

subsequent transactions are executed. Xcel Energy is currently meeting all other reporting requirements.

SPP FTR Margining Requirements — The SPP conducted its initial auction for FTRs in 2013. The full process for transmission

owners involves the receipt of Auction Revenue Rights (ARRs), and if elected by the transmission owner, conversion of those ARRs

to firm FTRs. At Dec. 31, 2013, SPS had a $26 million letter of credit posted as collateral for its SPP FTRs. In early January 2014,

this letter of credit was reduced to $17 million.

Pension Fund — Xcel Energy’s pension assets are invested in a diversified portfolio of domestic and international equity securities,

short-term to long-duration fixed income securities, and alternative investments, including, private equity, real estate, hedge funds and

commodity investments.

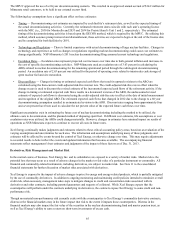

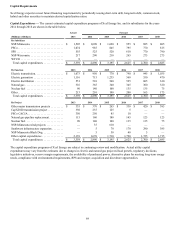

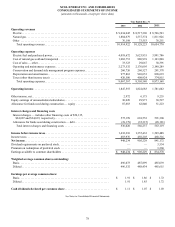

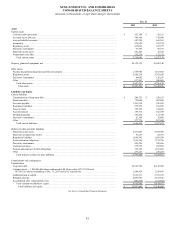

The funded status and pension assumptions are summarized in the following tables:

(Millions of Dollars) Dec. 31, 2013 Dec. 31, 2012

Fair value of pension assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,010 $ 2,944

Projected pension obligation (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,441 3,640

Funded status. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (431) $ (696)

(a) Excludes nonqualified plan of $37 million and $39 million at Dec. 31, 2013 and 2012, respectively.

Pension Assumptions 2013 2012

Discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.75% 4.00%

Expected long-term rate of return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.05 6.88

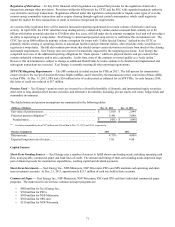

Capital Sources

Short-Term Funding Sources — Xcel Energy uses a number of sources to fulfill short-term funding needs, including operating cash

flow, notes payable, commercial paper and bank lines of credit. The amount and timing of short-term funding needs depend in large

part on financing needs for construction expenditures, working capital and dividend payments.

Short-Term Investments — Xcel Energy Inc., NSP-Minnesota, NSP-Wisconsin, PSCo and SPS maintain cash operating and short-

term investment accounts. At Dec. 31, 2013, approximately $21.7 million of cash was held in these accounts.

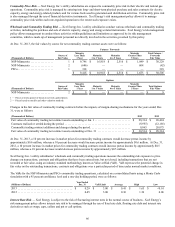

Commercial Paper — Xcel Energy Inc., NSP-Minnesota, NSP-Wisconsin, PSCo and SPS each have individual commercial paper

programs. The authorized levels for these commercial paper programs are:

• $800 million for Xcel Energy Inc.;

• $700 million for PSCo;

• $500 million for NSP-Minnesota;

• $300 million for SPS; and

• $150 million for NSP-Wisconsin.