Xcel Energy 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

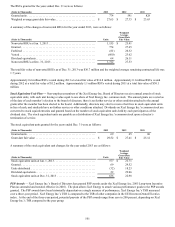

2013 2012 2011

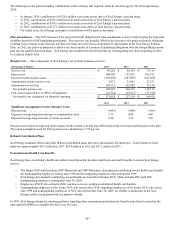

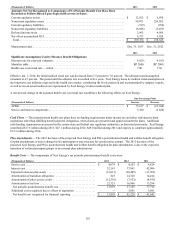

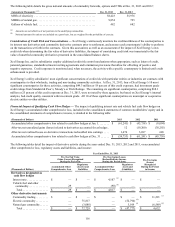

Significant Assumptions Used to Measure Costs:

Discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.10% 5.00% 5.50%

Expected average long-term rate of return on assets. . . . . . . . . . . . . . . . . . 7.11 6.75 7.50

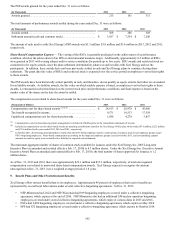

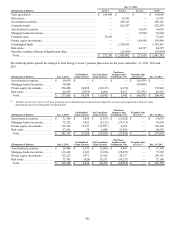

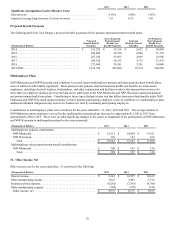

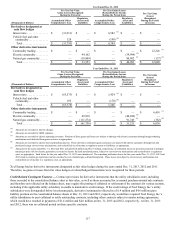

Projected Benefit Payments

The following table lists Xcel Energy’s projected benefit payments for the pension and postretirement benefit plans:

(Thousands of Dollars)

Projected

Pension Benefit

Payments

Gross Projected

Postretirement

Health Care

Benefit Payments

Expected

Medicare Part D

Subsidies

Net Projected

Postretirement

Health Care

Benefit Payments

2014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 313,226 $ 53,516 $ 2,627 $ 50,889

2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 266,802 54,576 2,806 51,770

2016. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 267,186 55,965 2,969 52,996

2017. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 269,526 56,513 3,135 53,378

2018. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 272,908 58,181 3,291 54,890

2019-2023 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,339,764 282,860 18,274 264,586

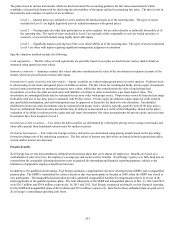

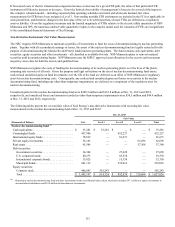

Multiemployer Plans

NSP-Minnesota and NSP-Wisconsin each contribute to several union multiemployer pension and other postretirement benefit plans,

none of which are individually significant. These plans provide pension and postretirement health care benefits to certain union

employees, including electrical workers, boilermakers, and other construction and facilities workers who may perform services for

more than one employer during a given period and do not participate in the NSP-Minnesota and NSP-Wisconsin sponsored pension

and postretirement health care plans. Contributing to these types of plans creates risk that differs from providing benefits under NSP-

Minnesota and NSP-Wisconsin sponsored plans, in that if another participating employer ceases to contribute to a multiemployer plan,

additional unfunded obligations may need to be funded over time by remaining participating employers.

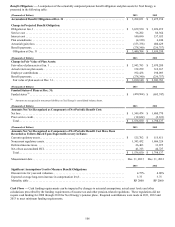

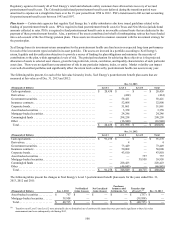

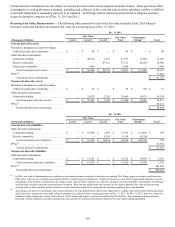

Contributions to multiemployer plans were as follows for the years ended Dec. 31, 2013, 2012 and 2011. The average number of

NSP-Minnesota union employees covered by the multiemployer pension plans increased to approximately 1,100 in 2013 from

approximately 800 in 2012. There were no other significant changes to the nature or magnitude of the participation of NSP-Minnesota

and NSP-Wisconsin in multiemployer plans for the years presented:

(Thousands of Dollars) 2013 2012 2011

Multiemployer pension contributions:

NSP-Minnesota. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 23,515 $ 14,984 $ 17,811

NSP-Wisconsin. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 130 163 169

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 23,645 $ 15,147 $ 17,980

Multiemployer other postretirement benefit contributions:

NSP-Minnesota. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 390 $ 197 $ 336

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 390 $ 197 $ 336

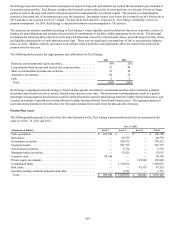

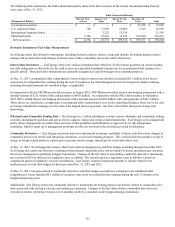

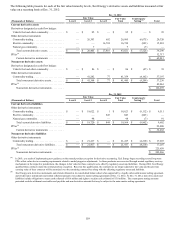

10. Other Income, Net

Other income, net for the years ended Dec. 31 consisted of the following:

(Thousands of Dollars) 2013 2012 2011

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,343 $ 10,327 $ 10,639

Other nonoperating income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,025 3,483 3,722

Insurance policy expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8,292)(7,365)(4,785)

Other nonoperating expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (104)(270)(321)

Other income, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,972 $ 6,175 $ 9,255