Xcel Energy 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

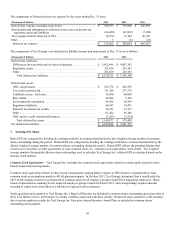

Share-based compensation arrangements for which there is currently no dilutive impact to EPS include the following:

• RSU equity awards subject to a performance condition; included in common shares outstanding when all necessary

conditions for settlement have been satisfied by the end of the reporting period.

• PSP liability awards subject to a performance condition; any portions settled in shares are included in common shares

outstanding upon settlement.

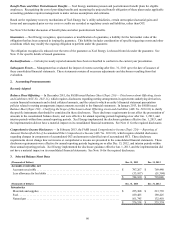

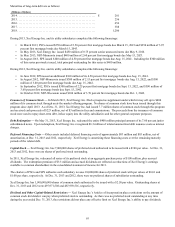

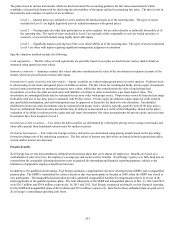

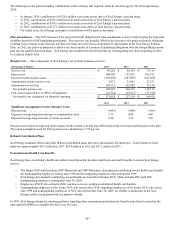

The dilutive impact of common stock equivalents affecting EPS was as follows:

2013 2012 2011

(Amounts in thousands, except

per share data) Income Shares

Per

Share

Amount Income Shares

Per

Share

Amount Income Shares

Per

Share

Amount

Net income. . . . . . . . . . . . . . . . . . . . . $ 948,234 $ 905,229 $ 841,172

Less: Dividend requirements on

preferred stock . . . . . . . . . . . . . . . . . . — — (3,534)

Less: Premium on redemption of

preferred stock . . . . . . . . . . . . . . . . . . — — (3,260)

Basic earnings per share:

Earnings available to common

shareholders . . . . . . . . . . . . . . . . . . . . 948,234 496,073 $ 1.91 905,229 487,899 $ 1.86 834,378 485,039 $ 1.72

Effect of dilutive securities:

401(k) equity awards. . . . . . . . . . . . — 459 — 535 — 576

Diluted earnings per share:

Earnings available to common

shareholders . . . . . . . . . . . . . . . . . . . . $ 948,234 496,532 $ 1.91 $ 905,229 488,434 $ 1.85 $ 834,378 485,615 $ 1.72

No stock options were outstanding during 2013 and 2012. In 2011, Xcel Energy Inc. had approximately 2.1 million weighted average

options outstanding that were antidilutive, and therefore, excluded from the EPS calculation.

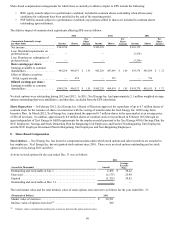

Share Repurchase — In February 2012, Xcel Energy Inc.’s Board of Directors approved the repurchase of up to 0.7 million shares of

common stock for the issuance of shares in connection with the vesting of awards under the Xcel Energy Inc. 2005 Long-Term

Incentive Plan. In March 2012, Xcel Energy Inc. repurchased the approved 0.7 million shares in the open market at an average price

of $26.42 per share. In addition, approximately 0.9 million shares of common stock were purchased in February 2012 through an

agent independent of Xcel Energy to fulfill requirements for the employer match pursuant to the Xcel Energy 401(k) Savings Plan; the

NCE Employees’ Savings and Stock Ownership Plan for Bargaining Unit Employees and Former Non-Bargaining Unit Employees;

and the NCE Employee Investment Plan for Bargaining Unit Employees and Non-Bargaining Employees.

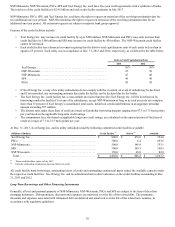

8. Share-Based Compensation

Stock Options — Xcel Energy Inc. has incentive compensation plans under which stock options and other incentives are awarded to

key employees. Xcel Energy Inc. has not granted stock options since 2001. There were no stock options outstanding and no stock

option activity during 2013 and 2012.

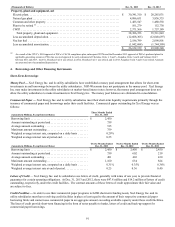

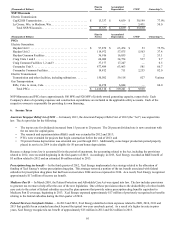

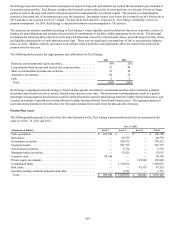

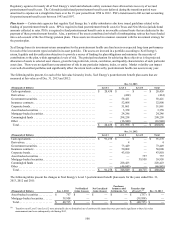

Activity in stock options for the year ended Dec. 31 was as follows:

2011

(Awards in Thousands) Awards

Average

Exercise

Price

Outstanding and exercisable at Jan. 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,498 $ 30.42

Exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,173) 25.90

Expired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,325) 34.42

Outstanding and exercisable at Dec. 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . — —

The total market value and the total intrinsic value of stock options exercised were as follows for the year ended Dec. 31:

(Thousands of Dollars) 2011

Market value of exercises . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 30,761

Intrinsic value of options exercised (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 380

(a) Intrinsic value is calculated as market price at exercise date less the option exercise price.