Xcel Energy 2013 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

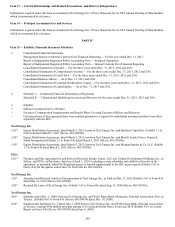

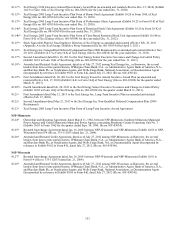

147

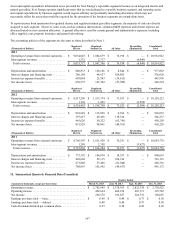

Asset and capital expenditure information is not provided for Xcel Energy’s reportable segments because as an integrated electric and

natural gas utility, Xcel Energy operates significant assets that are not dedicated to a specific business segment, and reporting assets

and capital expenditures by business segment would require arbitrary and potentially misleading allocations which may not

necessarily reflect the assets that would be required for the operation of the business segments on a stand-alone basis.

To report income from operations for regulated electric and regulated natural gas utility segments, the majority of costs are directly

assigned to each segment. However, some costs, such as common depreciation, common O&M expenses and interest expense are

allocated based on cost causation allocators. A general allocator is used for certain general and administrative expenses, including

office supplies, rent, property insurance and general advertising.

The accounting policies of the segments are the same as those described in Note 1.

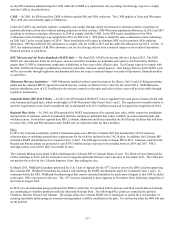

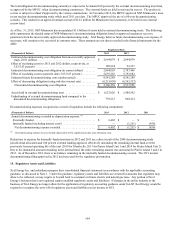

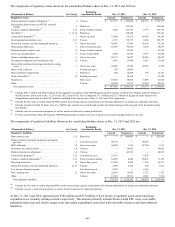

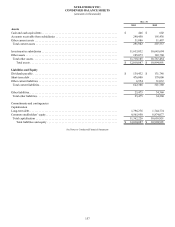

(Thousands of Dollars) Regulated

Electric Regulated

Natural Gas All Other Reconciling

Eliminations Consolidated

Total

2013

Operating revenues from external customers . . $ 9,034,045 $ 1,804,679 $ 76,198 $ — $ 10,914,922

Intersegment revenues. . . . . . . . . . . . . . . . . . . . 1,332 2,717 — (4,049) —

Total revenues. . . . . . . . . . . . . . . . . . . . . . . . . $ 9,035,377 $ 1,807,396 $ 76,198 $ (4,049) $ 10,914,922

Depreciation and amortization . . . . . . . . . . . . . $ 840,833 $ 128,186 $ 8,844 $ — $ 977,863

Interest charges and financing costs . . . . . . . . . 386,198 44,927 104,895 — 536,020

Income tax expense (benefit). . . . . . . . . . . . . . . 495,044 25,543 (36,611) — 483,976

Net income (loss). . . . . . . . . . . . . . . . . . . . . . . . 850,572 123,702 (26,040) — 948,234

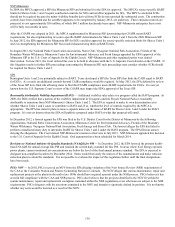

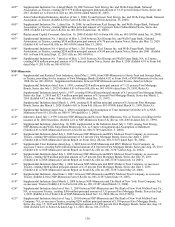

(Thousands of Dollars) Regulated

Electric Regulated

Natural Gas All Other Reconciling

Eliminations Consolidated

Total

2012

Operating revenues from external customers . . $ 8,517,296 $ 1,537,374 $ 73,553 $ — $ 10,128,223

Intersegment revenues. . . . . . . . . . . . . . . . . . . . 1,169 1,425 — (2,594) —

Total revenues. . . . . . . . . . . . . . . . . . . . . . . . . $ 8,518,465 $ 1,538,799 $ 73,553 $ (2,594) $ 10,128,223

Depreciation and amortization . . . . . . . . . . . . . $ 801,649 $ 115,038 $ 9,366 $ — $ 926,053

Interest charges and financing costs . . . . . . . . . 397,457 49,456 119,324 — 566,237

Income tax expense (benefit). . . . . . . . . . . . . . . 465,626 50,322 (65,745) — 450,203

Net income (loss). . . . . . . . . . . . . . . . . . . . . . . . 851,929 98,061 (44,761) — 905,229

(Thousands of Dollars) Regulated

Electric Regulated

Natural Gas All Other Reconciling

Eliminations Consolidated

Total

2011

Operating revenues from external customers . . $ 8,766,593 $ 1,811,926 $ 76,251 $ — $ 10,654,770

Intersegment revenues. . . . . . . . . . . . . . . . . . . . 1,269 2,358 — (3,627) —

Total revenues. . . . . . . . . . . . . . . . . . . . . . . . . $ 8,767,862 $ 1,814,284 $ 76,251 $ (3,627) $ 10,654,770

Depreciation and amortization . . . . . . . . . . . . . $ 773,392 $ 106,870 $ 10,357 $ — $ 890,619

