Xcel Energy 2013 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

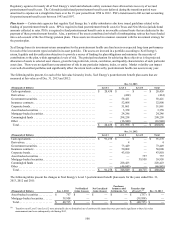

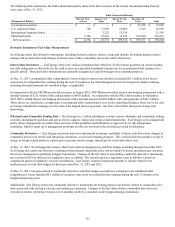

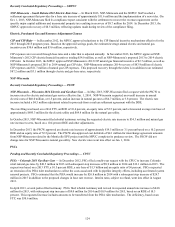

114

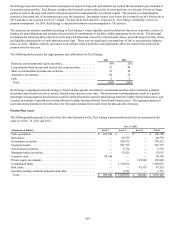

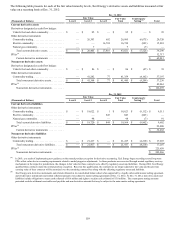

Dec. 31, 2012

Fair Value

(Thousands of Dollars) Cost Level 1 Level 2 Level 3 Total

Nuclear decommissioning fund (a)

Cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 246,904 $ 237,938 $ 8,966 $ — $ 246,904

Commingled funds . . . . . . . . . . . . . . . . . . . . . . . . . . 396,681 — 417,583 — 417,583

International equity funds . . . . . . . . . . . . . . . . . . . . . 66,452 — 69,481 — 69,481

Private equity investments . . . . . . . . . . . . . . . . . . . . 27,943 — — 33,250 33,250

Real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32,561 — — 39,074 39,074

Debt securities:

Government securities . . . . . . . . . . . . . . . . . . . . . 21,092 — 21,521 — 21,521

U.S. corporate bonds . . . . . . . . . . . . . . . . . . . . . . 162,053 — 169,488 — 169,488

International corporate bonds. . . . . . . . . . . . . . . . 15,165 — 16,052 — 16,052

Municipal bonds. . . . . . . . . . . . . . . . . . . . . . . . . . 21,392 — 23,650 — 23,650

Asset-backed securities . . . . . . . . . . . . . . . . . . . . 2,066 — — 2,067 2,067

Mortgage-backed securities . . . . . . . . . . . . . . . . . 28,743 — — 30,209 30,209

Equity securities:

Common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . 379,093 420,263 — — 420,263

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,400,145 $ 658,201 $ 726,741 $ 104,600 $ 1,489,542

(a) Reported in nuclear decommissioning fund and other investments on the consolidated balance sheet, which also includes $91.2 million of equity investments in

unconsolidated subsidiaries and $37.1 million of miscellaneous investments.

