Xcel Energy 2013 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.150

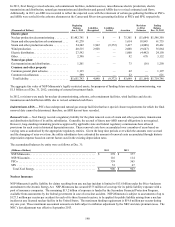

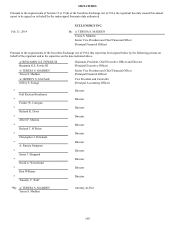

4.03* Supplemental Indenture No. 4 dated March 30, 2007 between Xcel Energy Inc. and Wells Fargo Bank, National

Association, as Trustee, creating $253.979 million aggregate principal amount of 5.613 percent Senior Notes, Series due

2017 (Exhibit 4.1 to Form 8-K (file no. 001-03034) dated March 30, 2007).

4.04* Junior Subordinated Indenture, dated as of Jan. 1, 2008, by and between Xcel Energy Inc. and Wells Fargo Bank, National

Association, as Trustee (Exhibit 4.01 to Form 8-K (file no. 001-03034) dated Jan. 16, 2008).

4.05* Supplemental Indenture No. 1, dated Jan. 16, 2008, by and between Xcel Energy Inc. and Wells Fargo Bank, National

Association, as Trustee, creating $400 million principal amount of 7.6 percent Junior Subordinated Notes, Series due

2068 (Exhibit 4.02 to Form 8-K (file no. 001-03034) dated Jan. 16, 2008).

4.06* Replacement Capital Covenant, dated Jan. 16, 2008 (Exhibit 4.03 to Form 8-K (file no. 001-03034) dated Jan. 16, 2008).

4.07* Supplemental Indenture No. 5 dated as of May 1, 2010 between Xcel Energy Inc. and Wells Fargo Bank, National

Association, as Trustee, creating $550 million principal amount of 4.70 percent Senior Notes, Series due May 15, 2020

(Exhibit 4.01 to Form 8-K (file no. 001-03034) dated May 13, 2010).

4.08* Supplemental Indenture No. 6 dated as of Sept. 1, 2011 between Xcel Energy Inc. and Wells Fargo Bank, National

Association, as Trustee, creating $250 million principal amount of 4.80 percent Senior Notes, Series due 2041 (Exhibit

4.01 to Form 8-K dated Sept. 12, 2011 (file no. 001-03034)).

4.09* Supplemental Indenture No. 7 dated as of May 1, 2013 between Xcel Energy and Wells Fargo Bank, NA, as Trustee,

creating $450 million principal amount of 0.75 percent Senior Notes, Series due May 9, 2016 (Exhibit 4.01 to Form 8-K

dated May 9, 2013 (file no. 001-03034)).

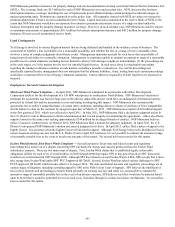

NSP-Minnesota

4.10* Supplemental and Restated Trust Indenture, dated May 1, 1988, from NSP-Minnesota to Harris Trust and Savings Bank,

as Trustee, providing for the issuance of First Mortgage Bonds (Exhibit 4.02 to Form 10-K of NSP-Minnesota for the year

1988, file no. 001-03034). Supplemental Indentures between NSP-Minnesota and said Trustee, dated as follows:

Supplemental Indenture dated June 1, 1995, creating $250 million principal amount of 7.125 percent First Mortgage

Bonds, Series due July 1, 2025 (Exhibit 4.01 to Form 8-K (file no. 001-03034) dated June 28, 1995, Rider A).

Supplemental Indenture dated April 1, 1997, creating $100 million principal amount of 8.5 percent First Mortgage Bonds,

Series due Sept. 1, 2019 and $27.9 million principal amount of 8.5 percent First Mortgage Bonds, Series due March 1,

2019 (Exhibit 4.47 to Form 10-K (file no. 001-03034) dated Dec. 31, 1997).

Supplemental Indenture dated March 1, 1998, creating $150 million principal amount of 6.5 percent First Mortgage

Bonds, Series due March 1, 2028 (Exhibit 4.01 to Form 8-K (file no. 001-03034) dated March 11, 1998, Rider A).

