Xcel Energy 2013 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

151

4.22* Supplemental Indenture dated as of Aug. 1, 2012 between NSP-Minnesota and The Bank of New York Mellon Trust

Company, NA, as successor Trustee, creating $300 million principal amount of 2.15 percent First Mortgage Bonds, Series

due Aug. 15, 2022 and $500 million principal amount of 3.40 percent First Mortgage Bonds, Series due Aug. 15, 2042

(Exhibit 4.01 to NSP-Minnesota’s Form 8-K dated Aug. 13, 2012 (file no. 001-31387)).

4.23* Supplemental Trust Indenture dated as of May 1, 2013 between NSP-Minnesota and The Bank of New York Mellon Trust

Company, N.A., as successor Trustee, creating $400 million principal amount of 2.60 percent First Mortgage Bonds,

Series due May 15, 2023 (Exhibit 4.01 to NSP-Minnesota’s Form 8-K dated May 20, 2013 (file no. 001-31387)).

NSP-Wisconsin

4.24* Supplemental and Restated Trust Indenture, dated March 1, 1991, between NSP-Wisconsin and First Wisconsin Trust

company, providing for the issuance of First Mortgage Bonds (Exhibit 4.01 to Registration Statement 33-39831).

4.25* Supplemental Trust Indenture, dated April 1, 1991 (Exhibit 4.01 to Form 10-Q (file no. 001-03140) for the quarter ended

March 31, 1991).

4.26* Supplemental Trust Indenture, dated Dec. 1, 1996 (Exhibit 4.01 to Form 8-K (file no. 001-03140) dated Dec. 12, 1996).

4.27* Trust Indenture dated Sept. 1, 2000, between NSP-Wisconsin and Firstar Bank, NA as Trustee (Exhibit 4.01 to Form 8-K

(file no. 001-03140) dated Sept. 25, 2000).

4.28* Supplemental Trust Indenture dated Sept. 1, 2003 between NSP-Wisconsin and US Bank National Association,

supplementing indentures dated April 1, 1947 and March 1, 1991 (Exhibit 4.05 to Xcel Energy Form 10-Q (file

no. 001-03034) dated Nov. 13, 2003).

4.29* Supplemental Trust Indenture dated as of Sept. 1, 2008 between NSP-Wisconsin and U.S. Bank National Association, as

successor Trustee, creating $200 million principal amount of 6.375 percent First Mortgage Bonds, Series due Sept. 1,

2038 (Exhibit 4.01 of Form 8-K of NSP-Wisconsin dated Sept. 3, 2008 (file no. 001-03140)).

4.30* Supplemental Indenture dated as of Oct. 1, 2012 between NSP-Wisconsin and U.S. Bank National Association, as

successor Trustee, creating $100 million principal amount of 3.700 percent First Mortgage Bonds, Series due Oct. 1, 2042

(Exhibit 4.01 of Form 8-K of NSP-Wisconsin dated Oct. 10, 2012 (file no. 001-03140)).

PSCo

4.31* Indenture, dated as of Oct. 1, 1993, between PSCo and Morgan Guaranty Trust Company of New York, as trustee,

providing for the issuance of First Collateral Trust Bonds (Form 10-Q, Sept. 30, 1993 — Exhibit 4(a)).

4.32* Indentures supplemental to Indenture dated as of Oct. 1, 1993, between PSCo and Morgan Guaranty Trust Company of

New York, as trustee:

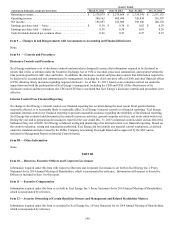

Dated as of Previous Filing: Form; Date or file no. Exhibit

No. Dated as of Previous Filing: Form; Date or file no. Exhibit

No.

Nov. 1, 1993 S-3, (33-51167) 4(b)(2) Sept. 1, 2002 8-K, Sept. 18, 2002 (001-03280) 4.01

Jan. 1, 1994 10-K, 1993 4(b)(3) Sept. 15, 2002 10-Q, Sept. 30, 2002 (001-03280) 4.04

Sept. 2, 1994 8-K, September 1994 4(b) March 1, 2003 S-3, April 14, 2003 (333-104504) 4(b)(3)

May 1, 1996 10-Q, June 30, 1996 4(b) April 1, 2003 10-Q May 15, 2003 (001-03280) 4.02

Nov. 1, 1996 10-K, 1996 (001-03280) 4(b)(3) May 1, 2003 S-4, June 11, 2003 (333-106011) 4.9

Feb. 1, 1997 10-Q, March 31, 1997 (001-03280) 4(a) Sept. 1, 2003 8-K, Sept. 2, 2003 (001-03280) 4.02

April 1, 1998 10-Q, March 31,1998 (001-03280) 4(b) Sept. 15, 2003 Xcel 10-K, March 15, 2004 (001-03034) 4.100

Aug. 15, 2002 10-Q, Sept. 30, 2002 (001-03280) 4.03 Aug. 1, 2005 PSCo 8-K, Aug. 18, 2005 (001-03280) 4.02

4.33* Indenture dated July 1, 1999, between PSCo and The Bank of New York, providing for the issuance of Senior Debt

Securities and Supplemental Indenture dated July 15, 1999, between PSCo and The Bank of New York (Exhibits 4.1 and

4.2 to Form 8-K (file no. 001-03280) dated July 13, 1999).

4.34* Financing Agreement between Adams County, Colorado and PSCo, dated as of Aug. 1, 2005 relating to $129.5 million

Adams County, Colorado Pollution Control Refunding Revenue Bonds, 2005 Series A (Exhibit 4.01 to PSCo Current

Report on Form 8-K, dated Aug. 18, 2005, file no. 001-03280).

4.35* Supplemental Indenture, dated Aug. 1, 2007, between PSCo and U.S. Bank Trust National Association, as successor

Trustee (Exhibit 4.01 to PSCo Form 8-K (file no. 001-03280) dated Aug. 14, 2007).

4.36* Supplemental Indenture dated as of Aug. 1, 2008, between PSCo and U.S. Bank Trust National Association, as successor

Trustee, creating $300 million principal amount of 5.80 percent First Mortgage Bonds, Series No. 18 due 2018 and $300

million principal amount of 6.50 percent First Mortgage Bonds, Series No. 19 due 2038 (Exhibit 4.01 of Form 8-K of

PSCo dated Aug. 6, 2008 (file no. 001-03280)).

4.37* Supplemental Indenture dated as of May 1, 2009 between PSCo and U.S. Bank Trust National Association, as successor

Trustee, creating $400 million principal amount of 5.125 percent First Mortgage Bonds, Series No. 20 due 2019

(Exhibit 4.01 of Form 8-K of PSCo dated May 28, 2009 (file no. 001-03280)).