Interest charges and financing costs . . . . . . . . . 402,668 52,115 108,336 — 563,119

Income tax expense (benefit). . . . . . . . . . . . . . . 473,848 57,408 (62,940) — 468,316

Net income (loss). . . . . . . . . . . . . . . . . . . . . . . . 788,967 101,842 (49,637) — 841,172

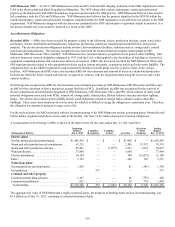

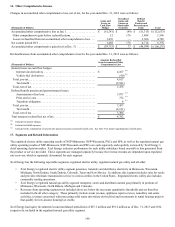

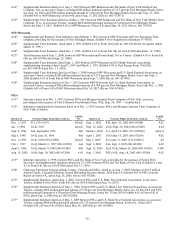

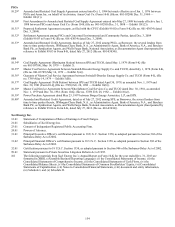

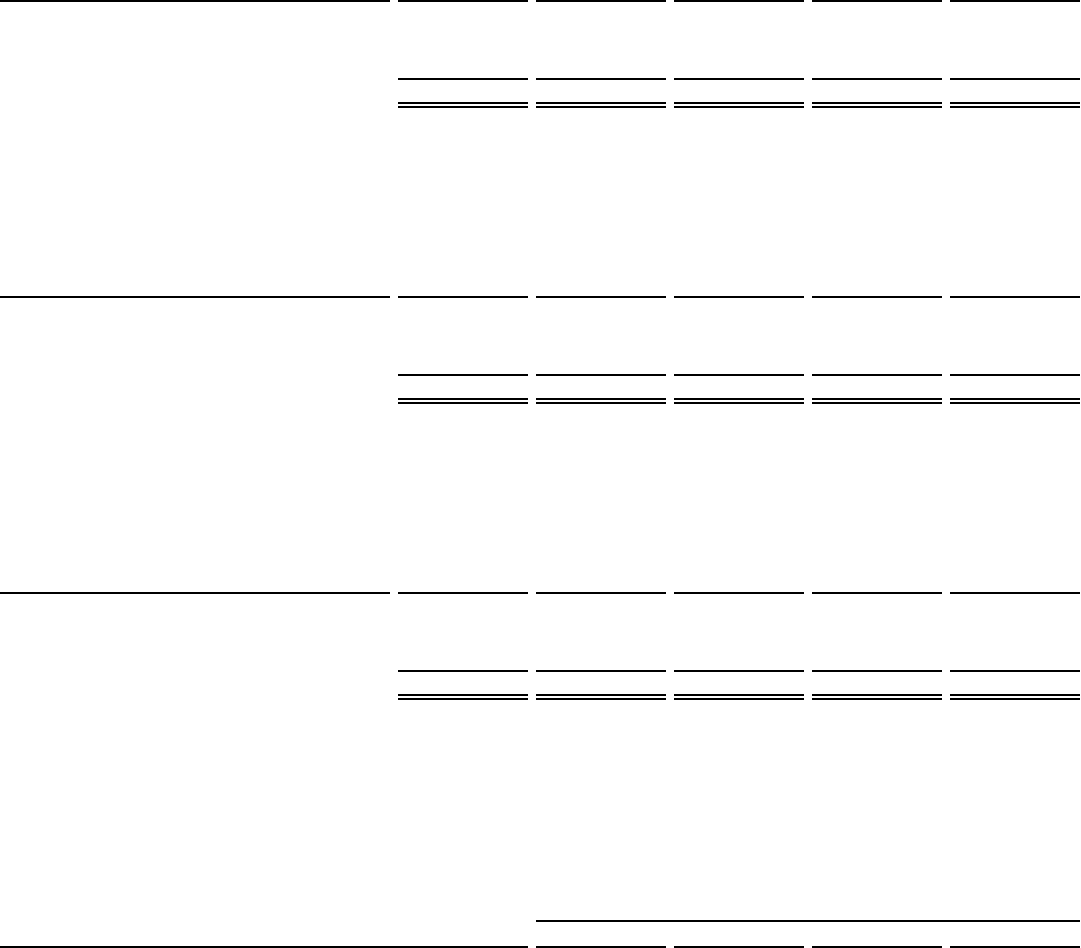

18. Summarized Quarterly Financial Data (Unaudited)

Quarter Ended

(Amounts in thousands, except per share data) March 31, 2013 June 30, 2013 Sept. 30, 2013 Dec. 31, 2013

Operating revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,782,849 $ 2,578,913 $ 2,822,338 $ 2,730,822

Operating income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 454,624 402,236 665,113 325,582

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 236,570 196,857 364,752 150,055

Earnings per share total — basic. . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.48 $ 0.40 $ 0.73 $ 0.30

Earnings per share total — diluted . . . . . . . . . . . . . . . . . . . . . . . . 0.48 0.40 0.73 0.30

Cash dividends declared per common share. . . . . . . . . . . . . . . . . 0.27 0.28 0.28 0.28