Xcel Energy 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

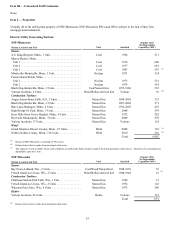

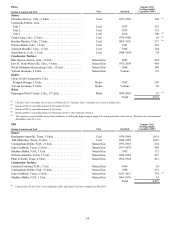

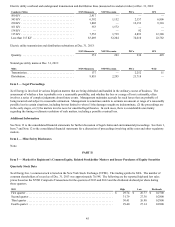

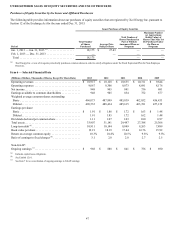

Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations

Business Segments and Organizational Overview

Xcel Energy Inc. is a public utility holding company. In 2013, Xcel Energy’s operations included the activity of four utility

subsidiaries that serve electric and natural gas customers in eight states. These utility subsidiaries are NSP-Minnesota, NSP-

Wisconsin, PSCo and SPS. These utilities serve customers in portions of Colorado, Michigan, Minnesota, New Mexico, North

Dakota, South Dakota, Texas and Wisconsin. Along with WYCO, a joint venture formed with CIG to develop and lease natural gas

pipelines, storage and compression facilities, and WGI, an interstate natural gas pipeline company, these companies comprise the

regulated utility operations.

Xcel Energy Inc.’s nonregulated subsidiary is Eloigne, which invests in rental housing projects that qualify for low-income housing

tax credits.

Forward-Looking Statements

Except for the historical statements contained in this report, the matters discussed in the following discussion and analysis are

forward-looking statements that are subject to certain risks, uncertainties and assumptions. Such forward-looking statements,

including the 2014 EPS guidance and assumptions, are intended to be identified in this document by the words “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “may,” “objective,” “outlook,” “plan,” “project,” “possible,” “potential,” “should” and similar

expressions. Actual results may vary materially. Forward-looking statements speak only as of the date they are made, and we do not

undertake any obligation to update them to reflect changes that occur after that date. Factors that could cause actual results to differ

materially include, but are not limited to: general economic conditions, including inflation rates, monetary fluctuations and their

impact on capital expenditures and the ability of Xcel Energy Inc. and its subsidiaries to obtain financing on favorable terms; business

conditions in the energy industry, including the risk of a slow down in the U.S. economy or delay in growth recovery; trade, fiscal,

taxation and environmental policies in areas where Xcel Energy has a financial interest; customer business conditions; actions of

credit rating agencies; competitive factors, including the extent and timing of the entry of additional competition in the markets served

by Xcel Energy Inc. and its subsidiaries; unusual weather; effects of geopolitical events, including war and acts of terrorism; state,

federal and foreign legislative and regulatory initiatives that affect cost and investment recovery, have an impact on rates or have an

impact on asset operation or ownership or impose environmental compliance conditions; structures that affect the speed and degree to

which competition enters the electric and natural gas markets; costs and other effects of legal and administrative proceedings,

settlements, investigations and claims; actions by regulatory bodies impacting our nuclear operations, including those affecting costs,

operations or the approval of requests pending before the NRC; financial or regulatory accounting policies imposed by regulatory

bodies; availability or cost of capital; employee work force factors; the items described under Factors Affecting Results of Operations;

and the other risk factors listed from time to time by Xcel Energy Inc. in reports filed with the SEC, including “Risk Factors” in Item

1A of this Annual Report on Form 10-K and Exhibit 99.01 hereto.

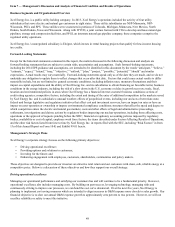

Management’s Strategic Plans

Xcel Energy’s corporate strategy focuses on the following primary objectives:

• Driving operational excellence;

• Providing options and solutions to customers;

• Investing for the future; and

• Enhancing engagement with employees, customers, shareholders, communities and policy makers.

These objectives are designed to provide our investors an attractive total return and our customers with clean, safe, reliable energy at a

competitive price. Below is a discussion of these objectives and how they support our overall strategy.

Driving operational excellence

Managing our operational performance and satisfying our customers has and will continue to be a fundamental priority. However,

operational excellence also includes managing costs. By building on past success, leveraging technology, managing risks and

continuously striving to improve our processes, we can bend the cost curve downward. Over the next five years, Xcel Energy is

planning to implement cost saving measures which are intended to align increases in O&M expense more closely to sales growth. Our

financial objective is to slow our annual O&M expense growth to approximately zero percent to two percent. However, we will not

sacrifice reliability or safety to meet this initiative.