Xcel Energy 2013 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.143

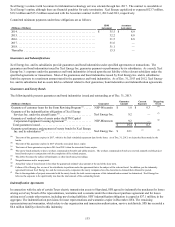

In July 2011, the United States and NSP-Minnesota executed a settlement agreement resolving both lawsuits, providing an initial $100

million payment from the United States to NSP-Minnesota, and providing a method by which NSP-Minnesota can recover its spent

fuel storage costs through 2013, estimated to be an additional $100 million. In January 2014, the United States proposed, and NSP-

Minnesota accepted, an extension to the settlement agreement which will allow NSP-Minnesota to recover spent fuel storage costs

through 2016. The extension does not address costs for used fuel storage after 2016; such costs could be the subject of future

litigation. NSP-Minnesota received the initial $100 million payment in August 2011, the second installment of $18.6 million in March

2012, the third installment of $20.7 million in October 2012, and the fourth installment of $42.6 million in November 2013. Amounts

received from the installments were subsequently credited to customers, except for approved reductions such as legal costs, customer

credits still in process at Dec. 31, 2013, and amounts set aside to be credited through another regulatory mechanism.

Other Contingencies

See Note 12 for further discussion.

14. Nuclear Obligations

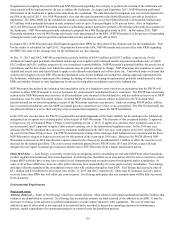

Fuel Disposal — NSP-Minnesota is responsible for temporarily storing used or spent nuclear fuel from its nuclear plants. The DOE is

responsible for permanently storing spent fuel from NSP-Minnesota’s nuclear plants as well as from other U.S. nuclear plants. NSP-

Minnesota has funded its portion of the DOE’s permanent disposal program since 1981. The fuel disposal fees are based on a charge

of 0.1 cent per KWh sold to customers from nuclear generation. In January 2014, the DOE sent its court mandated proposal to adjust

the current fee to zero. The Nuclear Waste Policy Act provides that a proposal by the Secretary of Energy to adjust the fee shall be

effective after a period of 90 days of continuous session unless either House of Congress adopts a resolution disapproving the

Secretary’s proposed adjustment.

Fuel expense includes the DOE fuel disposal assessments of approximately $10 million in 2013, $12 million in 2012 and $11 million

in 2011. In total, NSP-Minnesota had paid approximately $444.8 million to the DOE through Dec. 31, 2013. See Note 13 — Nuclear

Waste Disposal Litigation for further discussion.

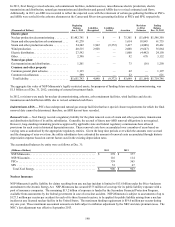

NSP-Minnesota has its own temporary on-site storage facilities for spent fuel at its Monticello and Prairie Island nuclear plants, which

consist of storage pools and dry cask facilities at both sites. The amount of spent fuel storage capacity currently authorized by the

NRC and the MPUC will allow NSP-Minnesota to continue operation of its Prairie Island nuclear plant until the end of its renewed

licenses terms in 2033 for Unit 1 and 2034 for Unit 2 and its Monticello nuclear plant until the end of its renewed operating license in

2030. Other alternatives for spent fuel storage are being investigated until a DOE facility is available, including pursuing the

establishment of a private facility for interim storage of spent nuclear fuel as part of a consortium of electric utilities.

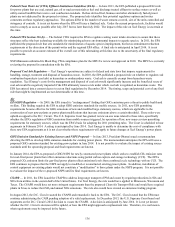

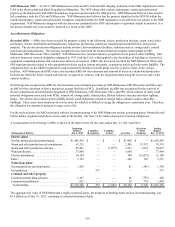

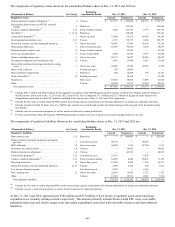

Regulatory Plant Decommissioning Recovery — Decommissioning of NSP-Minnesota’s nuclear facilities is planned for the period

from cessation of operations through at least 2091, assuming the prompt dismantlement method. NSP-Minnesota is currently

recording the costs for decommissioning over the MPUC-approved cost-recovery period.

Monticello received its initial operating license in 1970 and began commercial operation in 1971. With its renewed operating license

and CON for spent fuel capacity to support 20 years of extended operation, Monticello can operate until 2030. The Monticello 20-

year depreciation life extension until September 2030 was granted by the MPUC in 2007. The Monticello dry-cask storage facility

currently stores 15 of the 30 canisters authorized by the MPUC.

Prairie Island Units 1 and 2 received their initial operating license and began commercial operations in 1973 and 1974. With its

renewed operating license from the NRC, Prairie Island Units 1 and 2 can operate until 2033 and 2034, respectively. The MPUC

approved depreciation life for Prairie Island is consistent with the remaining life of the NRC approved operating license. The Prairie

Island dry-cask storage facility currently stores 35 of the 64 casks authorized by the MPUC.

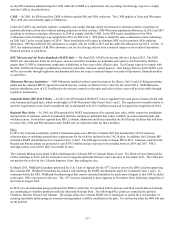

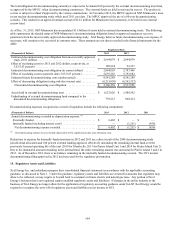

NSP-Minnesota previously recorded annual decommissioning accruals based on periodic site-specific cost studies and a presumed

level of dedicated funding consistent with cost-recovery in utility customer rates. Cost studies quantify decommissioning costs in

current dollars. This study presumed that costs will escalate in the future at a rate of 3.63 percent per year during operations and

radiological portion of decommissioning and 2.63 percent during the independent spent fuel storage installation and site restoration

portion of decommissioning. The total estimated decommissioning costs that will ultimately be paid, net of income earned by the

external decommissioning trust fund, is currently being accrued using an annuity approach over the approved plant-recovery period.

This annuity approach uses an assumed rate of return on funding, which is an after-tax return between 4.57 percent and 5.53 percent,

depending on production unit and time frame for external funding. The net unrealized gain or loss on nuclear decommissioning

investments is deferred as a regulatory asset or liability.