4.11* Supplemental Indenture dated Aug. 1, 2000 (Assignment and Assumption of Trust Indenture) (Exhibit 4.51 to NSP-

Minnesota Form 10-12G (file no. 000-31709) dated Oct. 5, 2000).

4.12* Indenture, dated July 1, 1999, between NSP-Minnesota and Norwest Bank Minnesota, NA, as Trustee, providing for the

issuance of Sr. Debt Securities. (Exhibit 4.01 to NSP-Minnesota Form 8-K (file no. 001-03034) dated July 21, 1999).

4.13* Supplemental Indenture, dated Aug. 18, 2000, supplemental to the Indenture dated July 1, 1999, among Xcel Energy,

NSP-Minnesota and Wells Fargo Bank Minnesota, NA, as Trustee (Assignment and Assumption of Indenture)

(Exhibit 4.63 to NSP-Minnesota Form 10-12G (file no. 000-31709) dated Oct. 5, 2000).

4.14* Supplemental Indenture dated July 1, 2002 between NSP-Minnesota and BNY Midwest Trust Company, as successor

Trustee, creating $69 million principal amount of 8.5 percent First Mortgage Bonds, Series due April 1, 2030

(Exhibit 4.06 to NSP-Minnesota Current Report on Form 10-Q, (file no. 001-31387) dated Sept. 30, 2002).

4.15* Supplemental Trust Indenture dated Aug. 1, 2002 between NSP-Minnesota and BNY Midwest Trust Company, as

successor Trustee, creating $450 million principal amount of 8.0 percent First Mortgage Bonds, Series due Aug. 28, 2012

(Exhibit 4.01 to NSP-Minnesota Current Report on Form 8-K, (file no. 001-31387) dated Aug. 22, 2002).

4.16* Supplemental Indenture dated July 1, 2005 between NSP-Minnesota and BNY Midwest Trust Company, as successor

Trustee, creating $250 million principal amount of 5.25 percent First Mortgage Bonds, Series due July 15, 2035

(Exhibit 4.01 to NSP-Minnesota Current Report on Form 8-K, (file no. 001-31387) dated July 14, 2005).

4.17* Supplemental Indenture dated May 1, 2006 between NSP-Minnesota and BNY Midwest Trust Company, as successor

Trustee, creating $400 million principal amount of 6.25 percent First Mortgage Bonds, Series due June 1, 2036

(Exhibit 4.01 to NSP-Minnesota Current Report on Form 8-K, (file no. 001-31387) dated May 18, 2006).

4.18* Supplemental Indenture, dated June 1, 2007, between NSP-Minnesota and BNY Midwest Trust Company, as successor

Trustee (Exhibit 4.01 to NSP-Minnesota Form 8-K (file no. 001-31387) dated June 19, 2007).

4.19* Supplemental Indenture dated March 1, 2008 between NSP-Minnesota and The Bank of New York Trust Company, NA,

as successor Trustee (Exhibit 4.01 to Form 8-K (file no. 001-31387) dated March 11, 2008).

4.20* Supplemental Indenture dated as of Nov. 1, 2009 between NSP-Minnesota and The Bank of New York Mellon Trust Co.,

NA, as successor Trustee, creating $300 million principal amount of 5.35 percent First Mortgage Bonds, Series due Sept.

1, 2039 (Exhibit 4.01 of Form 8-K of NSP-Minnesota dated Nov. 16, 2009 (file no. 001-31387)).

4.21* Supplemental Indenture dated as of Aug. 1, 2010 between NSP-Minnesota and The Bank of New York Mellon Trust

Company, NA, as successor Trustee, creating $250 million principal amount of 1.950 percent First Mortgage Bonds,

Series due Aug. 15, 2015 and $250 million principal amount of 4.850 percent First Mortgage Bonds, Series due Aug. 15,

2040 (Exhibit 4.01 to Form 8-K dated Aug. 11, 2010 (file no. 001-31387)).