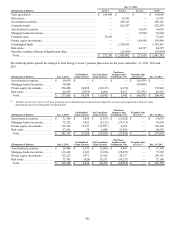

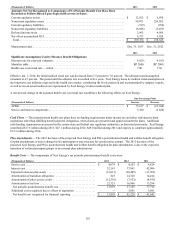

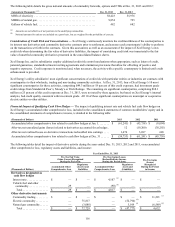

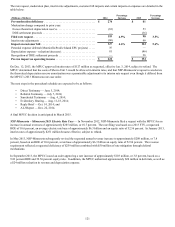

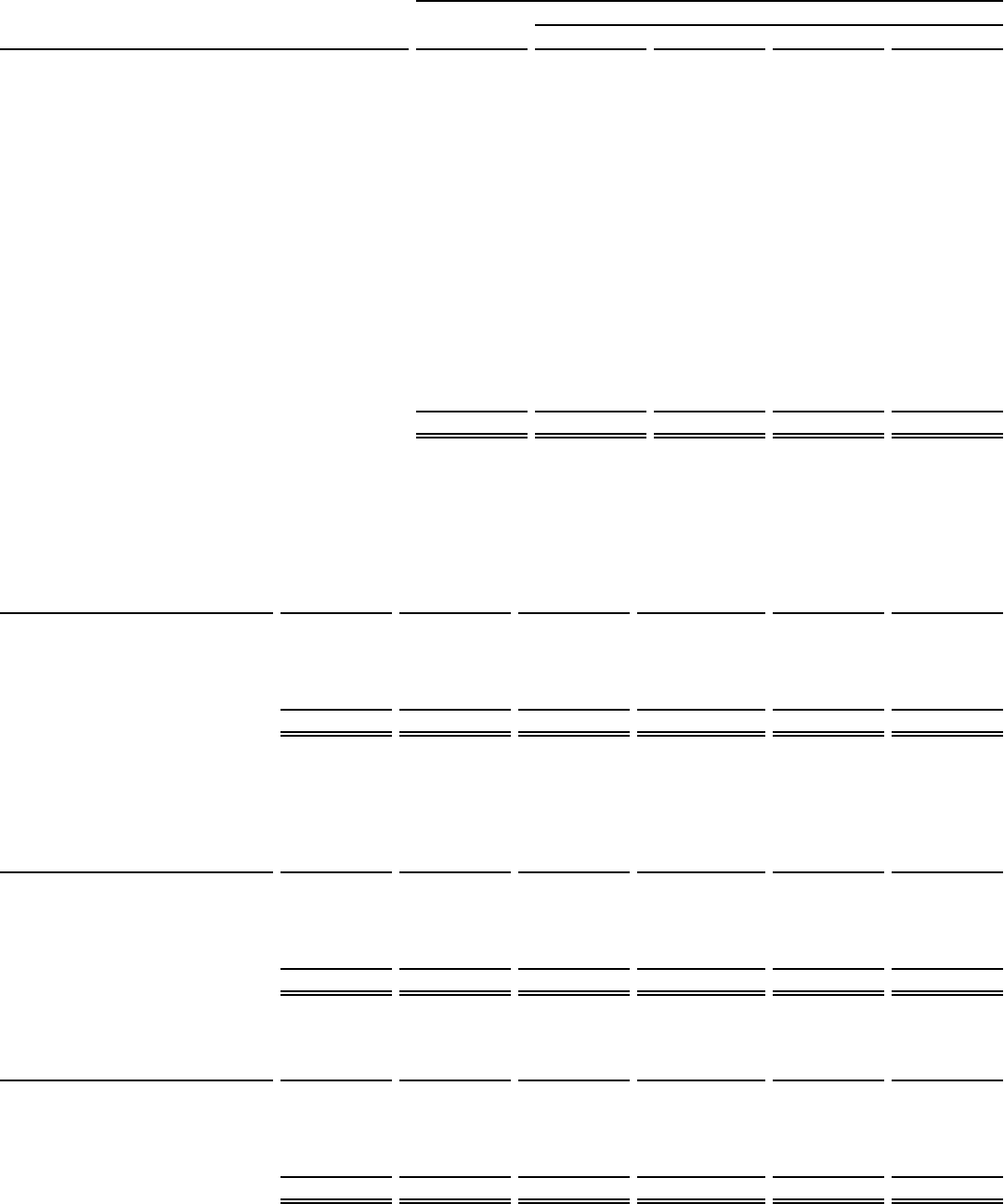

The following tables present the changes in Level 3 nuclear decommissioning fund investments:

(Thousands of Dollars) Jan. 1, 2013 Purchases Settlements

Gains

Recognized as

Regulatory Assets

and Liabilities Transfers Out

of Level 3 (a) Dec. 31, 2013

Private equity investments . . . . . . . $ 33,250 $ 24,201 $ — $ 5,245 $ — $ 62,696

Real estate . . . . . . . . . . . . . . . . . . . 39,074 31,626 (18,622) 5,290 — 57,368

Asset-backed securities . . . . . . . . . 2,067 — — — (2,067) —

Mortgage-backed securities . . . . . . 30,209 — — — (30,209) —

Total. . . . . . . . . . . . . . . . . . . . . . . $ 104,600 $ 55,827 $ (18,622) $ 10,535 $ (32,276) $ 120,064

(a) Transfers out of Level 3 into Level 2 were principally due to diminished use of unobservable inputs that were previously significant to these fair value

measurements and were subsequently sold during 2013.

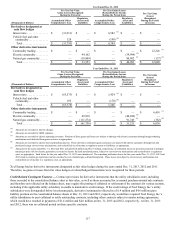

(Thousands of Dollars) Jan. 1, 2012 Purchases Settlements

Gains (Losses)

Recognized as

Regulatory Assets

and Liabilities Transfers Out

of Level 3 Dec. 31, 2012

Private equity investments . . . . . . . $ 9,203 $ 20,671 $ (1,931) $ 5,307 $ — $ 33,250

Real estate . . . . . . . . . . . . . . . . . . . 26,395 9,777 (3,611) 6,513 — 39,074

Asset-backed securities . . . . . . . . . 16,501 — (14,450) 16 — 2,067

Mortgage-backed securities . . . . . . 78,664 33,016 (79,899)(1,572) — 30,209

Total. . . . . . . . . . . . . . . . . . . . . . . $ 130,763 $ 63,464 $ (99,891) $ 10,264 $ — $ 104,600

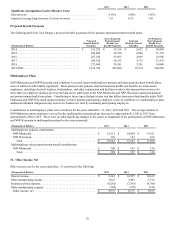

(Thousands of Dollars) Jan. 1, 2011 Purchases Settlements

Gains (Losses)

Recognized as

Regulatory Assets

and Liabilities Transfers Out

of Level 3 Dec. 31, 2011

Private equity investments . . . . . . . $ — $ 9,203 $ — $ — $ — $ 9,203

Real estate . . . . . . . . . . . . . . . . . . . — 24,768 — 1,627 — 26,395

Asset-backed securities . . . . . . . . . 33,174 16,518 (32,560)(631) — 16,501

Mortgage-backed securities . . . . . . 72,589 168,688 (161,134)(1,479) — 78,664

Total. . . . . . . . . . . . . . . . . . . . . . . $ 105,763 $ 219,177 $ (193,694) $ (483) $ — $ 130,763