Xcel Energy 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130

NSP-Minnesota Wind Projects — In October 2013, the MPUC approved two projects totaling 350 MW that will be owned by NSP-

Minnesota. A NDSPC decision is anticipated in early 2014. The Pleasant Valley wind farm in Minnesota and the Border Winds wind

farm projects in North Dakota are anticipated to be operational by 2015.

SPS Transmission NTC — SPS has accepted NTCs for several hundred miles of transmission line and related substation projects based

on needs identified through SPP’s various planning processes, including those associated with economics, reliability, generator

interconnection or the load addition processes. A major project committed to is the TUCO to Woodward District Extra High Voltage

Interchange, a 345 KV transmission line. This line connects the TUCO substation near Lubbock, Texas with the OGE substation in

Woodward, Okla. The PUCT approved SPS’ CCN to build the line in 2012. It is anticipated to be complete in 2014.

Fuel Contracts — Xcel Energy has entered into various long-term commitments for the purchase and delivery of a significant portion

of its current coal, nuclear fuel and natural gas requirements. These contracts expire in various years between 2014 and 2060. Xcel

Energy is required to pay additional amounts depending on actual quantities shipped under these agreements.

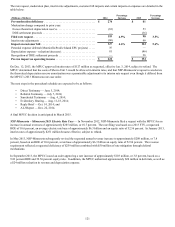

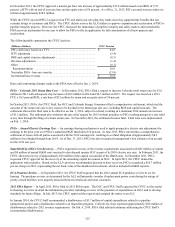

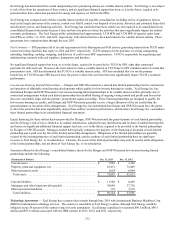

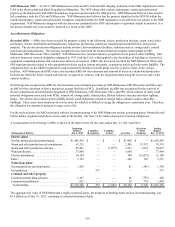

The estimated minimum purchases for Xcel Energy under these contracts as of Dec. 31, 2013 are as follows:

(Millions of Dollars) Coal Nuclear fuel Natural gas

supply

Natural gas

storage and

transportation

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 947.6 $ 128.8 $ 492.8 $ 272.3

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 770.7 79.9 234.4 266.4

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500.2 121.5 232.0 207.5

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 221.3 127.5 225.4 164.2

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73.2 69.4 278.4 106.6

Thereafter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 428.6 697.6 1,211.3 1,214.2

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,941.6 $ 1,224.7 $ 2,674.3 $ 2,231.2

Additional expenditures for fuel and natural gas storage and transportation will be required to meet expected future electric generation

and natural gas needs. Xcel Energy’s risk of loss, in the form of increased costs from market price changes in fuel, is mitigated

through the use of natural gas and energy cost-rate adjustment mechanisms, which provide for pass-through of most fuel, storage and

transportation costs to customers.

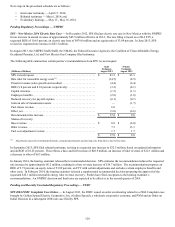

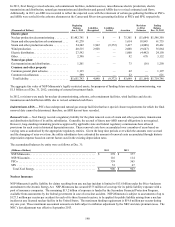

PPAs — NSP Minnesota, PSCo and SPS have entered into PPAs with other utilities and energy suppliers with expiration dates through

2033 for purchased power to meet system load and energy requirements and meet operating reserve obligations. In general, these

agreements provide for energy payments, based on actual energy delivered and capacity payments. Certain PPAs accounted for as

executory contracts also contain minimum energy purchase commitments. Capacity and energy payments are typically contingent on

the independent power producing entity meeting certain contract obligations, including plant availability requirements. Certain

contractual payments are adjusted based on market indices. The effects of price adjustments on our financial results are mitigated

through purchased energy cost recovery mechanisms.

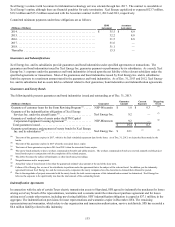

Included in electric fuel and purchased power expenses for PPAs accounted for as executory contracts were payments for capacity of

$217.0 million, $261.9 million and $325.3 million in 2013, 2012 and 2011, respectively. At Dec. 31, 2013, the estimated future

payments for capacity and energy that the utility subsidiaries of Xcel Energy are obligated to purchase pursuant to these executory

contracts, subject to availability, are as follows:

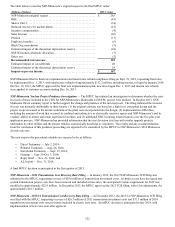

(Millions of Dollars) Capacity Energy (a)

2014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 254.2 $ 121.9

2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 254.5 120.5

2016. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 215.5 100.2

2017. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 186.1 90.4

2018. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 141.1 93.2

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 571.3 866.7

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,622.7 $ 1,392.9

(a) Excludes contingent energy payments for renewable PPAs.

Additional energy payments under these PPAs and PPAs accounted for as operating leases will be required to meet expected future

electric demand.